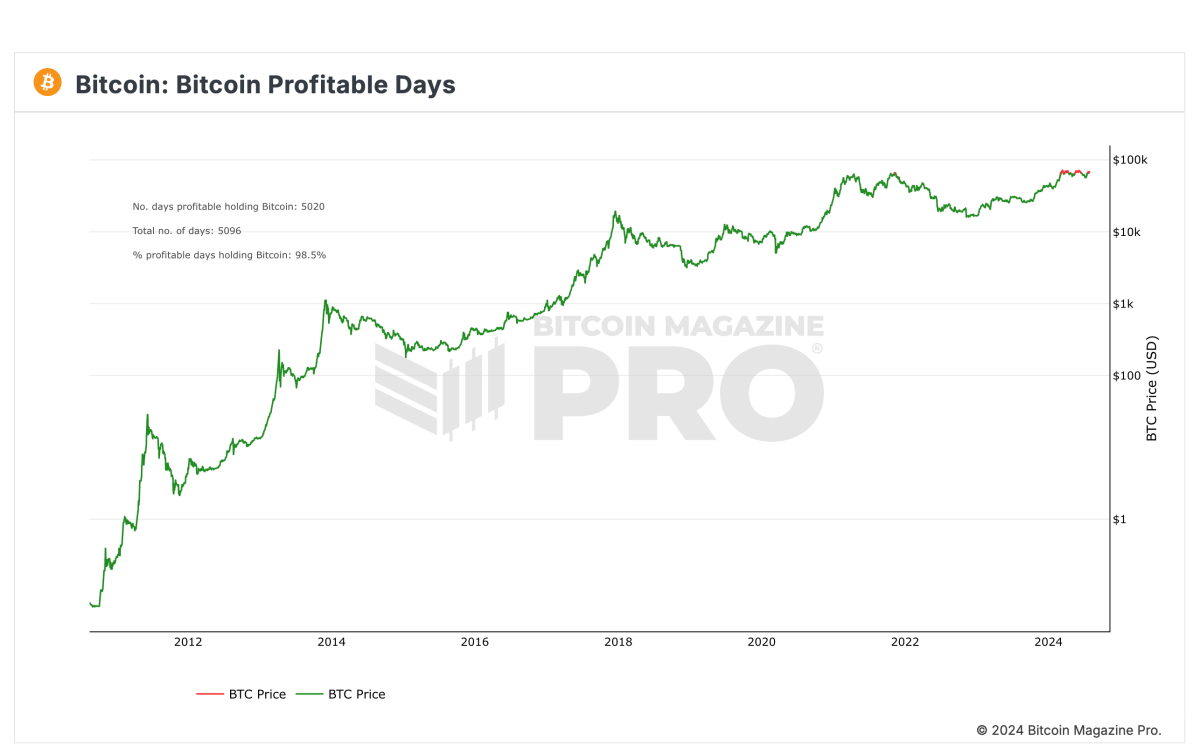

According to Bitcoin Magazine Pro data, holding Bitcoin has been profitable for 98.5% of its existence. The data reveals that out of the last 5,096 days since Bitcoin trading began, holding BTC has been profitable for 5,020 days relative to the current price of ~$66,500 per BTC.

Since August 17, 2010, when Bitcoin was priced at just $0.07, its value has skyrocketed to around $66,500, representing an astounding increase of 94,999,900%. This consistent upward trajectory highlights Bitcoin's sustained growth and increasing adoption over time.

The chart from Bitcoin Magazine Pro underscores the aggressive growth of Bitcoin's adoption curve, driven by its limited supply of only 21 million BTC and ever increasing demand. This growth is a critical factor for investors to understand, as it demonstrates the potential long-term benefits of holding Bitcoin. However, it also emphasizes the importance of market cycle awareness, as buying during market cycle tops can lead to extended drawdowns, historically lasting 2-3 years.

Though, this data counters the mainstream narrative that Bitcoin can be too risky for investors to buy and hold long-term. Instead, it demonstrates the significant rewards of long-term investment in Bitcoin, showcasing its use case as a reliable store of value.

For those trying to calculate where the price of Bitcoin may trend towards in the future, this indicator shows how Bitcoin's value has accelerated as it gains global traction. As adoption and interest continue to rise, the percentage of profitable days is expected to increase and potentially surpass 99% in the future.

For more detailed information, insights, and to sign up for a free trial to access Bitcoin Magazine Pro's data and analytics, visit the official website here.

via bitcoinmagazine.com