The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin miners have not been operating under normal circumstances for the past several months. Bitcoin’s blockchain has seen a particularly intense degree of demand over the past several months, and it looks like BRC-20s, and to a lesser extent, image inscriptions, all made possible by the Ordinals protocol, bear a great deal of responsibility. Essentially, this protocol enables users to inscribe unique data on the most minute denominations of bitcoin, allowing them to create new “tokens” directly on Bitcoin’s blockchain. This means that quantities of bitcoin worth pennies in terms of their fiat value may nevertheless be bought and sold multiple times, with every one of these transactions needing to be processed through the same blockchain, not to mention the high demand seen while initially minting.

This is where the Bitcoin miners come in. The energy-utilizing computations undertaken by specialized mining hardware are not only meant to generate new bitcoin, but they also can be used to verify the blockchain’s transactions and keep the digital economy flowing smoothly. With network usage about as high as it’s ever been, miners have more than enough opportunities to earn revenue just by processing these transactions, and the actual production of newly-issued Bitcoin can take something of a backseat. As of February 2024, these conditions have created a situation where mining difficulty is higher than ever before in Bitcoin’s history, yet the industry is raking in large profits. However, one of the most reliable patterns in the Bitcoin market has been the sheer chaos that sees fees spike and then plummet. So, what will happen to miners after these conditions change?

It’s this ecosystem that became quite disturbed on January 31 when federal regulators declared a new mandate: the EIA, a subsidiary of the US Department of Energy (DOE), was going to begin a survey of electricity use from all miners operating in the United States. Identified miners will be required to share data on their energy usage and other statistics, and EIA administrator Joe DeCarolis claimed that this study will “specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand.” These goals seem straightforward enough at first glance, but several factors have given Bitcoiners pause. For one thing, Forbes claimed that this directive came from the White House, which referred to this action as an “emergency collection of data request.” This survey is explicitly created with the goal of examining the potential for “public harm” from the mining industry, and even included an aside that this “emergency” collection might lead to a more routine collection expected from every miner in the near future.

Obviously, language like this has left many in the community extremely uneasy, and several leading miners have already made statements condemning the initiative. The tone coming from regulators seems to be of an overwhelming narrative that these businesses are a potential threat, whether by increasing carbon emissions, taxing electrical infrastructure, or being a public nuisance. Some of the most egregious claims are easily debunked, but it doesn’t change the reality that a few hostile government actions could greatly upset this ecosystem. Furthermore, the world of mining already has a major upset on the horizon, in the form of the impending Bitcoin halving. This regular protocol baked into Bitcoin’s blockchain is set to automatically cut mining rewards in half sometime in April, at block 840,000, and already some pessimists are claiming that this upset will be enough to put nearly the entire industry out of business. What are the actual worst case scenarios here? What are the most likely ones?

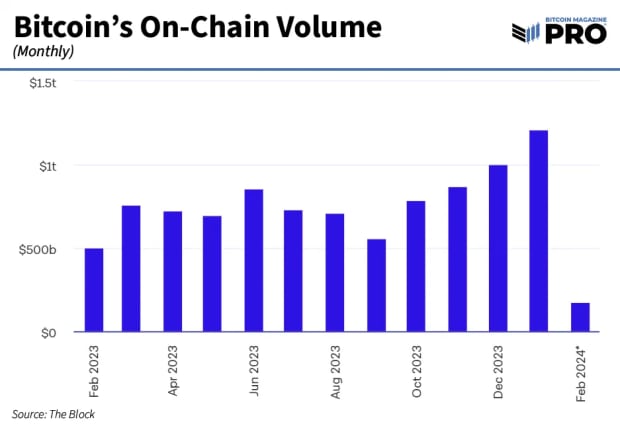

First, it’s important to examine some of the factors inherent to Bitcoin that are likely to impact miners, regardless of government pressure. The miners are in a bizarre market situation because transaction fees can generate revenue on the same level as actual mining, but the situation may be stabilizing. New data shows that Ordinals sales plummeted by 61% in January 2024, showing that their impact on blockspace demand is likely to diminish. So, if certain miners are depending on these tokens to maintain profits, that revenue stream is not looking particularly dependable. However, even though network usage from these microtransactions is likely to plummet, regular transactions are actually looking great. The trading volume of bitcoin is higher than it has been since late 2022, and it shows no signs of stopping. Surely, then, there will be plenty of demand for the minting of new bitcoin.

Bitcoin traffic has been increasing for several months as the prospect of a legalized Bitcoin ETF became more and more real, and now that this battle is over, the trading volume has increased at a greater rate. While the halving can present opportunities and challenges for miners, none can claim that it’s an unexpected event. Firms have been preparing for it as a matter of course, with around $1B of this increased trading volume coming from miners themselves. Reserves of bitcoin held by miners are at their lowest point since before the spike in 2021, and miners are using the capital from these sales to upgrade equipment and ready themselves.

In other words, independent of any government action, it seems that the market conditions are likely to shift due to these factors. The bottom may fall out for some of the smaller firms that operate on slim margins, but the overall growth in Bitcoin trading volume means that there will always be opportunities to make revenue. Since it’s the most well-capitalized firms that can make the most extensive preparations for the halving, it may very well come to pass that some of the more inefficient mining companies will not be able to survive. From a regulatory standpoint, perhaps that is a wanted outcome.

The federal government seems mostly concerned with perpetuating the idea that the mining industry is a tax on society as a whole, consuming massive amounts of electricity for an unclear benefit. However, only the most efficient operations will be guaranteed to survive the halving and its economic fallout. As the less efficient ones close their doors, the survivors will be left with a much larger slice of a smaller overall pie. Besides, if the open letters from several leading firms are anything to go by, these companies are fully prepared to make a vocal fight against any attempted crackdown on the industry. Considering that the survey itself is still in its first week of data collection, it’s difficult to say what conclusions it will draw, or how the EIA will be empowered to act afterwards. The most important thing to consider, then, is that these new trends are taking place with or without the EIA’s influence.

The survey is only just beginning, and the halving is only months away. There are plenty of reasons to be concerned about the EIA’s impact on the mining industry, but it’s not like this is the only factor. From where we’re sitting, it seems like the whole ecosystem may be substantially changed by the time regulators are ready for any action, even if the action is harsh. The people left to face them will be hardened themselves, survivors and innovators from a chaotic market. Bitcoin’s great strength has been its ability to change rapidly, allowing new enthusiasts the chance to take advantage of one set of rules, and then rise or fall as the rules change. It’s this spirit that propelled Bitcoin to its global heights over more than a decade of growth. Compared to that, what chance do its opponents have?

via bitcoinmagazine.com