Plan B Passports offers Bitcoiners the ability to legally avoid taxes on their BTC profits.

If you would like to avoid onerous capital gains taxes after spending or selling BTC following boom cycles, then there is a service just for you.

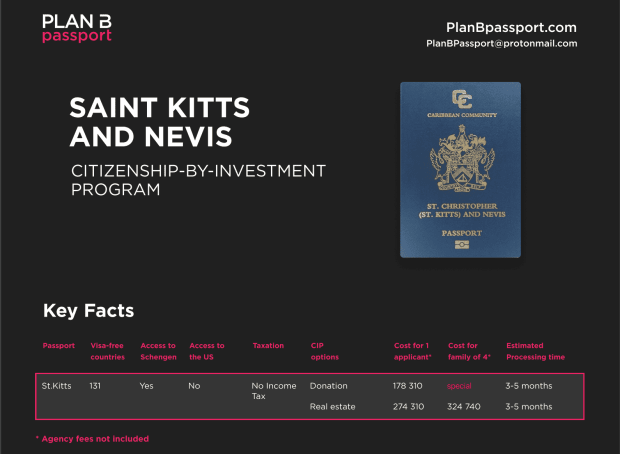

Bitcoin maximalist and entrepreneur Katie Ananina helps bitcoiners who have made significant gains on their BTC holdings to legally avoid such taxes by obtaining a second passport through her company Plan B Passports. It offers clients seven different passport options for nations with favorable tax regulations, including credentials for Portugal, Saint Kitts and Nevis, Saint Lucia, Grenada, Antigua and Barbuda, Dominica and Vanuatu, according to CNBC. Obtaining a passport to one of these countries gives someone the opportunity to bypass heftier capital gains taxes required by countries like the U.S.

This is made possible by partnerships that Plan B Passports has acquired with governments’ residence- or citizenship-by-investment programs. Plan B Passports’ customers find a way to avoid paying major bitcoin taxes, while the countries that furnish the new passports receive a new stream of foreign investment.

“In Saint Lucia you can obtain citizenship by an investment of between $100K (donation), $250K (government bonds) or $300K (real estate),” an attorney with international tax law firm Andersen, Ernest Marais, explained via email to CNBC.

Ananina shared that the average cost for these passports range from $130,000 to $180,000.

“It’s basically a donation into the sustainable growth fund of the country,” she told CNBC. “So, clients make a $100,000 or $150,000 donation, plus some due diligence fees, government fees, and then $20,000 for my legal fees.”

These donations can also be very beneficial to countries that don’t have many natural resources, and can then allocate those funds for what they need.

Buying bitcoin when it’s price is low and holding it until the price rises is an accomplishment to be proud of. When Bitcoiners finally decide to part with some of their sats to purchase goods or services, they don't want to pay capital gains taxes. Ananina has done that herself, and wants to help others who don’t want to pay taxes on these gains to governments that she feels don’t deserve them.

“I was smart enough to figure out that $200 in bitcoin will be worth $100,000 at some point,” said Ananina, according to CNBC. “I don’t think the government should have 40% of that.”

Ananina also said that her business is booming, and that she’s booked out three weeks ahead for consultation calls. And it seems likely that as bitcoin’s price once again approaches new all-time highs, we’re only going to see more people searching for capital gains tax relief.

via bitcoinmagazine.com