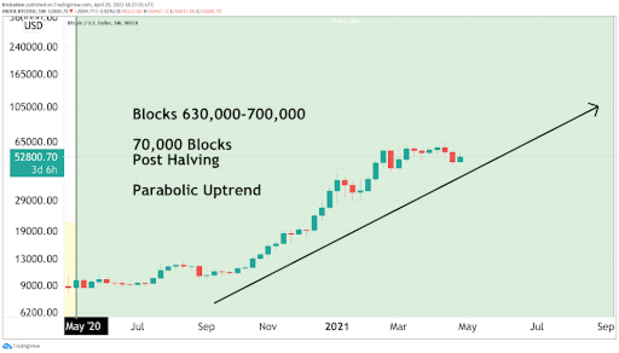

As previous halving cycles along with the fundamental nature of bitcoin show, the BTC price is set to break $60,000 and go parabolic in 2021.

The price of Bitcoin has been consolidating for the last two months, and on-chain analytics and historical precedent suggest that Bitcoin is a caged bull below $60,000, ready for the next leg of parabolic price appreciation.

Halving Cycle Dynamic: Three Stages Of A Cycle

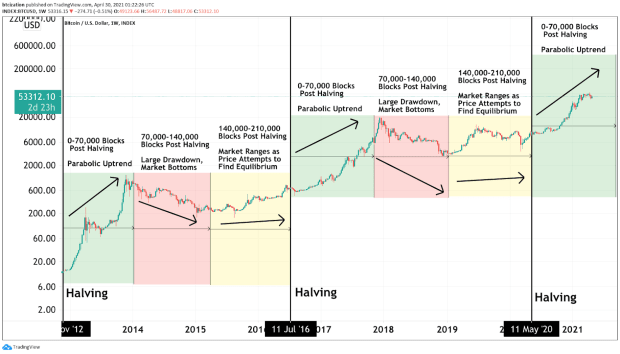

Many are familiar with the correlation between bitcoin’s supply issuance halving and the price action, but digging deeper can provide context to where bitcoin is in the current cycle, and what the future price action may hold.

The previous two bitcoin bull runs paint quite an interesting picture about the interplay of the protocol’s inelastic supply issuance schedule and the price action of the monetary asset.

To provide context: The Bitcoin network issues new supply every block on a predetermined schedule, with the amount of bitcoin issued by the protocol being reduced every 210,000 blocks, or approximately once every four years (as blocks come in at an average time of once every 10 minutes).

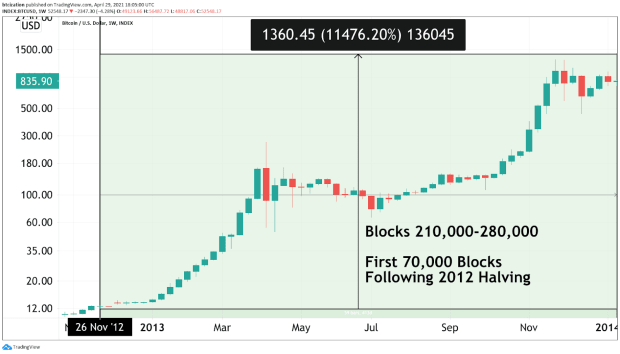

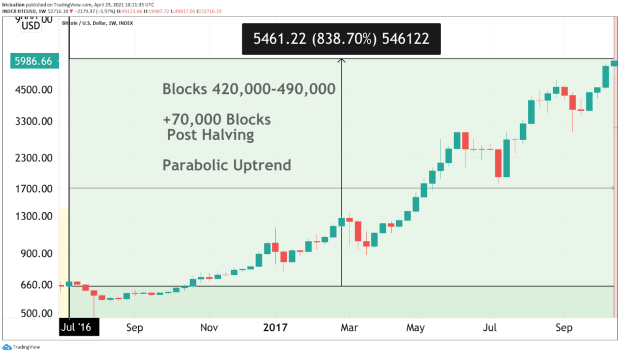

Stage One: The Parabolic Advance (First 70,000 Blocks After Halving)

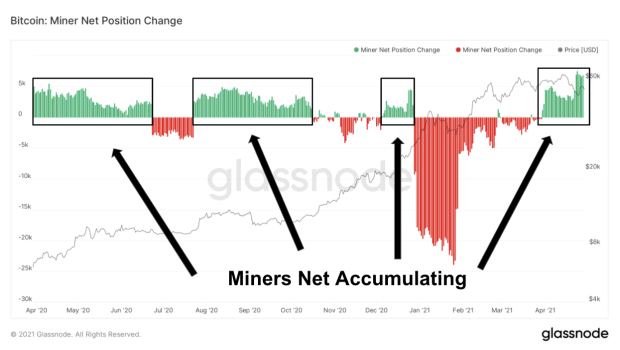

Bitcoin miners can be thought of as the most bullish market participants, as large capital expenditure must be made before any bitcoin is even acquired, followed by the operational expenses that come with the energy needed to mine. As a result, miners hold onto as much bitcoin as they possibly can, oftentimes only selling the bare minimum to cover expenses.

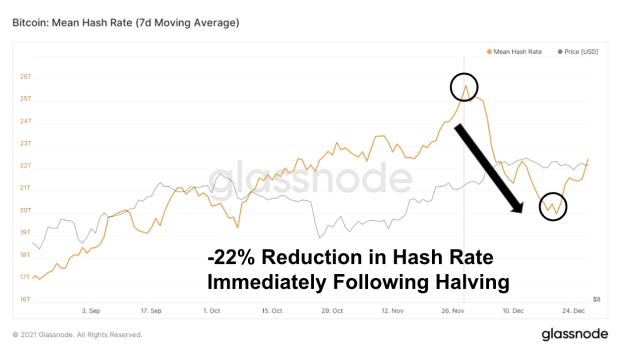

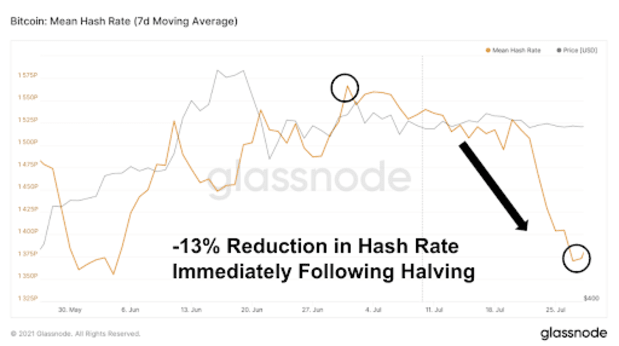

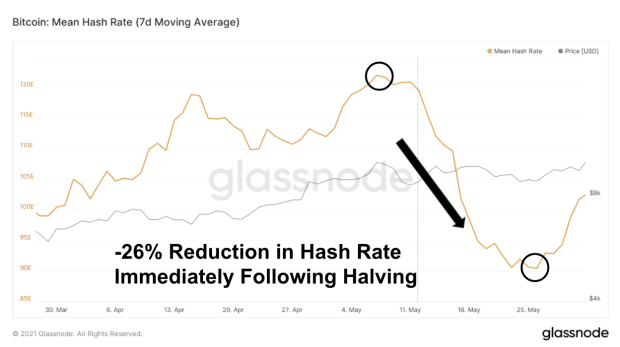

Directly following a halving event, new supply issuance of bitcoin is cut by 50%, which puts downwards pressure on inefficient mining operations, which have to shut down as their revenue is cut by approximately 50% overnight.

This purge of inefficient mining operations causes network hash rate to temporarily drop off, leaving only efficient mining operations with cheap power sources and/or next generation ASICs to mine for blocks. With inefficient miners that operated with negligible profit margins out of the market, and hash rate pulling back significantly, difficulty adjusts downwards and the miners still in the market are left with significant profits, greatly reducing sell pressure in the market.

Inefficient mining operations will often be sold and/or relocated to a different jurisdiction with cheaper energy.

Not only does the halving event decrease the quantity of new bitcoin supply issued per day immediately, but in the process, remaining mining operations see their competitors ousted simultaneously. With inefficient mining operations having to turn off and oftentimes geographically relocate, efficient operations enjoy greater market share, as well as wide profit margins.

These dynamics, coupled with increasing development, improved exchange and wallet infrastructure and a fresh wave of new adopters, create a massive disequilibrium between available bitcoin supply versus market demand, which serves as rocket fuel for the price of bitcoin.

During the parabolic leg of a bull market following the halving, the price action and adoption of bitcoin is reflexive. A new all-time high is breached, and bitcoin is once again thrown in the center of the media circuit, catching the eyes of speculators and investors across the globe. It begins to sink in for many that Bitcoin has not “died” as they may have previously believed, and increased legitimacy, market liquidity, market infrastructure and the newfound support by respected investors increases demand, despite supply remaining completely inelastic.

A feeding frenzy is incited, as an exponential increase in demand for the monetary asset has to be priced against an absolutely fixed, verifiable supply. The 2012 and 2016 cycles saw this dynamic play out for approximately 70,000 blocks.

Stage 2: Large Drawdown (70,000 to 140,000 Blocks After Halving)

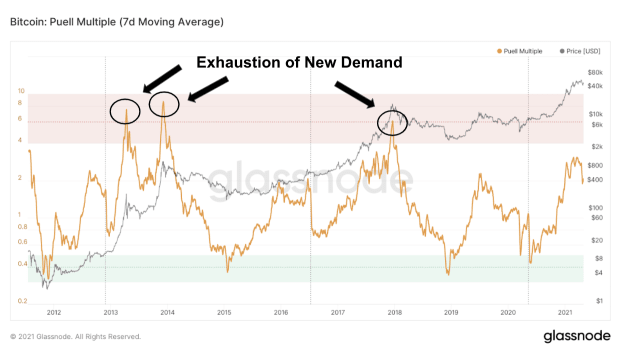

Following the parabolic advance, the price of bitcoin is an order of magnitude (or more) above where it was trading at the Halving. Even with a new wave of adopters in the market, the last two halving cycles have witnessed a protracted drawdown as new demand is exhausted and is unable to keep up with supply hitting the market. There are a few reasons this takes place.

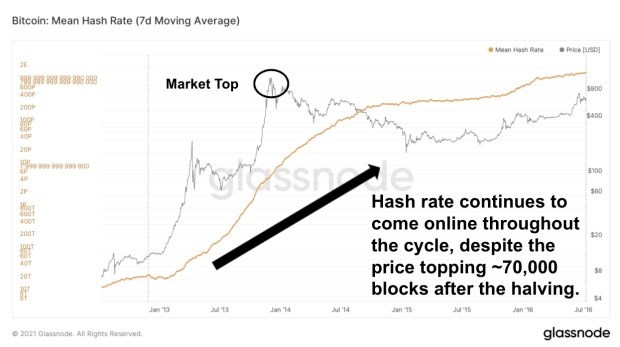

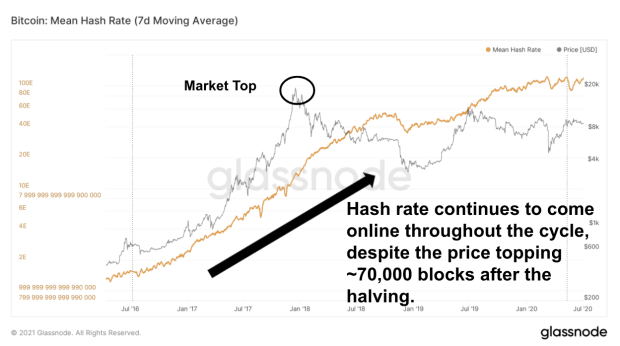

A result of the rising bitcoin price is that the mining industry becomes extremely competitive. With the price of bitcoin increasing exponentially, mining profitability skyrockets. This creates an incentive for new market participants to enter, but because of the rapid increase in demand, supply of new mining equipment lags behind price. As the price goes exponential, hash rate follows, with new miners coming online throughout the cycle. A result of economic incentives, the new ASICs take time to be manufactured, shipped out and plugged in efficiently and effectively. This is why hash rate often will lag price, only to catch up later on after the cyclical top.

Because of the difficulty adjustment that is built into the protocol, the miners continue to fight for the same amount of bitcoin, despite increasing competition and difficulty. This dynamic means that with all else being equal, profit margins across the mining industry are diminished, thus increasing potential sell pressure as miners have capital expenditure and operating expenses denominated in dollars.

With increased sell pressure from miners later in the bull run, demand eventually cannot keep up. With the exponential increase in users and adopters (stackers/HODLers), an increasing amount of buy side pressure is exerted in the market in the early stages of the bull run. However, as bitcoin increases in value by an order of magnitude (or more) in a very short amount of time, newfound demand dries up, and the sell pressure from miners and long-term holders can no longer be met with increasing demand to sustain such a high price.

This dynamic can be seen with the Puell Multiple Indicator, which is calculated by dividing the daily issuance value of bitcoins in dollars by the 365-day moving average of daily issuance value. Even with demand increasing exponentially, if price rises too far, too fast, the new high in price cannot be sustained for long.

Interestingly, the 2013 bull run saw what some call a “double bubble,” as the price rose to a high of $250, then crashing down to $50, before reaching a high of over $1,100 later in the year.

The price floor is eventually found multiples above the previous cycle high as the new wave of adopters establish a steady stream of demand as HODLers/stackers continue to accumulate the asset despite the severe drawdown. In 2015, the price found a solid floor around $200, while in 2018 the floor was found around $3,200. The bottom is in when the sell pressure from the purge of inefficient miners (who are squeezed by ever-increasing hash rate), speculators and long-term holders is met by equal demand from strong-handed bitcoin accumulators, who come to understand the superior monetary attributes of the asset.

Stage Three: Consolidation (Market Attempts To Find New Equilibrium)

Following the protracted decline in price, the last approximately 70,000 blocks of the halving cycle see the price of bitcoin attempt to find a new price equilibrium. The price ranges above the bottom set approximately 140,000 blocks after halving, and below the all-time high set approximately 70,000 blocks following the halving. All the while, hash rate continues to rise as new miners plug in as lagging demand to mine bitcoin by increasingly deep pocketed and sophisticated investors with cheap energy sources is finally felt in the market.

What To Expect For The Rest Of 2021

If anything can be taken away from past market cycles and a multitude of various metrics and on-chain analytics, the price of bitcoin is set to continue to go parabolic throughout the rest of 2021.

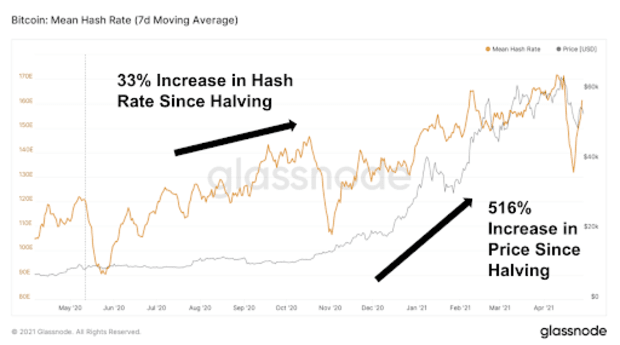

Since the halving, price has surged 516% while hash rate has only increased by 33%. This can be attributed to a variety of factors, including a global semiconductor shortage. This is significant because it means that miner profitability has surged with the increase of price, while hash rate and subsequently difficulty has lagged far behind. This is extremely bullish as new waves of demand continue to push the bitcoin price higher, while miner selling pressure remains near non-existent.

With this in mind, with a high amount of certainty it seems that the “top” is nowhere close to being set, with the parabolic advance still having much of 2021 to develop. However, following the parabolic rise that comes with the first 70,000 blocks following a halving, will bitcoin see a protracted approximate 80% drawdown and bear market similar to past cycles? One must not be so sure.

This Time Different™

The traditional boom and bust cycle is well known at this point, but this cycle has seen developments that could alter the traditional market cycle that bitcoiners and investors have become accustomed to. Often called the four most dangerous words in finance: Is this time different? Yes, and here is why.

A Developed Market For Bitcoin As Collateral

Throughout the course of previous bitcoin bull runs, early adopters and HODLers grew specutaturly wealthy in very short amounts of time, off of what often began with a small allocation. These individuals naturally would look to sell/spend a proportion of their holdings, whether to diversify into alternative investments or to spend for personal enjoyment, as bitcoin is, at the most fundamental level, money, after all.

However, this cycle comes with optionality that was not present in previous cycles. The dynamic of a developed bitcoin futures and derivatives market, along with the increasing ease of deploying bitcoin as collateral changes market dynamics significantly.

No longer do long time holders need to sell their bitcoin to enjoy their recently exponentially increased savings/wealth. The advent of a market for dollar loans collateralized by bitcoin holdings is a massive deal, and has broad implications for both bitcoin and the dollar.

The value of the global market for collateral is estimated to be approximately $20 trillion. Currently, government bonds and cash like securities are the most prevalent forms of collateral. An efficient and liquid market for collateral is imperative for a fully functional financial system.

Collateralized loans can be beneficial to both borrowers and lenders, as lenders hold security against default risk, and the borrower can obtain credit that they would not have obtained otherwise and/or receive the loan on more favorable terms. Various forms of collateral come with their own sets of tradeoffs.

What is not very well understood outside of the bitcoin space is that the asset is the best form of collateral the world has ever seen, and this statement becomes increasingly relevant the larger and more liquid the bitcoin market becomes.

Bitcoin trades 24/7/365, has liquidity in every jurisdiction and market in the world, is highly portable, fungible, and is not subject to rehypothecation like many other traditional forms of collateral like bonds and other financial assets, and as a completely transparent ledger it allows any entity to audit ownership and know who exactly owns what.

With the ability to use an absolutely scarce, digital bearer asset as a form of collateral, lenders can mark to market positions every second, and in the case of a steep BTC/USD drawdown, liquidate the borrowers collateral.

Market participants, specifically those with an extremely large amount of bitcoin, now have the option to never sell any of their holdings, while living off of their stack. With the assurances of steady devaluation across all fiat currencies, HODLers can borrow against a small proportion of their bitcoin stack and use the dollars to spend/invest. When it comes time to pay off the principal of the loan later on, more fiat can be borrowed and the fiat obligations can be rolled over.

This works because the centrally planned market rate for fiat currencies is coming up against the free market price of bitcoin; an absolutely scarce, digital monetary asset. Bitcoin will continue to appreciate at a greater pace than the interest rates set by central banks, which have attempted to warp the cost of capital to zero (or even negative in many jurisdictions).

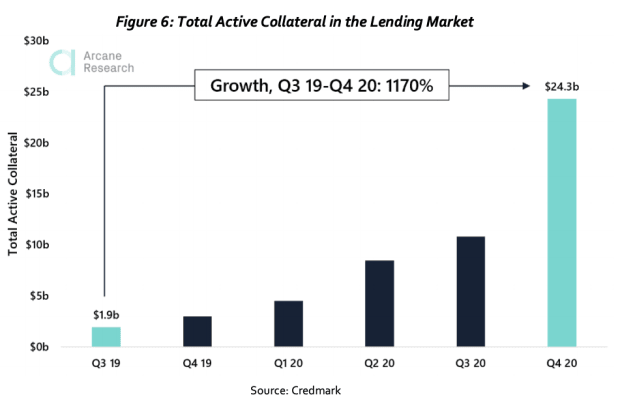

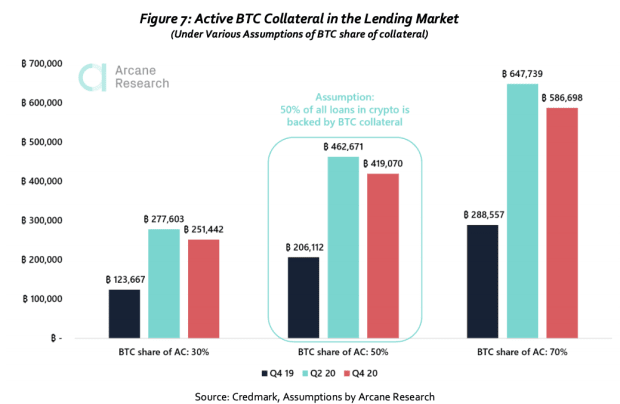

Credmark, a leading company in the credit data space, shared data in a report released this February by Arcane Research, showing that the lending market has seen a sharp rise over the past year, estimating that approximately 400,000 BTC could already be in use as collateral in the lending market at the time of the report’s release.

This is occurring at the same time that the incumbent monetary system is at the tail end of the long-term debt cycle, and the explosive combination of a free market, absolutely scarce, global monetary asset — up against various centrally-planned national currencies that are issued by central banks which are forced to continue to pump liquidity into the system — will bring about an extinction event for the incumbent monetary regime/s.

Expect bitcoin to go parabolic throughout the rest of 2021, but be wary, this time may be different...

via bitcoinmagazine.com