What’s been a hedge against inflation for thousands of years has had its throne usurped by bitcoin, and for good reason.

Alexander Vasiliev is the co-founder and CCO of the global payment network Mercuryo.

Ever since bitcoin began to grow in popularity, many people have come to call it "digital gold."

And for valid reasons.

While the cryptocurrency's anonymous creator, Satoshi Nakamoto, originally intended bitcoin to function as a peer-to-peer (P2P) electronic cash system, BTC also possesses excellent store of value and safe-haven asset qualities.

Gold has similar store of value properties, with many conservative investors considering the precious metal one of the safest traditional investment instruments on the market. There's also a popular belief that the financial instrument is a good inflation hedge.

However, numerous experts from the same group also criticize bitcoin for its lack of stability, often calling the cryptocurrency a bubble.

That said, such statements about gold and bitcoin don't reflect the full truth.

Bitcoin Beats Gold in Terms of Purchasing Power

To see the entire picture, it's essential to analyze gold and bitcoin in regard to how the two financial instruments perform in terms of inflation hedges, stores of value, and safe-haven assets.

According to the Bureau of Labor Statistics' Consumer Price Index (CPI), the United States Dollar has lost 11% of its purchasing power due to inflation in the last five years.

This shouldn't come as a surprise as fiat currencies like the USD are inflationary due to the lack of fixed supply and continuous money printing practices of central banks.

For an asset to be a decent inflation hedge, it must maintain a value growth at or above the inflation rate to protect investors against the price depreciation of fiat currencies.

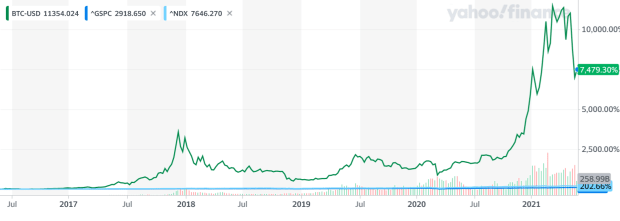

If we take a look at the SPDR Gold Shares' (GLD) performance in the last five years via the chart above, we can see that the precious metal has maintained a value increase of nearly 54%, which is almost five times higher than the USD's inflation rate.

For that reason, we can call the instrument an inflation hedge. But is it better in this field than bitcoin?

The simple answer is no. The chart above clearly shows that in the last five years – even after bitcoin’s recent price drop and 2018's bear market – BTC maintained a price appreciation of nearly 7,500%, which is over 138 and 680 times higher than gold's and the USD's rate of inflation, respectively.

More Than Simply an Inflation Hedge

Throughout its twelve-year history, bitcoin has outperformed all other asset classes, increasing its purchasing power so significantly that it clarifies that the cryptocurrency is more than just a simple inflation hedge.

Due to BTC's limited supply capped at 21 million coins, as well as the halving mechanism that cuts the new coin supply into half roughly every four years, the digital asset features a deflationary monetary policy that is hard-coded on the protocol level.

For that reason, there is no way to increase the bitcoin supply during times when the demand for the cryptocurrency is higher.

At the same time, due to the continuously decreasing flow of new supply, BTC will experience a long-term price appreciation even if the demand stays at the same level as it is now.

This, in addition to its durability due to its highly resilient and immutable blockchain network, makes bitcoin an excellent store of value.

While gold is also a highly scarce asset, like oil its production can be increased or decreased based on the current demand.

However, due to the vast stockpile present on Earth and the complexity of gold mining, the precious metal's annual production rate is usually at around 2% of the total supply.

For that reason and due to gold's qualities that make it impossible to destroy or synthesize the asset from other materials, the precious metal is also a good store of value that has experienced a long-term price appreciation.

But, in this field, bitcoin has a major advantage over gold. While BTC can be easily utilized for P2P payments without any intermediaries, there is no system of buying products or services with a gold bar.

In terms of being a safe haven asset – a financial instrument that can retain or increase its value when the general market is in turmoil – both bitcoin and gold maintain a relatively low correlation with other asset classes.

Thus, both instruments have safe-haven-asset qualities that distinguish them from others in this field.

Bitcoin Is on the Road to Become a Viable Alternative to Gold

Bitcoin has the necessary qualities to be a viable alternative to gold and other precious metals in terms of an inflation hedge, store of value, and a safe-haven asset.

Despite the criticism, many businesses and institutional investors have chosen to invest in bitcoin to safeguard their assets during the pandemic and the economic fallout that followed.

Tesla is an excellent case study for that, even with Elon Musk's recent criticism concerning BTC's high energy usage. The electric car maker generated 23% of its Q1 2021 profits only by selling some of its bitcoin holdings.

And with excellent store of value properties, increased purchasing power, and high versatility, bitcoin has the potential to take the lead from gold and become the standard asset to fight inflation and hedge against general market turmoil.

This is a guest post by Alexander Vasiliev. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

via bitcoinmagazine.com