Don’t worry, this isn’t an article to either espouse or attack the current global climate change agenda. Debating whether the earth will perish in a few years or not isn’t my plan. While not only being a believer and investor in the Bitcoin ecosystem, I am also an avid supporter of start-ups and innovators supporting green technologies to provide for a more energy efficient future. Here I simply want to discuss how Bitcoiners should adopt the concepts quite effectively applied by the global climate change movement under their green investment proposals to also promote expanded Bitcoin adoption. These are techniques that I have seen implemented first-hand among the climate change posse.

While there are certainly natural reasons to adopt Bitcoin, especially considering the world’s current turmoil in banking and monetary systems, Bitcoiners can’t simply keep relying upon these periodic bouts of crisis as the main driving force to expand adoption. Bombastic shout-outs that the crisis is here under a Bitcoin lexicon are all too often used and easily can just hit on deaf ears. Also, posting that you paid for a latte at McDonald’s in Bitcoin or sending a stranger on the street 100 sats to their new wallet are not activities equal to the high level of professionalism used under the coordinated symphony of the climate change echo-system as they move their agenda forward. Further, simply saying the "other side is evil" will only get us so far and when I say “other side” I mean the fiat world. Bitcoiners need to implement more state-of-the-art and systematic methods if we want to reach the next level of adoption. We need to stay away from the likes of dancing wizards.

To achieve this, Bitcoiners can follow and blend with other globally promoted agendas like that of climate change to better gain recognition. The climate change movement is often trying to portray Bitcoin as a threat. If we latch onto the same tactics and approaches applied by the climate change movement to promote themselves, integrating these tactics into our tool basket to support Bitcoin adoption, we can't be ignored, belittled, or excluded.

The timing to consider how Bitcoiners can expand our tactics drawing from the climate change agenda cannot be more perfect as the current planned United Nations Climate Change conference, referred to as COP28, will be held from 30 November to 12 December here in Dubai.

Time Preference for Bitcoin and Green Investments

The global climate change movement makes the case that investing in green projects today, even though current societal costs can be large, will result in greater future benefits for everyone. To support this thesis, they loosely utilize the concepts applied in finance and economics including discount rates, present values, cost-benefit analysis, and propensities to save or spend. Bitcoin is also a natural case to apply this thesis. We need to show that saving today through investing in Bitcoin will result in a larger wealth outcome in the future and greater societal benefits. Bitcoiners often discuss time preferences related to spending or savings as is explained in the “Bitcoin Standard”. To demonstrate this better we should apply the concepts of a Social Discount Rate (SDR) and a “Just Transition” as is utilized by the climate change movement.

Applying the Social Discount Rate to Bitcoin Adoption

In simple terms the SDR is the discount rate used to calculate the present value of future societal benefits realized from green investments today. For the climate change movement, this applies to things like building electric vehicle (EV) charging stations, installing solar arrays, or perhaps building bike-paths. With these types of societal investments there are public benefits generated that, to some extent, cannot be fully quantified under a pure numerical cost-benefit analysis, nor fit into typical for-profit value calculations.

Governments attempt to discount these future social benefits of investments using the SDR. The rate is higher than traditional "risk-free" rates used in basic finance due to the added vast uncertainties present over the volume of intangible societal benefit might be obtained. The SDR also differs depending on the level of development of a country. A more developed country can have more certainty regarding the future societal benefits realized so the rate they apply is lower.

The SDR is essentially a rate that balances the choice of the public to spend today versus invest for tomorrow to realize implicit societal benefits. The propensity to save balances the propensity to spend when the SDR is applied. I will call this a wealth transfer decision across generations. This example shows that the concepts often discussed regarding Bitcoin adoption and the concepts applied within the global green movement are quite similar. Bitcoiners regularly talk about creating generational wealth, preserving wealth against de-basement and, in the words of Greg Foss to do it "for the kids".

Bitcoin adoption today by an individual is consideration of the current versus future trade-offs and cost-benefits. Invest today for potential greater benefits in the future or spend today to satisfy present needs. The concept is most often presented through the memes posted of a HODLer’s empty one-room flat with only a mattress on the floor and a mining rig next to it, as they give up everything to invest in their future.

A ”Just Transition” and Bitcoiners

How did the climate change posse so effectively grab the concept of societal benefits and propensities to save to push their agenda and why didn’t we Bitcoiners adopt and apply the same SDR concept as it is clearly a natural fit? Well, before I answer this question, I must explain a parallel concept being used within the climate agenda referred to as a "Just Transition".

With climate change plans, such as a shift away from fossil fuels to renewables or the move to EVs, the question arises about how normal people will be impacted during the transition. Will the masses lose their jobs if a "dirty" industry is suddenly shut? How will people support their families if they can't afford to invest in new energy efficiency requirements imposed on their small business?

Of course, to be fair, we must also consider how some people could also be adversely affected by climate changes if, for example, their farms are impacted by desertification. The assessment goes both ways.

The point is not whether climate, weather or natural disasters can have an impact on people, their livelihoods, or their wealth (or lack thereof), but the issue is that people who have lower income, less wealth, or fewer resources available will be less able to mitigate life’s routine risks and also the changing conditions created during a green transition. As if people today don’t already have enough to worry about, add to their concerns the impact of policies imposed by governments under the climate change agenda.

The concept being applied under a "Just Transition" policy is that the negative, transitory impacts of those climate change policies should not hurt common people, especially those at the lower income levels of society. Governments must somehow meet their global climate change commitments under their Nationally Determined Contributions without making things like the wealth gap and poverty worse in the interim. Basically, protect those people least able to assume risk and handle the transition so that they can better preserve their current income and wealth for the future. Doesn’t this sound very similar to the concept of Bitcoin adoption where we are trying to help people protect their wealth for the future?

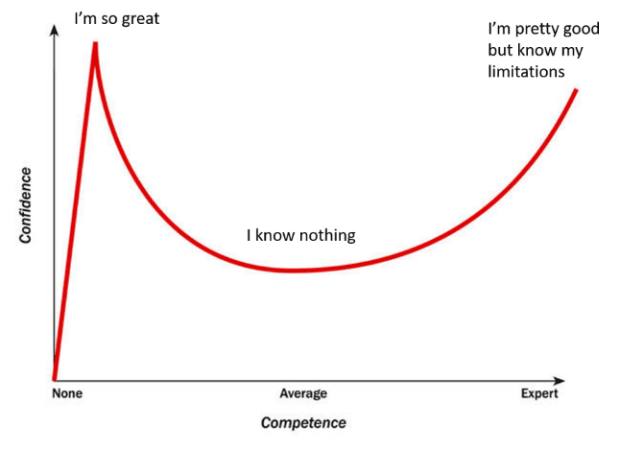

The climate change movement believes there is an expectation of increased societal benefits in the future, and this outweighs all current costs and hardships assumed by transforming an economy. The benefits outweigh the costs even when the required SDR is applied. The dilemma for a person with lower wealth and income is whether a dollar received today provides them with more utility now against if they invested that dollar to gain more wealth in the future. The climate movement will say that everyone will be better off in the future if they sacrifice now. However, to most people, current concerns and needs will certainly predominate life. Therefore, they will place a higher value on present day spending against investing for the future. Most people think that that they are excellent financial risk managers. Are we all poster-children for the Dunning-Kruger effect? More likely, simple basic human character applies where people just focus on day-to-day survival. They have more propensity and need to spend their wealth and income today. This contradiction affects the level of support for and conformance with the climate change agenda as well as impacting Bitcoin adoption.

Dunning-Kruger Effect

Applying the concept of “Just Transition” to Bitcoiner lexicon would mean asking something like: “What is the future value of being able to retain your individual sovereignty today?” I am drawn here to coin Mastercard's lingo and simply say that it's "Priceless". This example shows how hard it is to truly place a value on something intangible and in the future, regardless of your state of current prosperity to spend or save. Applying pragmatic considerations, the basis for the trade-off between a person’s present and future welfare varies depending on their current capacity to manage and assume risk whether considering Bitcoin investing or their potential support for any green societal investment.

Planning for the Societal Benefits of Bitcoin

There are many commonalities between what Bitcoin promotes and the advertised benefits of the climate change agenda. Bitcoin adoption is a societal benefit. Saving today in Bitcoin will help build wealth for the future. Bitcoin’s benefits are not only for the individual, but also for society. The underlying concepts raised and used by the global climate change movement to garner support can easily be used by Bitcoiners to back further adoption. Bitcoin offers security against de-basement, or in other words preservation of your current wealth and its buying power for the future. Everyone, regardless of their wealth level can utilize it to better support their future livelihood.

Bitcoiners need to better apply the concepts of societal benefits more effectively through the concept of the SDR. Through this we can better express the positives for adoption and lead more people into saving and investing for the future protecting next generations, their children, and grandchildren. Without effective planning to bring in the SDR and the deeper concepts of societal benefits, further Bitcoin adoption will be a challenge.

This groundwork planning supports what even Benjamin Franklin said centuries ago that “By failing to prepare, you are preparing to fail.” So, let’s not fail future generations.

This is a guest post by Enza Coin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

via bitcoinmagazine.com