The commonly-cited method of dollar-cost averaging might be less effective than lump-sum purchases.

It is fashionable in bitcoin circles these days to join the DCA army: to dollar-cost average your savings into bitcoin. If you put away a little bit at a time, even trifling amounts like $1, $5, or $10 a day, you can grow your stash into very impressive fortunes. It makes for a smoother journey, and it overcomes the psychological barrier of buying at (what until two minutes ago seemed like) very high prices.

DCAing is an investment strategy that bitcoiners inherited from the world of traditional finance – and it’s completely wrong.

First, let me give some caveats: I adore Hass McCook; his articles, particularly those on energy use, are amazing. I don't dispute his conclusion that a DCA army would be good for the bitcoin network’s price stability and for moving sats into strong hands. Most people don’t have the guts to stomach the risk of buying a top with everything they’ve got. And for even more of us the psychological commitment device of repeating a small thing every single day turns terrifying saving decisions into routine habits.

But as an investment thesis on top of a structurally upward-moving asset, it makes little sense. Most people have heard the investment quips of people like Warren Buffet or Ken Fisher saying that “time in the market beats timing the market;” DCAing a current stash of dollar savings into bitcoin over a certain time period intentionally delays your time in the market in exchange for avoiding the prospect of horrifically mistiming the market.

Let me then unleash my contrarian nature for a minute and say the following: if you have a stack of money about to enter an appreciating asset, DCAing is psychologically soothing but rationally foolish.

The Virtues Of Dollar-Cost Averaging

As with many things, we often give practical advice to beginners that the pros don’t follow. Sometimes we even give advice that isn’t literally true, but gets the job done and gets the beginner over the initial hump. We teach people unfamiliar with guns to always treat them as loaded and off safety, even when we know they’re neither; we instruct kids to follow through their baseball swings or their golf strokes, even though what they do after they’ve hit the ball cannot have any impact on the ball’s trajectory.

A similar thing is at play with moving an increasing amount of your assets into bitcoin: it makes a lot of sense and harks back to well-studied diversification strategies in legacy finance.

The virtue of dollar-cost averaging into an investment over time is twofold. First, DCAing allows for a smoother journey: you buy when it’s cheap, and you buy when it’s expensive, which means that over time you get a decent cost basis – without needing to know when that is. This calms people's nerves, gets them comfortable with price swings, and disciplines their feelings so that they don’t deviate from a strategy that over time works reasonably well.

Second, you avoid the psychologically painful experience of buying with everything you have right before a 30-50% reversal. Those hurt, and bitcoin’s past has a few of them. Mistiming lump-sum purchases right before such reversals feels like throwing a lot of money right down the drain. You instantly lost a big part of your savings. Making matters worse, had you only waited a little while, you could have bought coins at a steep discount. Ouch.

But those are unrealistic fears. The entire reason we’re considering a DCA is that we can't time the market. We don't know when those terrifying reversals are coming, and so calculating what would have been had we been omniscient is an exercise into the unreal. Such is not an option available to us mortals.

Some Numbers To Illustrate The Problem

Let’s use some legacy-finance returns to show the problem. Jeremy Schneider at Personal Finance Club has a calculator that runs on S&P 500 returns reaching back to the late 1800s. This American stock index works as a comparison with bitcoin because, like bitcoin, it’s a volatile price journey on a structurally upward-moving trend.

Almost no matter what numbers you put into these calculators, you can’t get the DCA strategy to outperform the lump-sum purchase more than about 35-40% of the time. DCA only wins when your lump-sum purchase happens right before big market crashes. In every other scenario, and under long enough time investment horizons, the lump-sum purchase wins.

Moneychimp, who offers a similar calculator, writes

“Dollar cost averaging will win if your start date falls right before a dramatic crash (like October 1987) or at the start of an overall 12-month slump (like most of 2000). But unless you can predict these downturns ahead of time, you have no scientific reason to believe that dollar-cost averaging will give you an advantage.”

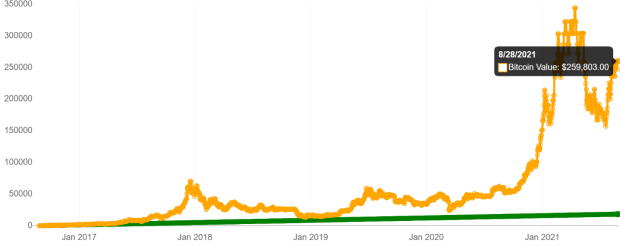

Let’s perform the same exercise for bitcoin. Plugging in Hass McCook’s suggested $10 daily purchases for the last five years on DCAbtc.com we get $18,260 invested for a total portfolio value as of late August of almost $260,000 — a little over 1300% return:

Compared to a 56% gain on a similar S&P 500 DCA plan, that’s pretty good.

But five years ago, bitcoin traded at $568.40. A lump-sum purchase of $18,260 would have afforded you over 32 full coins, for a total value today somewhere north of $1,500,000. That's 8,400% return – quite a lot above the 1300% profit that the DCA plan returned. The lump-sum purchase wins, because it didn’t happen right before a major crash but before a few major bull runs.

Had you had the extremely poor timing of buying bitcoin in early December 2017, you'd get a purchasing price of somewhere between $9,000 and $16,000 for total returns until today, now between a 202% and 437% return. Not terrible, but only a little bit less than what a DCA plan starting then would have yielded you — 452%.

Asymmetry Of The Upside And The Downside

If you have the foresight (or hubris) to think you can time the market and determine when bitcoin is selling for cheap, you don’t need any of these strategies; you just need to play the formula you think you’ve uncovered. Of course, chances are you’re wrong because almost nobody manages to time any market — at least not often enough and consistently enough that it’s distinguishable from luck.

The rationale for DCAing into any asset is that we can’t foresee the future: we do not know how to time the market. There are going to be shocks to the price of any asset, up and down. But if our thesis of bitcoin’s superiority is right, those shocks are going to be up more often than down. If you wait and delay purchases — which is the essence of DCAing — you’re more likely to expose yourself to missing out on upward shocks than protecting yourself from downward shocks.

If you think the dollar is a melting ice cube and you think your target asset is on a volatile journey with an upward trend, you will suffer more from the opportunity cost of waiting to enter than from the real loss of buying at a (local) top. They’re both losses: one just feels more real than the other. Dollar-cost averaging is a hedge against entry into fairly symmetrical trades. As an entry into an upward asymmetrical trade, it’s a losing proposition.

If you deviate from the DCA rule, thinking “I'm going to wait for a pull-back and opportunistically buy when it’s cheap” you might be waiting forever. More importantly, you've already returned to the mindset of trying to time the market — but without the rules, the safety mechanisms, and the analytical tools to actually do it. You're like a central banker, refusing to honor the rules you know work better over time, setting them aside to trust your gut feeling, to make policy on a whim, on extreme fears, or the present bias and action bias which most people succumb to.

Even if you’re not sold on my contrarian take so far, keep in mind that most people’s finances are structured for DCAing anyway: you earn an income every month, and insofar as your conviction remains or strengthens, you’ll likely stack more with whatever future surplus you manage to eke out from spending less than you earn. To needlessly DCA even more, out of a dollar stash you’re already holding, is inconsistent with what you say you believe.

Investing on top of a structurally upward-moving trajectory, a positive-sum game, tilts the stakes in favor of getting in earlier (once again, “time in the market…”). Against that, DCAing operates like an insurance: you protect against the worst negative outcomes, but you pay for it dearly by giving up most of the grand upside you say is coming.

If you think yourself in control of your investment decisions and capable of withstanding the psychological pain of outlier events (buying at, say, $64,000 right before this year's 50% drawdown), the optimal strategy is to buy as much as you can, as early as you can. Ironically, the more bullish you are on bitcoin's (long-term) prospects, the less favorably you ought to look at DCAing.

Smooth your purchases over time if that makes you sleep better at night, but for superior long-term performance you’re probably better off just plunging headfirst into the deep end.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

via bitcoinmagazine.com