This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.

Which way Western Man?

“Equality… belongs essentially to decline: the chasm between man and man, class and class, the multiplicity of types, the will to be one’s self, and to distinguish one’s self out — that which I call pathos of distance — characterizes every strong age.”

- Nietzsche, Twilight of the Idols

It’s often thought the grand struggle of the modern world is between right and left, Republican and Democrat, or liberal against conservative. Libertarians take a more nuanced view. Like them, I used to think it was the individual and individualist against the collective and the collectivists — I wrote about this dimension in the UnCommunist Manifesto last year.

While there is truth in all of this, I’ve come to realize there is a much deeper and more important axis around which we all must orient.

Quality versus Equality

In this essay, I lay out the case for why the former is the basis for both healthy individuals and a healthy society, and how the latter is the harbinger of corruption and decay. From there, you can make your own mind up about which political and philosophical modalities are best pursued in this life, and which, if any, Bitcoin is most aligned with.

Let us begin this exploration with an analysis on life.

The Eternal Battle

A battle rages on, across the universe. Order on the one hand, chaos on the other; life versus entropy. It has and always will endure, and despite the fact that we cannot change it, we each play our part. It’s in our DNA. Humans are the most sophisticated vessels in the eternal battle against entropy, and life seeks to perpetuate itself through us.

Why do I call it a battle? Think about it. Life literally starts as hundreds of millions of sperm competing for the chance to reach the female egg only to be faced with the enormous task of fertilizing it successfully, following which the DNA of your mother and father have to match, fuse and unite to miraculously — over nine months inside a human slow-cooker — become you: the living, breathing, thinking being that is sitting here reading this now. This competition has one winner and many losers over many iterations. You are literally the product of a successful territorial conquest: the only sperm among billions who survived, claimed the egg, and thus changed the destiny of both progenitors.

The reward for winning against millions of other sperm, bonding with the egg, and creating life is your successful individuation! You are born into this world, but before you can celebrate that fact, you’re ripped out of the cozy womb, into the harsh light of reality and faced with… a new competition. Only this time, there are billions of other successful territorial conquests, like you, each seeking to individuate themselves in a new, more complex dimension. They are all driven by a similar set of instincts, yearning to claim new territory, seeking to bring order to chaos and scouring the Earth to plant their seed, so that they can feel whole, and ultimately, so that life can continue its epic battle against entropy.

This is the ultimate goal of life: continuation. You, me, all of us are vessels to that end. Life implants us with dreams, instincts, and desires to increase its chance of successful perpetuation. For many, these dreams remain fantasies and many desires remain unfulfilled. But for some, their dreams come true and it’s those that propel life onwards — the Alexanders, the Caesars, the Jobs, the Newtons, the da Vincis of the world. The empires they built, the legacies they left, and the lives they lived serve as a reminder that life continues not through being average, but through individuation, the act of which is the separation of oneself from the mass.

Why? Because by reaching and expanding, by claiming new territory, life takes another step forward in the fight against entropy. When you set a new standard, the whole of life becomes larger because everyone else now knows what’s possible. Roger Bannister was the first man to break the four-minute mile. What’s interesting is not that he was the first to do something everyone thought was impossible, but that within a year of doing so, another 24 people also ran a four-minute mile, and since then almost 2,000 have.

Before Roger, it was not even considered possible. After Roger, it’s become another standard. The lesson? When you win, life wins.

The Territorial Imperative

Territory is at the heart of evolutionary history. Life wants to claim space and to transform it — and humans are its prime vessels. From the forests where our ancestors first carved out shelters to modern civilizations that sprawl across continents, we had and always will have an impulse to claim, cultivate, and conquer space.

This territorial imperative is more than just a primal urge. It’s a deep-seated instinct for growth. It’s the apothos that drove Alexander the Great to march to the ends of the known world and compelled Magellan to circumnavigate the Earth on a ship made of wood. It’s not just a desire to control resources but a yearning to claim space, and, by extension, claim our destiny.

Think about the words here; etymology tells us a lot. A destiny is a destination, which is a place. A place is another way of saying territory. We are literally wired for this. It’s in our bodies, in our language, and in the very way we conceptualize and interact with the world. This is why private property works so well. It’s not just a “rational fiction” made up by the human mind, but an abstracted biological imperative. It is a fact of nature and a fact of life that applies beyond just humans. It’s how nature and social species of all kinds develop a dynamic equilibrium with competitors, with other species and with their environment. It’s how the “good” is able to thrive and grow, while the “bad” is discarded and recycled. The following image from a recent study of wolf packs denotes this. They require no “abstract rational fiction” or written constitution to enforce property rights. There is natural conflict at the borders (enmity), peace and homogeneity internally (amity) — and miraculously, it works.

Territory must be claimed and owned, which by definition creates insiders and outsiders. There is no equal access to or on territory, and the quality of the territory is not only a function of what is included within its borders, but also what is excluded. The ancients practiced ostracism as a form of punishment for those who did not abide by or conform to local customs and norms. Banishment from the community or the tribe was worse than any sort of confinement. It was the same principle in action.

Those who believe in common property are ignorant of this fact of life, and it’s why their narratives always break down and their experiments always fail.

Territory is inescapable, and the rule of claiming and maintaining it is quality.

When the quantity exceeds what the ordering force on the territory can handle, the quality will diminish and the territorial integrity will fall, opening the door to entropy. This is how dynamic equilibrium occurs in nature. The “border” is where the fight we discussed in the prior section occurs. You can’t just let everyone — or everything — in. There has to be a barrier to entry. This is also why there exist both economies and diseconomies of scale. Bigger is not always better. It’s the most adapted that matters, hence why truth, first principles, and alignment with natural order is so critical. Ignorance, lies, or deceit will lead you to make decisions that produce a lower-quality territory in all dimensions. It will lead you to an illusion of strength and right, when in reality you are weak and wrong. This is where Rome was in its twilight. It’s where the West finds itself today: confused, open, fractured, and territorially compromised.

A final note on territory: It’s not only physical but metaphysical. It includes the body, the mind and the spirit. It is psychological and emotional. Your territory starts with you. It radiates outward, and its size is proportional to the amount of life force that you can harness and channel. This is the will to power manifest, and it has not only shaped our evolutionary trajectory but also serves as a testament to life’s undying ambition to expand and imprint its essence wherever it can.

The lesson? When you expand, life expands.

Hierarchy

Territory requires hierarchy. Hierarchy implies quality — at least a functional one does. Like territory, hierarchy is internally inclusive, and externally exclusive. It is far from equal or flat. It’s more like a pyramid, which requires a strong enough base to support a sharp tip.

What is a hierarchy and why can I be so sure that it matters? The answer is simple. It’s how all living organisms orient and organize their relationships to time and energy.

Time marches forward, and cannot be reversed. Energy is the currency of the universe. Living things are at all times, spending both. This is inescapable. The only question is “on what?” This is the essence of selection, which is a form of implicit prioritization. Selection is at times conscious but otherwise an unconscious valuation of an act, deed, or intent that ultimately either serves life or entropy.

Prioritization is by definition the formation of a hierarchy. You cannot do all things, all the time, all at once. You have to choose. To have the freedom of choice, carries with it the burden of responsibility: to say yes to one thing, and no to many others. You, me, all living things are ordering entities. We are always saying yes to some things at the exclusion of others. Sounds familiar? The sperm, the egg, and the creation of life.

Exclusion matters just as much as inclusion. Recall territory. Furthermore, some things are superior to others. The master to the apprentice, the adult to the child, the teacher to the student. To ignore this is to invert the natural order found in physical and biologically sound systems, or competent and meritocratically oriented social structures. Pecking orders are natural, and found across all living systems because life must select and prioritize.

So, if hierarchies will always form, the question is not whether they should exist, but “in what form are hierarchies most conducive to life”? As with most things, there is no “one” right way: Life is not so simple. There is a general shape, yes, but within it a spectrum. We exist in a complex world where hierarchies and methods for prioritization emerge across multiple dimensions. The pyramid analogy helps here.

The context it exists in will determine what the optimal size and breadth of the base is, and therefore how high it can reach, the pitch, the angle, and how sharp its point can be. If you’re building on unstable ground, you will need a stronger, larger, wider base to reach a similar height than if you’re building on stable ground, with a deep heritage or culture. On a uniquely stable territory, you can build more of an obelisk, and it will stand. The territory — which is not just “the place” — will determine the final style.

Can you have the wrong kind of hierarchy for a territory? Yes, of course. You can have top-heavy ones, you can have them built on quicksand, you can have them built from the wrong materials. I call these hierarchies by fiat. They are unnatural and exist not because they work, but because of some lofty decree. Like positioning a pyramid upside down and expecting it to stand strong. Such structures ultimately fall over, but while standing they suck up resources in a vain attempt to prove that up is down, down is up, and black is white. Entropy wins those battles quickly, because those experiments are inherently anti-life. They’re on the entropic side from the beginning. It’s why I call such anti-life ideologies “death-cult” ideologies.

The lesson here? Life promotes life. Entropy promotes entropy. There are hierarchies and modalities that favor life, and there are those that do not. Don’t be surprised to discover where each leads.

Quality over Quantity

We live in a world of excessive quantities, and ever-receding quality. Everywhere you turn, there is mass media, mass retail, mass politics, mass food, mass markets, mass social media, mass consumption, mass hysteria, mass medicine, mass money — mass everything. As a result, few of these things carry weight or value anymore. They are like worthless Zimbabwean, hyperinflated toilet paper money.

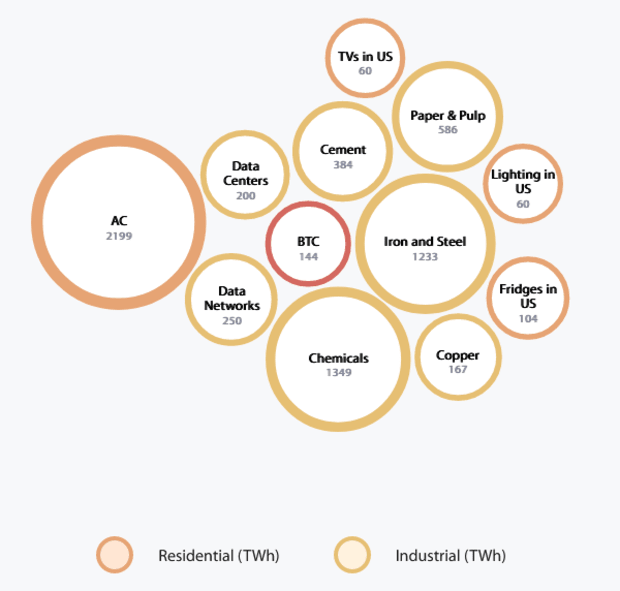

That which has quality, has weight and energy. Bitcoin is like this. It’s literally money backed by energy. Like gold, it has gravitas. It means something because it is scarce. When you hand someone a gold coin, you can feel it. There is something visceral about it. Bitcoin already carries a similar charge, despite having existed for only 14 years — imagine the charge it will carry in another half century of not changing.

Fiat on the other hand is very abstract. It can be created out of thin air and changed on a whim. It lacks weight and substance. It’s all conceptual. It’s why we call it “fiat”. It’s theatrical in nature. Think about the term “Quantitative Easing” for example. It’s the process of increasing the quantity of the money by making it easier to produce. This, of course, occurs at the expense of its promise and quality and makes the money “easy” or “soft”. People rightly do not trust it like they do a metal, and even less so when it’s just digits on a screen. This is why fiat money is in a death spiral. It is not only becoming more and more digital, but it carries no weight; it’s just the empty promise of a group of bureaucrats.

I will note that the digital nature of Bitcoin is a psychological challenge for many. While it has a fixed supply and absolute scarcity, it will take some time for people to get viscerally comfortable with it. This is also why Bitcoin’s value proposition lies in its resistance to change, not in its ability to “add new features”. Bitcoin is software, yes, but more importantly it’s money. People need to trust the promise of the money, and it will take time for Bitcoin to prove this.

Notwithstanding that fact, Bitcoin has scarcity, and scarcity is at the very root of quality. The more absolute or certain the scarcity, the higher the quality. This principle applies to money, property, art, relationships, or to the words you speak. Buying another NFT that anyone can screenshot is not real art but a mockery. An old painting from a deceased artist will be worth more than when he was alive. Many surface-level relationships will never compare to a few deep and meaningful ones. Talking too much inflates your speech and cheapens your words. The examples are endless. It’s why we have antiques and collectibles.

This is also why aphorisms are so powerful and why the greatest thinkers in history were not verbose, but tried to condense big ideas into as few words as possible. Nietzsche's work is so powerful because it cuts deep, like a sharp knife. It’s surgical. This is why the greatest leaders spoke little and took action. Alexander wasted no time and cut the Gordian Knot. Julius Caesar didn’t write prose, but instead said, “Veni Vidi Vici: I came, I saw, I conquered”. Leonidas, when told to surrender his arms, simply said, “Molon Labe: Come and take them”.

These people took the words they said seriously. In fact, the word “word” comes from the old Norse “wyrd”, which translates to “destiny”. The vikings understood words as incantations or the expression of an inner will. They wouldn’t just “say them” but would mean them because they led to a destiny. The word would precede an act, because it implied a commitment. It was either go or stay. There was no middle ground. No “try”. Do or do not.

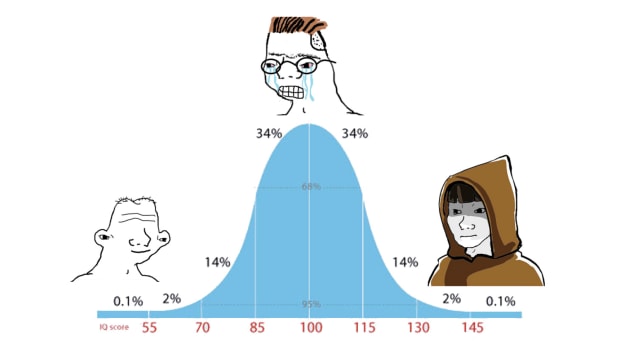

Why do you think the Bell Curve meme is so popular? At a primal level, we all know that the “mid” is the enemy of life. It is the fence, the noncommittal “middle ground” of average.

If you’re alive, you either commit to the fight or run away fast. You either take the leap or you don’t touch the water at all. You put your heart and soul into it or you completely ignore it and check out. Quality comes from depth, from scarcity, and it manifests at the extremes.

The in-between is where life lacks color. Think about what happens when you mix all the colors together? You get gray. You get the lifeless color of the mid. The bland. The enemy of life. There’s a reason the gray goo is the thing that eats up life in science fiction.

I should note that nothing of what I am saying implies eradicating the mid. In fact, it’s impossible: A middle will always exist. What I am saying is that we need not focus on it, orient around it, or even worry about that dimension because quantity will always follow quality anyway!

Like certainty at the base of the pyramid of human needs, the mid is not the goal of life. Mids and masses naturally follow because extremities are for the few. In fact, if you focus on quality and orient for the extremes, you expand life and make more room for the mid. But if you focus on quantity, you will end up losing quality, and the long-term effect is actually shrinkage and therefore less territory or room for quantity. It has the opposite effect!

That’s what’s happening in the West today. It’s why birth rates are dropping and why the culture is being lost. Nobody wants to procreate and produce into hell or nihilism, demographics follow quality, as does everything else. There is less room being created because there is less of a focus on excellence. The bucket is getting smaller and the remains are turning into crabs.

The lesson here is quality > quantity. Less is more. We need not focus on the mid — it will take care of itself. Where there is quality, quantity will follow because it naturally moves outward to new frontiers and makes way for the inertia of the masses to follow.

80/20 → It’s the way of life.

Equality of Outcome or Opportunity?

How about neither?

“Injustice results as much from treating unequals equally as from treating equals unequally.”

— Aristotle, Politics

I need not waste any time on “equality of outcome” because it is of course at the high end of insanity, but equality of opportunity, which many champion instead as a worthy pursuit. On deeper examination, it is also a deeply flawed idea. Flawed not because it’s inherently evil, but because it is a fantasy almost as stupid.

Think about it. How can two people, let alone eight billion, have the same opportunities? Let’s say we could somehow magically equalize the resources, climate, and the environment around us irrespective of where we are, so we all start with exactly the same thing. What do we do about our genetic differences? What about our natural talents and predispositions? Should we all be lobotomized at birth and programmed such that we have an equal array of talents? What about the resources passed down from our parents? Should some arbiter confiscate everything from the parents and distribute it to everyone else? Who would manage such a thing? What sort of cost would be involved in such redistribution? How would you ensure they don’t use that power to enrich themselves? Who should be given such power?

Obviously this is madness. The truth is that there can never be equality of opportunity. It is a fantasy. Equality, in all forms, and any pursuit toward it, simply kills life. The only outcome we’re equal in is death — when we flatline, literally, visually, graphically, and metaphorically speaking. Until then, life is a manifestation of inequality, and to live in accordance with it, we must embrace this truth and fact.

The best we can do as humans is strive to play fair games. Because fair games demand we grow and develop, they call upon the best from us. In a fair game, you have the battle of inequalities and the goal of the game is to win, i.e., to produce an unequal outcome. Losing in a fair game is also valuable, because when treated maturely, it is feedback. Participation awards destroyed this. Now everybody is a winner, even if they lost. It distorts our feedback mechanisms, and from there we come up with even more ridiculous ideas.

Modern equalitarianism in its many forms is full of examples. It’s a peculiar and artificial death-cult ideology that deviates from the historical norm. Its core tenet, that “all men are created equal” has taken root and gained an almost divine, cult-like status. People on both sides of the political spectrum pay homage to this idea, despite the fact that it is not only metaphysically impossible, but is clearly disproven by just looking around and observing human differences. We are not all equal; we are different. Ignoring reality doesn’t change that fact. It only leads to the suppression of quality where it matters, and worse, to Streisand-Frankenstein effects where stupidities such as “intersectionality” rise to fill the “diversity-void” left in the wake of this blind pursuit. It actually perverts the game of life and therefore people’s behavior downstream.

In fact, this is the fundamental distinction between life-affirming and death-cult philosophies. The former prioritize quality and fairness, while members of the latter prize equality. Period. The former recognize winners and losers. The latter, in trying to make everyone a winner, turn everyone into a loser.

There is a lot to say about Bitcoin, inequality, and fairness. It is a framework for a fair game, with fixed and very easily verifiable rules. Bitcoin’s unequal distribution is a reflection of the unequal and naturally uneven distribution of humans and access to information that they have.

For now, the lesson? You can have fairness, or equality. Not both.

Freedom or Equality?

Equality stands against not only quality, fairness, and excellence, but also freedom.

Freedom is counter to equality because as soon as you are free, you begin to de-equalize. The only way to equalize nature or humanity is to force it into an unnatural state. Another way of saying this is if you want equality, you must eradicate freedom. This is a paradox so evident that I don’t know how people remain oblivious to it, especially once it’s been pointed out. It takes some professional-level mental gymnastics to reconcile the two.

If you want excellence, freedom, quality, or vitality, you must learn the truth about equality. You must deprogram yourself and understand it for the anti-life lie that it is. These are strong words, yes. And they may hurt. They might call into question parts of your identity. That’s a good thing. It means you’re learning. The truth often burns in this way. It is an acid to falsehoods.

The West PSYOPed itself with the idea that “all men are created equal”. As we’ve established, there is no evidence for this. Not only are we all born genetically different, but we’re born to different cultures, territories, and eras. The only setting in which “all men are created equal” is the test tubes in human-growing labs from Huxley’s Brave New World. And even then, life finds a way to throw a spanner into the works of perfect “engineering” because life is variance. Ignoring this requires lying to ourselves, and lying about life or reality can only lead to decisions that increase entropy, which are in the end self-defeating.

The lesson here? You can have freedom, or equality. Not both.

Stories

If all of this is true, then why is equality so appealing and so persistent?

The answer lies in one of our most powerful tools. Narrative.

Humans are unique because of the stories we’re able to tell ourselves and share with others. We are conceptual creatures and both the human mind and body are wired to learn through stories. Experience, memory, dreams. These are all stories. Philosophy, politics, psychology. All are simply stories or elements of a story. History? A story. It’s in the word. Science too, is only useful within the context of a story. Outside of the why (a story), the study of matter does not matter.

Here’s what’s interesting. All stories have embedded within them both truth and lies, and all lies and truths are stories themselves. The closer the map (story) is to the territory (reality) the more useful the story. This is the purpose of truth. The further away, the less useful. This is why lying and deceiving have short legs.

Our left hemispheric brain — the often deluded, rationalizing part of our brain — is capable of both great analysis, and the creation of all sorts of rationalizations (stories). Some of these can be incredibly useful, but many can also be complete stupidities, cope, or delusion.

Equality is one such stupidity conjured up to hide the resentment some have for people and things more beautiful than them. Marxists are of this type. They have always been envious of a natural elite, and instead of competing with them or making their own selves better, they concoct elaborate stories of equality or equity to mask their envy, and psychologically justify (or even feel good about) bringing those people down.

They’ll force themselves to believe in this story until they have a taste of power, at which point the story begins to unravel. Their true desires, which were always there, pierce the veil and take hold of them. They become openly hateful and vengeful and spiteful. To deal with this, they must concoct new stories about “righteousness” or “justice” or fill-in-the-blanks. You saw this with the murders of the entire Russian royal family by the Bolsheviks, and the subsequent destruction of Russia by the communist regime over the next century. It was the same with the Maoists and every other deranged group that did the same.

Equalitarians are like the guy that’s been friend-zoned and secretly has feelings for the girl. He will rationalize away his feelings and lead himself to believe that he’s a friend, but if the girl ever texted him and said “I’m drunk and really horny”, his true drives would take over and the elaborate lie he’s told himself will fall apart, revealing the truth beneath it: He wants her. They want power, but because they’re unable to channel it, they have to find another way to take it. Equality is just the story being used. An elaborate lie a particular kind of person tells themself to, on the one hand, feel better about not being enough — which is one of the greatest human fears — and on the other, justify taking other people’s stuff or bringing them down to their level.

This is it. This is all.

The lesson here? True stories matter most.

The truth is we are not equal. Nothing in nature or life is, and if we do not live in accordance with life, it can only lead to death and decay . Quality is a story of growth, and therefore of life.

Equality in contrast, is a story of the opposite to growth, i.e., a map that pretends the territory does not exist. It’s like a man running east looking for a sunset. Such ignorance of reality can only lead to damage, destruction, and the opposite of growth, which is death.

What does this all have to do with Bitcoin?

Much.

First, the eternal battle.

Bitcoin itself lives at the nexus between chaos and order, and in that sense emulates something living. The tip of the Bitcoin blockchain is a place of constant battle between the order of a block and the entropy in a mempool, the order of a discovered nonce and the chaos of the mining process hashing trillions of times per second to find the right number. Bitcoin marches forward relentlessly because humans perceive value in participating in it, directing their energy and time toward it. Through a chaotic consensus mechanism, Bitcoin delivers ultimate order in the form of an immutable supply cap and schedule, that we in turn can trust.

Second, Bitcoin is territory. In fact, it’s some of the most valuable territory known to man, due to its attributes and absolute scarcity. Bitcoin is almost impossible to bend or change. It carries real weight and value, and therefore will always be in demand. Those who claim territory on the Bitcoin network today will be giants tomorrow. And like the most pristine forms of territory, it will remain long after their deaths, for future generations to lay claim and battle it out for usage and ownership.

Third, Bitcoin makes for functional hierarchies, not equality. There are no equal holders, there is no democracy or voting, there is no redistribution of wealth or equalization by fiat. There is ownership of your own bitcoin, complete freedom with, and associated responsibility for its use, and therefore the highest degree of localized consequence for both great and poor management of this resource. The result is greater probability for rewarding competence and merit, and greater probability for punishing incompetence and wastefulness.

The same goes for the way Bitcoin fundamentally functions. There can only be one block added to the blockchain, and if there is a chain split, there will be a war of probabilities that leads to one winner. The mining process itself is probabilistic. The more work you perform, the greater your chances of winning the block reward. If you have a better, newer, superior miner, you increase those chances. You don’t just get the block reward because you’re nice, and it’s not just distributed to everyone equally. Yes, you can be lucky at times (similar to real life) but this is the exception, not the rule. Bitcoin is fair, not equal. There is only equality in probabilities — which is another way to say fairness.

The topic of quality or quantity requires little discussion. Bitcoin is the ultimate, qualitative asset for there is a prescribed total quantity and this can never be altered. As this dawns on the world, and as the pendulum swings inevitably back to a desire for quality, everybody will seek to hold it.

Equality of outcome or opportunity? Bitcoin recognizes neither. You get it when you get it. You keep what you deserve. Is there a luck factor involved, yes, but that’s natural and normal. The key is that there’s no way to give everyone the same amount from the beginning through some ridiculous Worldcoin-like, iris-scanning contest — an impossibility, short of forcing everyone on the planet to do it (also impossible) — nor is there a way to redistribute it after the fact, like they will try with CBDCs.

Bitcoin’s unequal distribution is a reflection of the unequal and naturally uneven distribution of humans and access to information that they have. Some of this is fair, some not, but absent the idiotic idea of bombing the entire world and starting fresh where every person everywhere has exactly the same thing, at the same time, then this is just a fact of life we must deal with. The Bitcoin game is fair, but we’re transitioning to it from a fundamentally unfair and broken status quo. As a result, you cannot expect the transition to be smooth. But it has to be done! Whether voluntarily now, or by necessity later when the Titanic is sinking and everyone is drowning.

There will be large disparities in Bitcoin holdership. There will be the Michael Saylors and there will be those who came in “last” with two sats to their name. That’s the nature of any transition. There are first movers, and there are the smart, the prudent, the lucky, and even the unsavory types who take advantage. But once we’re on the new gameboard, the opportunity to close the gaps exists because there is a better quality of winners and losers. As a result of its fixed rules and unwavering nature, over time the distribution of bitcoin will likely reflect real and fair differences more closely. As the unfair frameworks — such as proximity to a money printer or government apparatus that can pay Peter by robbing Paul — disappear, we’re left with the results of unequal but more fair differences stemming from competence, effort, luck, territory, culture, natural resources, and the like. So forget about equality, bear with the process, and load up on bitcoin. It’s an insurance policy, and a head start for a new game.

Freedom or equality? It should be clear by now, the words equality and Bitcoin don’t belong together. Bitcoin is both freedom and responsibility money. You can’t have one without the other, and the more absolute one, the more absolute the other. There are no bail-outs on Bitcoin, no rewind or reverse. There is no central planner. Just a “physical law” in the form of a set of key promises, the main ones being a fixed supply cap and schedule. Around this you orient yourself. That is it, that is all.

Finally, what is Bitcoin’s story? Many like to call it science, or math, or technology, but this is like looking at a human through a microscope and coming to the conclusion that what you’ve discovered is simply a bunch of “cells”. Bitcoin is so much more than a technology. It’s a movement, it’s a philosophy, it’s a way of being, it’s a story, and yes, that also means it’s a religion. Whether you like it or not, from the very beginning, Bitcoin was a story. The chief protagonist was a pseudonymous figure that proposed an idea and essentially bootstrapped it alongside some early believers of the story. Had Marti, Hal, Laszlo, and others not believed in the idea (story) we might not have been here today. The disappearance of the lead character created a mythos around the real-life story which captured everyone’s imagination and continues to do so today. Stories about Bitcoin Pizza days, Silk Road cowboys, Mt. Gox exit scams and Bitcoin “fork wars” fill our feeds to this day, and will continue forever more. Memes themselves are stories in condensed form, and there is scarcely a more rich and nuanced meme-scape than Bitcoin.

HODL is a story, and so is NgU, RgU, HFSP, DCA, and the rest of them. These memes fuel micro and macro cults, creating movements around their message — whether that’s to save your bitcoin instead of trading it, to accumulate it by dollar-cost averaging (DCA) instead of trying to win big by gambling, to “stay humble and stack sats” as a way of quietly building up your personal reserves and not bragging about it, that winning is a matter of time and patience rather than tinkering or experimentation, and the list goes on.

The question with all of this is of course, are these stories life-aligned or not? From what I can tell, the answer is largely yes. There is some stupidity — the 80/20 rule always applies — but in general, Bitcoin narratives are searching for truth. They hone in and converge around ideas that represent a life-affirming way to deal with and handle reality. Savings is, in my opinion, the most important example, because it’s the bedrock for civilization and helps to set a standard for individual time preference, which in turn influences behavior. When a people have a low time preference, they are more inclined to mature and become strong. The outcome is a society which can dream, reach, and aspire toward excellence. They can build for tomorrow.

In Closing

What have we learned?

A number of things.

As I said at the outset, while it might seem that the battle is left versus right, liberal against conservative, or — if you’re a libertarian — individual versus collective, the truth is deeper.

The truth is that it’s life against death. It always was and always will be. As humans, it’s up to us to pick a side. We are vessels of life, and we have the choice to be either for life or against it. To be for it means we must first recognize what stories and principles are life-affirming and which are not. We must then consciously choose to support the former.

We can be for Quality, Excellence, Hierarchy, Freedom, Responsibility, Vitality, Energy, Strength, Family, Localism, Cultural Variance and Life.

Or…

We can be for equality, average, mass, homogeneity, globalism, commonality, flatness, fiat, decadence, nihilism, weakness, entropy, and death.

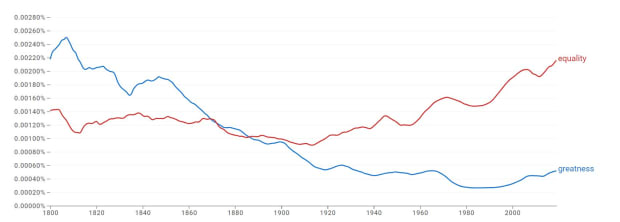

We must choose wisely, because while it seems so obvious when it’s written like that, for the past two hundred years, we’ve seen a steady decline in the former, and in an increase in the latter:

Our individual, and therefore collective thumos — or essence — matters. It’s our North Star. It guides our behavior. It orients us. If it’s qualitative, we become upward-gazing. Sure we will battle, but it will be for a place among the stars. Better that, than crabs in a bucket.

This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.

via bitcoinmagazine.com