The dollar wrecking ball is hurting emerging markets and competing currencies alike. Will the U.S. be the last country to print the global reserve currency?

This is an opinion editorial by Luke Mikic, a writer, podcast host and macro analyst.

This is the first part in a two-part series about the Dollar Milkshake Theory and the natural progression of this to the “Bitcoin Milkshake.”

Introduction

- “The dollar is dead!”

- “The Petrodollar system is breaking down!”

- “The Federal Reserve doesn’t know what it’s doing!”

- “China is playing the long game; the U.S. is only planning four years ahead.”

How many times have you heard claims like these from macroeconomists and sound money advocates in recent times? These types of comments have become so prevalent, that it’s now a mainstream opinion to declare that we’re about to see the imminent death of the U.S. dollar and subsequent fall of the great U.S. empire. Is modern America about to suffer the same fate as Rome, or does the country still have an economic wild card hidden up its sleeve?

Similarly dire predictions were made about the U.S. dollar in the 1970s during the

“Great Inflation,” after the abandonment of the gold standard in 1971. It took the dynamic duo of Richard Nixon and Henry Kissinger to pull a rabbit out of the hat to save the U.S. dollar. They effectively backed the USD with oil in 1973, birthing the petrodollar experiment.

It was an ingenious move that prolonged the life of the dollar and the hegemonic reign of the U.S. as the world’s dominant superpower. The lesson we should take away from this example in the 1970s is to never underestimate a great empire. They’re an empire for a reason. Could the United States be forced to play another monetary wild card today to retain their power as the global hegemon in the face of de-dollarization?

History doesn’t repeat, but it often rhythms.

Another similarity to the 1970s is emerging today as Federal Reserve Chair Jerome Powell is aggressively raising interest rates in an attempt to fight the most ravaging inflation we’ve seen since that time. Is Powell simply fighting inflation or is he also attempting to save the credibility of the U.S. dollar in the midst of a 21st-century currency war?

I believe we are on the precipice of the implosion of a globally interconnected, fiat-based financial system. There are currently over 180 different currencies all around the world, and in these two articles I’ll outline how we will end the decade with two currencies left standing. Another dynamic duo, if you will.

Most people assume these two currencies left standing will be in violent opposition to each other, but I’m not so sure. I believe they will form a symbiotic relationship where they compliment each other, the same way a plump cherry compliments a milkshake on a warm, sunny day.

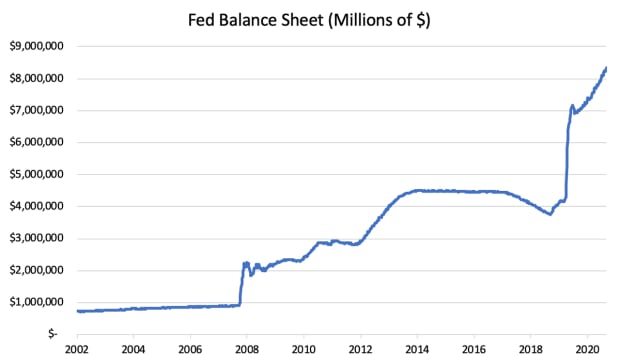

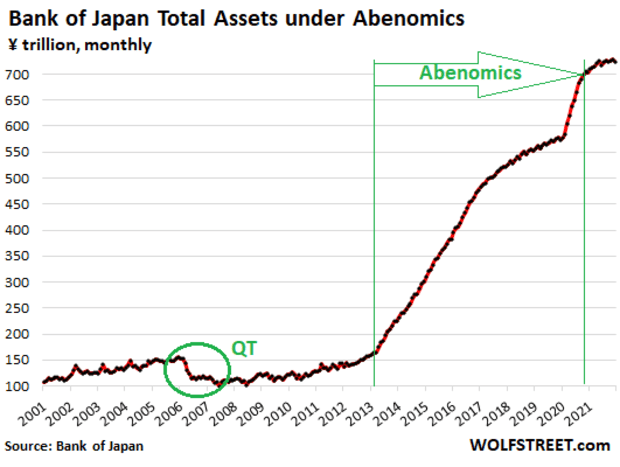

But how do we get there, and why do I believe the U.S. dollar will be one of the last dominos to fall? Simple gravity! Yes, the U.S. is running the largest fiscal deficits of all time. Yes, the U.S. has $170 trillion of unfunded liabilities. But gravity is gravity, and there’s an estimated $300 trillion of economic gravity around the world making it likely that the U.S. dollar will be the last fiat currency to hyperinflate. This is the biggest mistake people make when they analyze the dollar. We often only look at the supply of dollars and an exponentially growing Fed balance sheet.

However, everyone is forgetting the first lesson of Economics 101: supply and demand. There is an enormous demand for dollars all around the world.

This is a Bitcoin publication, so I will also be discussing the role that bitcoin may have in the cascading fiat currency collapse that I expect to unfold in the coming months and years.

If you accept the hypothetical assumption that one day the world will operate on a bitcoin standard, most people will then assume this is bad for the United States, as it is the current global reserve status holder. However, the monetization of bitcoin benefits one country disproportionally more than any other: the United States.

- A strong dollar will lead to hyperdollarization.

- A consequence of hyperdollarization is increased bitcoin adoption.

- A consequence of increased bitcoin adoption is increased stablecoin adoption.

- A consequence of increased stablecoin adoption is increased U.S. dollar adoption!

This dynamic feedback loop will ultimately become an all-consuming, fiat currency black hole.

Welcome to the “Bitcoin Milkshake Thesis,” the delicious macroeconomic dessert you haven’t heard of.

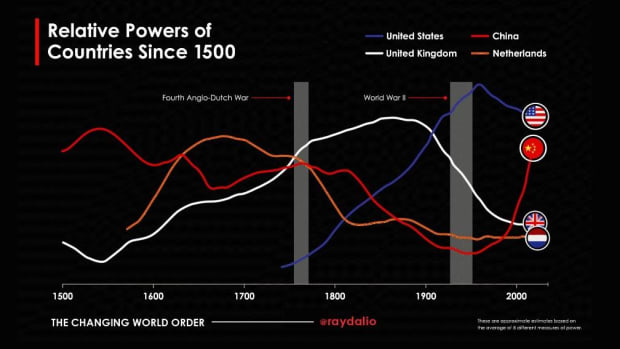

Let me explain many of these complicated-sounding macroeconomic theories prevalent today: petrodollars, eurodollars, dollar milkshakes, bitcoin milkshakes, Ray Dalio’s “Changing World Order.”

Most importantly, I will explain how they all relate to the most delicious dynamic duo in the macroeconomic dessert place: the Dollar Milkshake meets the Bitcoin Milkshake.

The Dollar Milkshake Theory

By now, you’ve probably at seen the effects that the “Dollar Milkshake Theory” had on financial markets. The Dollar Milkshake Theory, created and proposed by Brent Johnson in 2018, helps to explain why every asset class in the world is cratering. From global equities, blue chip tech stocks, real estate and bonds, money is flowing out of assets and the currencies of sovereign nations and into the global safe haven: the U.S. dollar.

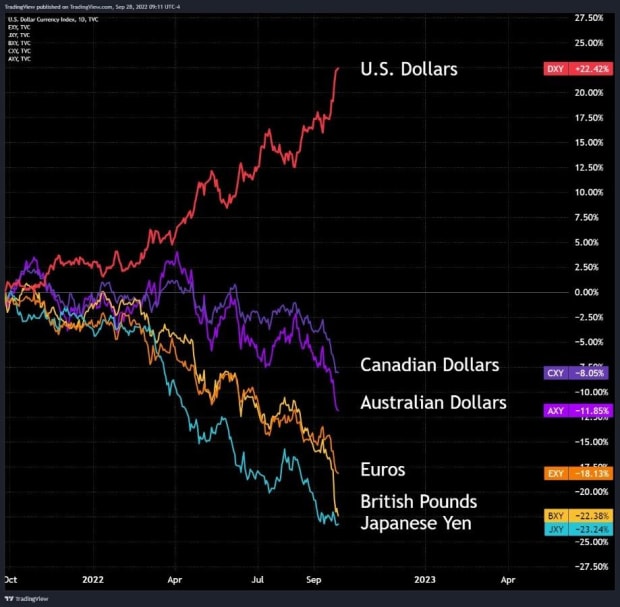

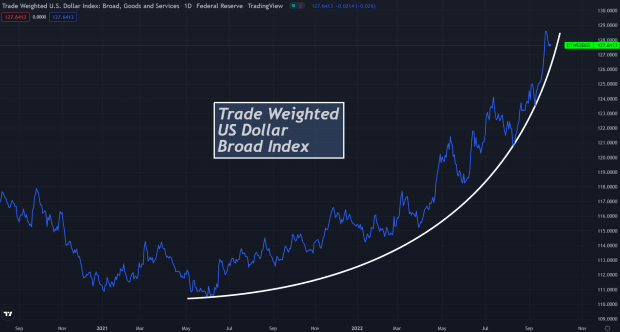

If there is one chart that explains the Dollar Milkshake, this is it.

Distilled into its simplest format, the Dollar Milkshake Theory explains how the macroeconomic endgame will unfold for our debt supercycle. It details in what order Johnson believes the dominos will fall as we transition to a new monetary system.

The “milkshake” part of this delicious dessert consists of trillions of dollars in liquidity that global central banks have printed over the past decade. Johnson articulates that the USD will be the straw that sucks up all of that liquidity when capital seeks safety in times of financial risk. Capital flows to where it is treated best. Johnson proposes that the U.S. dollar will be the last fiat currency standing, as sovereign nations are forced to devalue and hyperinflate their own national currencies to source the U.S. dollars they need during a global sovereign debt crisis.

Put very simply, the Dollar Milkshake Theory is a manifestation of the structural imbalances present in our monetary system. These imbalances were expected and even predicted by John Maynard Keynes at the Bretton Woods conference in 1944 and critiqued by Robert Triffin in the 1950s and 1960s. The consequences of abandoning the gold standard without using a neutral reserve asset was eventually going to come back to haunt the global economy.

With the dollar wrecking ball currently wreaking havoc on our financial system and bankrupting governments all around the world, I thought it would be timely to revisit what I said over a year ago:

That quote originated from an article I published in a series titled “Bitcoin The Big Bang To End All Cycles.” In the piece, I analyzed the history of 80-year, long-term debt cycles and the history of hyperinflation to conclude that the inflation that had just reared its head in 2021 was not going to be transitory, and instead would be an accelerating catalyst that would propel us toward a new monetary system by the end of the decade. Despite expecting acceleration, the acceleration we’ve seen since mid-2021 has still surprised me.

Here, I will take a more granular look at the intermediary steps involved in this global sovereign debt crisis, exploring the role bitcoin will play as this unfolds. That will give us hints as to which is likely to be the next global reserve currency after the unwinding of this debt supercycle.

Many are puzzled by the U.S. dollar decimating every other fiat currency on the globe. How is this possible? There are two major systems that have led to the structural imbalances present in our global economy: the eurodollar market and the petrodollar system.

Much of the dollar-denominated debt mentioned above was created by banks outside of the U.S. This is where the term “eurodollars” comes from. I’m not going to bore you with an explanation of the eurodollar market, rather just give you the basics that are relevant to this thesis. The key takeaway we need to understand is that the eurodollar market is rumored to be in the tens and even hundreds of trillions of dollars!

This means there is actually more debt outside the U.S. than there is within the country. Lots of countries either chose, or were forced, to take on U.S. dollar-denominated debt. For them to repay that debt, they need to access dollars. In times of an economic slowdown, lockdown of the global economy or when exports are low, these other countries sometimes have to resort to printing their own currencies to access U.S. dollars in the foreign exchange markets to pay their dollar-denominated debts.

When the dollar index rises — indicating that the U.S. dollar is getting stronger against other currencies — this puts even more pressure on these countries with large dollar-denominated debts. This is exactly what we’re witnessing today as the dollar index (DXY) reached 20-year highs.

For a more detailed breakdown on the Dollar Milkshake Theory and the devastating effects it’s having on markets today, I dedicated a blog to explaining the thesis.

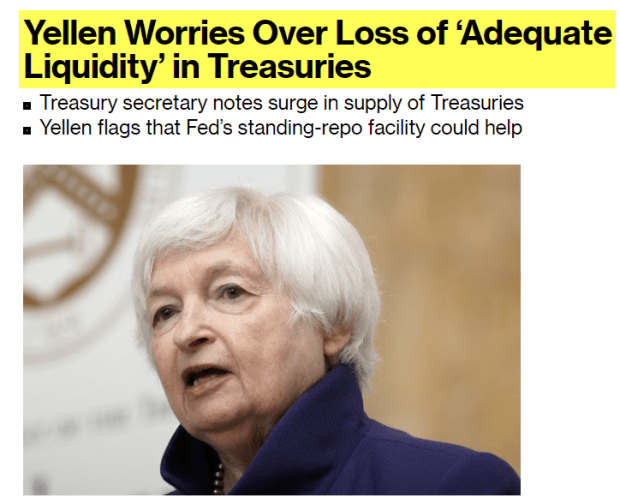

This milkshake dynamic creates an enormous demand for U.S. dollars outside of the country, which enables and actually requires the Fed to create enormous amounts of liquidity in order to supply the world with the dollars the world needs to service its debts. If the Fed wants the global economy to function effectively, it simply must supply dollars to the world. This is a key point. In a globally interconnected world during peacetime, it makes sense the Fed would supply the world with the needed dollars.

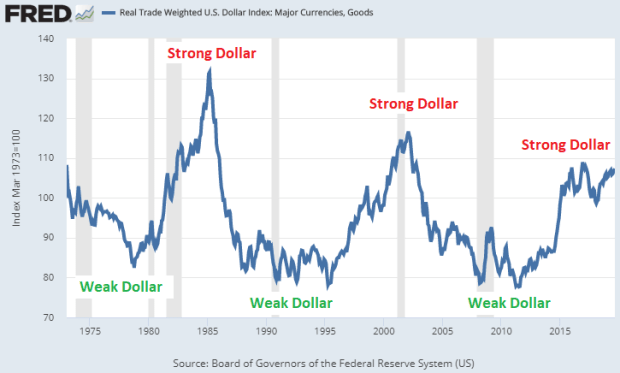

Since we’ve been on the petrodollar system for the past 50 years, we’ve experienced many calls for the death of the dollar. However, the most threatening times our financial system faced have emerged when there’s been a shortage of U.S. dollars, and the DXY has strengthened relative to other currencies.

The Deadly Dollar Bull Runs

The dominant narrative in the macroeconomic environment over the past decade has surrounded the Fed and central banks with historically unprecedented loose monetary policy. However, this appears to be changing in 2022.

As we watch the Fed and central banks around the world raise interest rates in an attempt to control inflation, many are shocked and confused as to what this new paradigm of tightening monetary policy will mean for our deglobalizing global economy. It’s paramount to remember: All fiat currencies are losing purchasing power against goods and services.

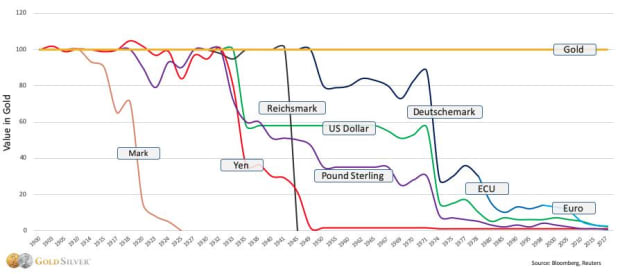

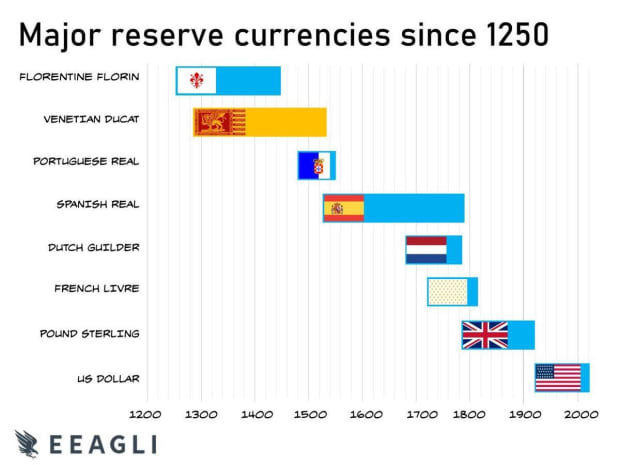

All currencies are being rapidly devalued and will eventually return to their intrinsic value of 0. Of the hundreds of currencies that have existed since 1850, most have gone to 0. Currently, we’re in the process of witnessing the final 150 or so trend to 0 in a globally competitive debasement to the bottom.

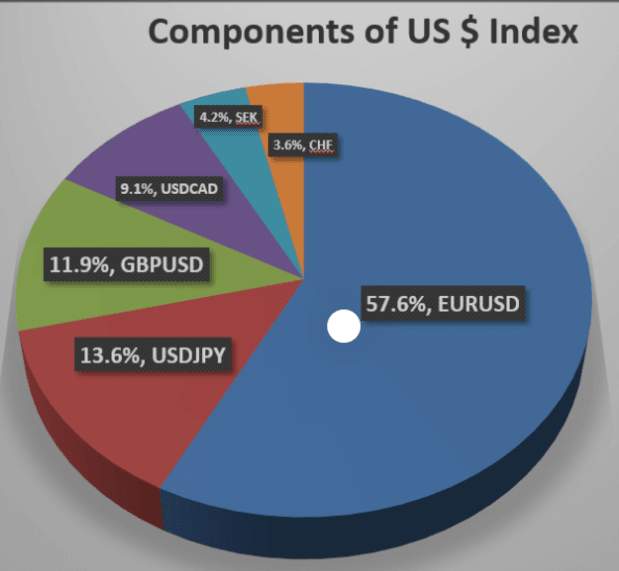

One of the major measurements everyone uses to measure this relative strength is the dollar index. It is measured against six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

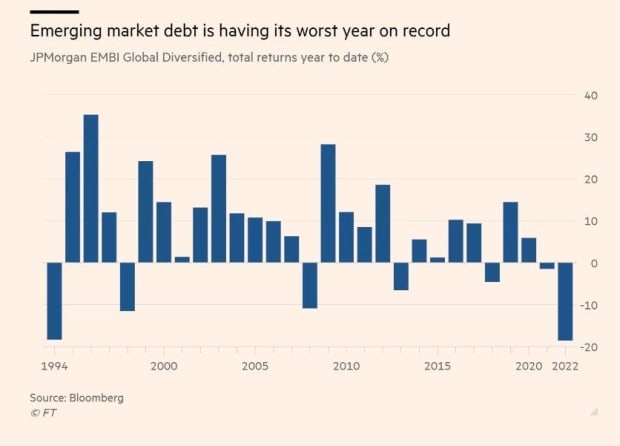

The DXY has had three major bull runs since 1971 that have threatened the stability of the global financial system. Every time the U.S. dollar has rallied, it’s destroyed the balance sheets of emerging market countries that have taken on too much U.S. debt with too little reserves.

In this dollar bull cycle, it’s not just fringe emerging markets that are suffering from the soaring U.S. dollar. Every single currency is being decimated against the mighty greenback. The Japanese yen has long been regarded as a safe haven alongside the U.S. dollar and for years it’s been held up as the poster currency by Keynesian economists. They’ve had the joy of pointing toward Japan’s enormous 266% debt-to-GDP ratio, alongside the Bank of Japan’s enormous 1,280-trillion-yen balance sheet with decades of low inflation.

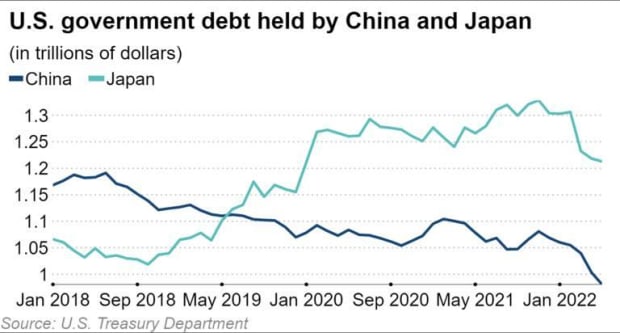

Japan held $1.3 trillion of U.S. Treasurys as of January 2022, beating out China as the largest foreign holder of U.S. debt.

Both the Japanese and the Chinese have recently resorted to selling their U.S. Treasury holdings as they suffer from the global dollar shortage.

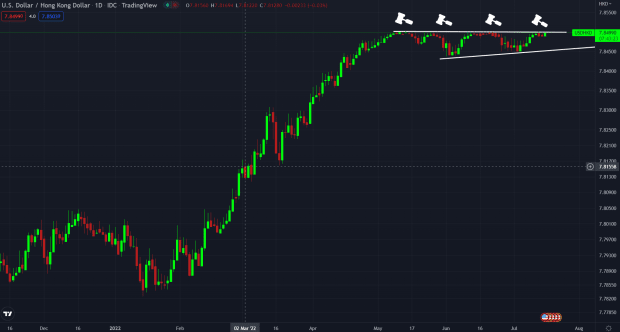

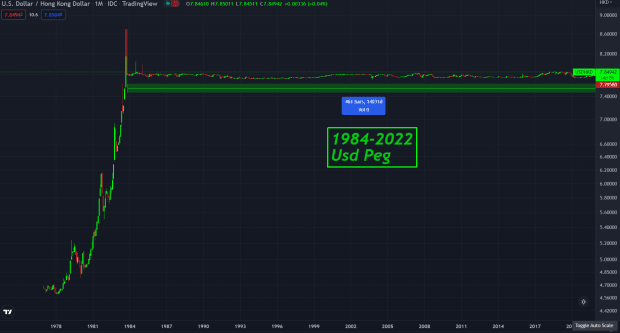

A weak Japanese yen is typically bad for China because Japanese exports become more attractive the weaker the yen gets. This is why every time the yen has significantly weakened, the yuan has typically followed. There appears not to be an exception to this rule in 2022, and close attention should be paid to the other exporting Asian currencies, like the South Korean won and the Hong Kong dollar.

Then we have the Hong Kong dollar peg, which is also on the brink of a major breakout, as it continues to knock on the 7.85 peg.

Shifting our attention to another energy-impoverished area, we can see that the USD is also showing enormous strength against the euro, which is the second-largest currency in the world. The EUR/USD has broken a 20-year support line and has recently traded below parity with the dollar for the first time in 20 years. The eurozone is suffering tremendously from a fragile banking system and energy crisis with its currency losing 20% of its value against the dollar in the past 18 months alone.

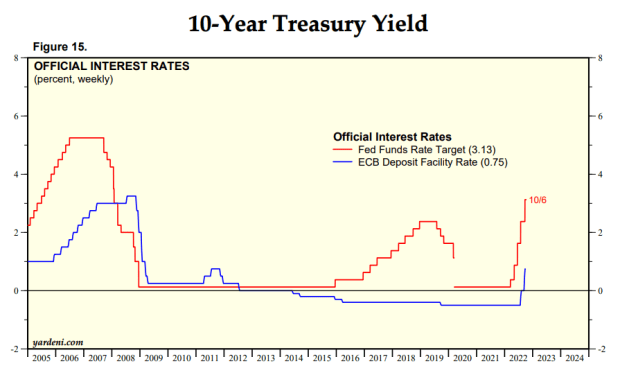

The European Central Bank looks to be in crisis mode as they’ve barely gotten interest rates into the positive realm, while the Fed has moved its federal funds rate to almost 4%.

This has caused significant capital flight out of Europe, and due to the recent volatility in their bond market, ECB President Christine Lagarde was forced to announce a new form of quantitative easing (QE). This “anti-fragmentation” tool is a new form of QE where the ECB sells German bonds to buy Italian bonds in an attempt to keep the fracturing eurozone together.

This dollar bull run is wreaking havoc on the world’s largest and safest currencies. The yen, euro and the yuan are the three largest alternatives to the U.S. dollar and all are competitors if the U.S. were to lose its reserve currency status. But the emerging market currencies are where the real pain is being felt the most. Countries like Turkey, Argentina and Sri Lanka are all experiencing 80%-plus inflation and serve as great examples of how the dollar wrecking ball hurts the smaller countries the most.

What Comes Next?

The DXY has had a hell of a run over the past 12 months, so a pullback wouldn’t surprise me. Both the DXY and the more equally-weighted broad dollar index are very extended after having parabolic rises in 2022 and are both now breaking down from their parabolas.

Could we see a Fed balance sheet shoot to $50 trillion while simultaneously seeing hyperdollarization as the eurodollar market is absorbed?

It’s possible, but I think the Fed is racing the clock. The petrodollar system is breaking down rapidly as the BRICS nations are racing to set up their new reserve currency.

It’s important to notice, this milkshake scenario was always going to unfold. The structural imbalances in our financial system would’ve always inevitably manifested themselves in this domino effect of currency collapses that Brent Johnson articulated.

Interestingly, I believe some recent events have actually accelerated this process. Yes, I see all the signposts that the dollar doomsayers are pointing out; the dollar will die eventually, just not yet. However, let’s entertain the idea that the dollar is in fact dying, and the USD will lose reserve currency status.

Who would take over the global reserve currency of the world?

For the economic reasons I’ve mentioned above, I don’t believe the euro, the yen or even the Chinese yuan are viable replacements for the U.S. dollar. In a recent article titled, “The 2020s Global Currency Wars,” I explored the theses of Ray Dalio and Zoltan Pozsar and explained why I believed both were ignoring the geopolitical, demographic and energy-related headwinds facing all the competitors to the U.S.

I do believe that commodities are significantly undervalued and that we will see a 2020s “commodities supercycle,” due to decades of underinvestment in the industry. I also believe securing commodities and energy will play a key role in a nation’s security, as the world continues to deglobalize. However — disagreeing with Pozsar here — backing money with commodities isn’t the solution to the problem the world is facing.

I believe the U.S. dollar will be the last fiat currency to hyperinflate, and I actually expect it to hold on to the reserve currency status until this long-term debt cycle concludes. To go one step further, I actually think there’s a strong possibility that the United States will be the last country ever to hold the title of “global reserve currency issuer” if they play their cards right.

We will explore the Bitcoin Milkshake Theory in part two.

This is a guest post by Luke Mikic. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

via bitcoinmagazine.com