The prices of ASICs, computing components central to Bitcoin mining, have surged this year. But why? And where will they go next?

There could be a number of factors contributing to the rising price of bitcoin mining ASICs — the components that are central to the specialized machines used to secure the Bitcoin network in exchange for BTC rewards — including supply shortages, worldwide shipping congestion, growing demand from Chinese miners relocating outside of China and skyrocketing demand and interest in bitcoin.

Even COVID-19 has seemingly been a factor, as Whatsminer factories in Thailand and Malaysia were almost forced to close in August 2021 due to the spread of the virus.

And as the prices of ASICs rise, the most popular mining rigs are as scarce as they have ever been — Bitmain’s Antminer S19j Pro, for instance, is currently listed at $9,300 on its website. All other Antminer products are listed as “sold out.”

“Bitmain and other manufacturers are sold out until mid-2022 and the growing North American miners are driving up demand and price for the ASICs that are available on the market,” Luxor Technologies CFO Ethan Vera explained to Bitcoin Magazine.

Unless a mining company has established a preorder or has a fixed contract with an ASIC provider, there’s often a wait until at least Spring 2022 for new equipment.

But to determine exactly how this ASIC market is shaping the present and future of bitcoin mining, Bitcoin Magazine spoke with players on both the manufacturing and sales sides of the equation. And there were two things that all appeared to agree upon:

- ASIC prices will continue to follow the price of bitcoin, and as it has risen in recent weeks so too have rig price tags.

- A worldwide chip shortage is the main manufacturing bottleneck driving ASIC prices up.

“ASIC miner prices always track the price of bitcoin,” Blockstream CSO Samson Mow said. “The higher the price of bitcoin, the higher the price of miners. [But] the other factor is the chip shortage, which is constraining supply. It’s possible that the supply of Bitcoin miners may never catch up to the demand.”

Rising Bitcoin Price, Rising ASIC Price

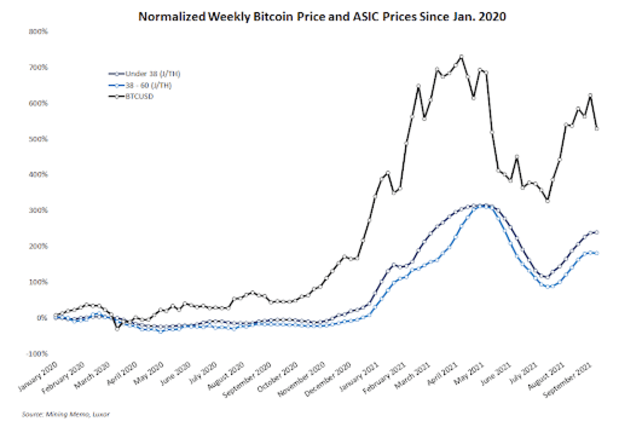

Compass Mining’s Zack Voell recently looked at the rapid rise in prices for mining equipment and he estimated that there has been a 25% increase in Q3 2021, a trend he attributes to the rising bitcoin price.

“Seeing prices across different categories of ASICs increase between 20-40% this quarter isn’t shocking, given bitcoin’s price rebound over the same period,” Voell wrote in a recent edition of Compass Mining’s newsletter.

When The Chips Are Down

Computer chips are the most expensive component by far in an ASIC rig and orders are backed up due to a worldwide shortage in many industrial products, including microprocessors, phones, automobiles and other electronics. It’s specifically the wafers which are scarce — small discs made of silicon that hold a chip together to build integrated circuits.

Samsung and Taiwan Semiconductor Manufacturing Company (TSCM), two of the largest manufacturers of these chips, have recently raised their prices in an effort to meet the mounting demand, said Vincent Zhang, sales director of MicroBT, on a recent Compass Mining podcast.

ASICs used for bitcoin mining constitute less than 1% of Samsung’s and TSCM sales and chip buyers like Apple and vehicle manufacturers are way ahead, Zhang explained. There’s no question, added Vincent Vuong of Compass Mining, on the same podcast, that bitcoin miners are getting “second-tier treatment” from Samsung and TSCM.

What’s Next For The ASIC Market?

While it appears that increasing bitcoin value will continue to drive ASIC prices up, other factors appear poised to influence the market as well.

In response to the latest chapter in China’s Bitcoin ban, including an edict that no mining equipment can be sold inside of the country, China’s e-commerce giant , Alibaba announced that it won’t be selling mining rigs or related accessories.

Starting Oct 15, 2021, Alibaba will shut down two sections of its website: “Blockchain Miner Accessories” and “Blockchain Miners.”

And Luxor’s research and content director Colin Harper said that he expects Bitmain is likely to shut down its remaining manufacturing plants in China.

“Think ASICs are expensive now?” Harper asked. “Next year is looking like a ‘hold my beer’ moment for higher prices still, as manufacturers relocate [out of China].”

But Mow said that the continuing China shutdown is not a major factor in the price of ASICs.

“The continuing China crackdown (including the latest edict that bans the sale of mining equipment inside China) is great for bitcoin decentralization but isn’t really affecting the price of ASICs,” he said. “The ASIC market has detached itself from the China market and is much more affected by the ongoing global shortage of chips, which were not manufactured or sold in China in any case.”

Zhang is confident that ASIC sales and prices will improve in Q4 2021 and into 2022, mainly due to an improvement in chip availability.

Vera sees a coming short-term decrease in ASIC prices as many miners, particularly those emigrating from China, give up on getting established elsewhere.

“We may see short-term decreases in ASIC prices as miners get impatient with infrastructure timelines and deals end up falling through,” Vera said. “Across North America, there have been dozens of planned mining operations that have failed to deliver this quarter, and many more to come. Major infrastructure setbacks will likely create a period of ASIC sell-offs.”

Meanwhile, Voell underscored the tried and true rule about ASIC prices in his own prediction for the future from his newsletter — the BTC price will ultimately drive the mining rig price. sees future prices following bitcoins price:

“Obviously, whichever direction bitcoin’s price goes, ASIC prices will follow,” he wrote. “Cryptocurrency traders and investors have widely disparate outlooks for the market going into the final quarter of 2021. A bullish market would be kind to paper gains on machine values for miners. A bearish outcome could be a nice gift for miners looking to procure more machines.”

via bitcoinmagazine.com