Despite Bitcoin’s muted monthly performance, STX, SSV, CFX, AGIX and GRT surged higher, likely because of popular market narratives.

The month of February was filled with investors’ hope that an earlier-than-expected Federal Reserve policy pivot would occur, but this sentiment faded as the inflation and employment data came in hotter than expected. While the start of the month was bullish for the crypto market, Bitcoin (BTC) retraced 60% of the move from February’s low at around $21,500 to the peak of $25,250.

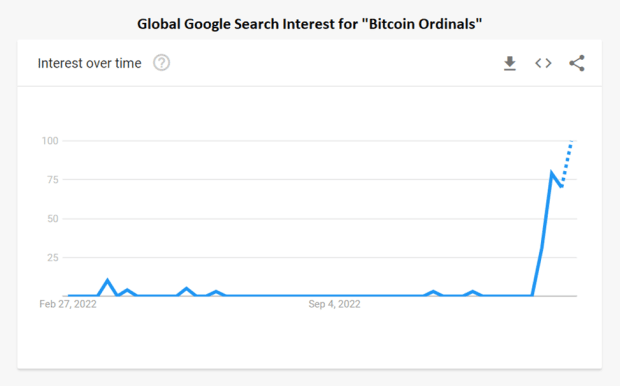

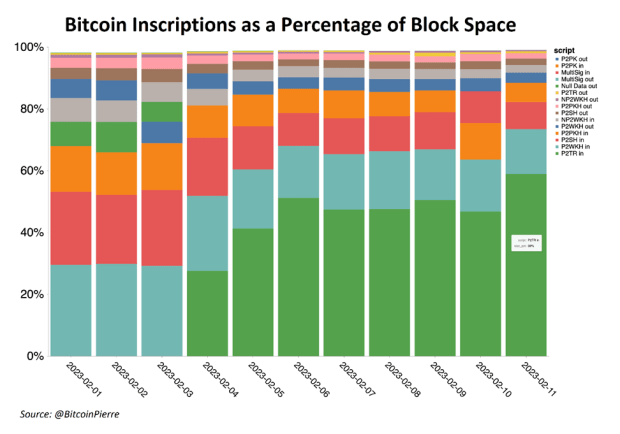

Nevertheless, some narrative-driven rallies still caused significant price growth in some altcoins. The leading narratives were Bitcoin NFTs, liquidity staking derivatives (LSDs) on Ethereum and Artificial Intelligence (AI) projects.

Let’s review the top performing coins of the month.

Stacks (STX)

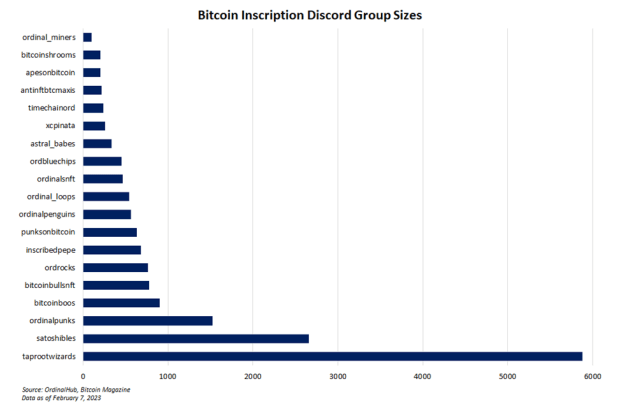

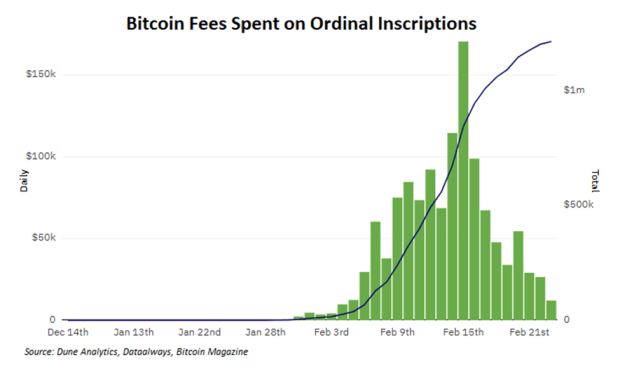

Stacks gained much attention as the hype over Ordinals kicked off at the start of the month. Gamma, a Stacks-based project, enabled the creation of Bitcoin Ordinals. However, full functionality in trading and public minting of Ordinals on Stacks is still in development.

Meanwhile, Stacks faces competition from other blockchains like Ethereum, where developers are working toward enabling Bitcoin NFT trading on Ethereum. Yuga Labs, the leading NFT firm, announced a 300-piece generative collection on Bitcoin on Feb. 27. The auction (or minting) will likely be held on Ethereum due to the lack of infrastructure on Bitcoin. Thus, as Stacks delays its development of making Ordinals accessible, more liquid chains are taking advantage of other solutions.

The fundamentals of the Stacks blockchain do not corroborate with the price surge, which suggests that it could be purely speculative given the potential for Stack's growth. In the short term, STX risks a pullback from the top of its trading range in both STX/USD and STX/BTC pairs. Nevertheless, if buyers can conquer resistance at $1.02, there's a probability of STX taking a shot at all-time highs of $3.40.

Conflux (CFX)

Conflux Network received a significant boost on Feb. 15 as the blockchain team announced a partnership with the second largest Telecom service in China, China Telecom. The telecom giant will provide blockchain-enabled mobile SIM cards to over 200 million users. The SIM card will store a public and private key, storing transferable user data in encrypted form.

Over the years, Conflux has earned the reputation of a Chinese enterprise blockchain with partners in Oreo China, McDonald's China and Chinese Instagram equivalent Little Red Book. The blockchain also hosts an RMB-pegged stablecoin in approval with the Chinese government, which is highly encouraging given the strict influence of the authorities over state policies.

The Conflux Network deploys both proof-of-work and proof-of-stake mechanisms to increase scalability and decentralization. The network processes between 3,000 to 6,000 transactions per second, which is considerably faster than Ethereum's speed of 15 tps.

While Conflux has established partnerships with leading Chinese brands, the activity on the blockchain has yet to justify the 500% increase in CFX's price in February. Data shows that the number of new Conflux addresses and NFTs minted on the platform has stayed at par with previous months with no evident spike.

This raises concerns about the sustainability of the hype building around the blockchain. Extensive partnerships in the blockchain space have often failed due to a lack of real-world integrations.

The CFX/USD pair’s vertical rally met with resistance at the October 2021 high of $0.34. The psychological levels of $0.20 and $0.10 will act as support in case of a pullback.

SSV Network (SSV)

SSV Network benefited from the craze around the Ethereum Shanghai upgrade, which has fueled the rise of LSD tokens. SSV Network is an infrastructure provider that will likely provide backend support for LSD platforms to help decentralize the Ethereum network.

The project is working on the idea of Distributed Validator Technology (DVT), first proposed by Ethereum founder, Vitalik Buterin, in the Ethereum 2.0 design. It enhances the security and decentralization of the Ethereum PoS network by allowing smaller stakers and validators to use the SSV Network and run Ethereum validating nodes.

On Jan. 19, the team announced a $50 million ecosystem fund to support the development of the technology. The fund is backed by leading crypto venture capitalists including Digital Currency Group, Coinbase Ventures, HashKey, NGC, Everstake, GSR and SevenX.

The project gained a lot of attention as the official sponsor of the ETH Denver Hackathon 2023, where the project gave grants to teams developing on DVT technology. SSV Network shows significant potential for adoption by LSD protocols as the amount of staked Ether increases after the Shanghai upgrade.

Still, a significant portion of the 160% gains in February could be due to a rotation from the crowded LSD tokens toward other protocols that stand to benefit after the Shanghai upgrade.

Technically, SSV token is in a price discovery mode, making new all-time highs. Thus, it’s likely that the token continues to surge higher, especially if leading LSD platforms like Lido or Rocket Pool announce SSV Network integration.

However, the token tagged the $50 psychological level on Feb. 27, which could see some profit booking from investors. On the downside, the token will likely find support near 2022 highs of $21.

SingularityNET (AGIX)

SingularityNET benefited from the continued hype in AI-related projects. The protocol’s marketplace invites users to purchase AI services in its native cryptocurrency, AGIX. The token’s price has jumped nearly 12 since the start of 2023, from $0.045 to a peak of $0.58.

The latest surge in SingularityNET can be attributed to its partnership with Cardano. The protocol currently resides on Ethereum for hosting rudimentary AI bots for image processing, language translations and statistical analysis. The migration to Cardano provided a huge boost to the protocol as it started offering ADA staking service and facilitating a decentralized bridge between Ethereum and Cardano.

AGIX token reversed from its all-time high levels at $0.63, which could continue to provide resistance for bulls. As the AI hype subsides, a correction toward $0.33 and $0.15 support cannot be ruled out. Nevertheless, if buyers are successful in pushing the price above the $0.63 resistance level, AGIX can run significantly higher.

Graph Protocol (GRT)

Similar to SingularityNET, The Graph protocol has also benefited from an increase in the AI narrative. The indexing protocol on Ethereum and IFPS is slowly transitioning to an independent layer-1 network. It works through coordination between subgraph developers, who create and store an easily accessible database of blockchains, and decentralized application developers, who use this database to create products.

According to a recent report by Messari, The Graph’s revenue increased 66% in Q4 2022 compared to the previous quarter. The number of subgraphs on the network has increased consistently, with a 12% quarter-on-quarter increase in revenue for network participants.

GRT token has significant upside potential if the growth of the network sustains. Technically, the July 2022 breakdown levels at $0.33 and 2022 highs of $0.51 will be the likely targets for bulls, with support at the psychological level of $0.1 and the 2023 yearly opening price of $0.056.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

via cointelgraph.com