Examining leverage in the derivatives market, which can explain some recent bearish price action in bitcoin.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This week has seen some bearish price action for bitcoin, and what's the cause? One of the main catalysts is the leverage in the derivatives market.

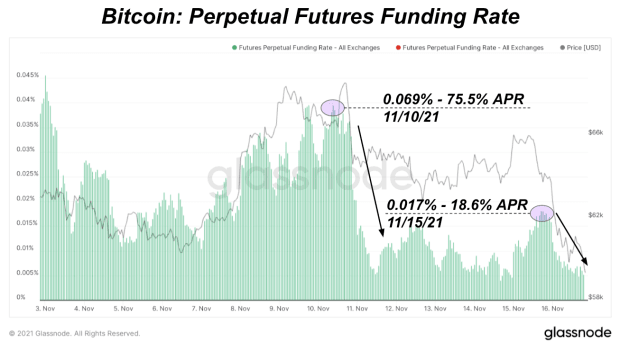

When looking at the perpetual futures funding rate, we can see downturns in bitcoin price coupled with a reduction in funding rate from the highs. What this is showing is that the derivatives market bulls got ahead of the spot bitcoin market, and were speculating with leverage on a rise in price. If/when this rise in price does not come, these traders are caught offsides, and a leverage unwind occurs.

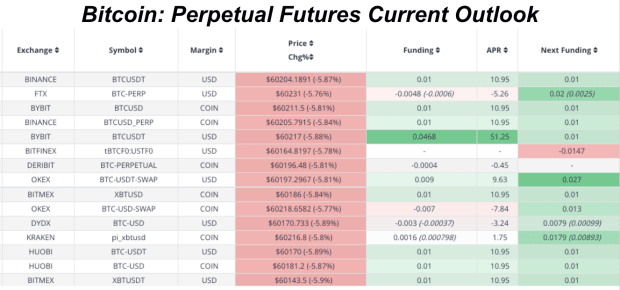

Below we can see the current state of the perpetual swaps bitcoin market, which shows mostly neutral positioning following the dip below $60,000: a classic shakeout.

One of the things that is so often misunderstood about the bitcoin market is that the price discovery and volatility that exists in the market is a way of shaking off any and all market participants that are overexposed/leveraged. Large buyers and sellers in the bitcoin spot market oftentimes closely follow the developments in the derivatives market, because they know that if the derivatives market finds itself offsides either to the upside or to the downside, a lot of money can be made by forcing these traders to unwind/exit their positions at a loss.

This is what has unfolded recently. Nothing about the on-chain accumulation dynamics nor macroeconomic backdrop has materially changed, rather the bitcoin market is shaking off the speculators looking to capture outsized returns during the imminent next leg up.

Volatility is the price you pay for returns in the bitcoin market, and those who look to amplify these returns with excess leverage may just find themselves with far less or even no bitcoin if they aren’t an expert at managing risk.

This is why spot bitcoin in personal self-custody is by far the best way to allocate to the bitcoin market. Short-term volatility is just noise if you understand what you are allocating towards.

via bitcoinmagazine.com