Everyone should consider their plans for retirement, and bitcoin can help you achieve this major life goal.

Before I found bitcoin, I was investing heavily into real estate to achieve early retirement and build generational wealth. When I found bitcoin and understood its value and future implications on the world, I knew that bitcoin would be the best asset I could ever buy to maximize the amount of time I could have with my family. From a generational wealth standpoint, I realized that I would be able to set my family up with a perpetual wealth-preserving machine, bitcoin. You have the same opportunity to do this for your family with as little as 0.001 ($68) or 0.01 ($680) of a bitcoin. As of this writing, bitcoin is worth $68,000 per coin.

Nothing in life comes easy and there are no get-rich-quick schemes that allow you to attain early retirement or generational wealth. You have to work hard! I worked very hard to learn about real estate and I know that it will help me to achieve early retirement but bitcoin will get me there much faster. The 1000+ hours I spent learning about bitcoin was the hard work that I had to put in, and I continue to learn more about bitcoin everyday! You can never stop learning about Bitcoin. I live by the mantra, "the day you stop learning is the day you die."

Here is how you can attain retirement, potentially early retirement, with bitcoin, whether you own 0.01 ($680) or 0.001 ($68) of a bitcoin. I am not a professional financial planner but I have been planning for retirement for over 10 years and I am so infatuated with early retirement that I created my own early retirement blog. None of what I'm about to disclose is financial advice but my calculations are all real-life calculations with my very conservative and liberal retirement scenarios.

I used this tool for my calculations in case you want to run your own retirement calculations for your specific scenario. My calculations do not account for inflation, cost of living adjustments and other variables that traditional financial planners integrate into retirement planning calculations. The beauty of bitcoin is that its huge rate of return negates having to really consider these variables.

The hardest thing for retirement planning with bitcoin is determining what compound interest rate you should use. I chose my compound interest rates using my common sense and good judgment but many “Bitcoin Maxis” would probably say to me, "why so bearish?" I would not disagree with this comment because bitcoin's compound interest rate will probably be much higher than 25%-37.5% in a 15-30 year time frame. I came upon my 37.5% interest rate by just taking the average between a 25% interest rate and a 50% interest rate (50%+25%/2 = 37.5%). I think that this interest rate is achievable in a 30-year time frame for bitcoin's appreciation. I believe this because estimates right now state that under 10% of the world’s population owns bitcoin, and it is valued at $68k. Imagine what is going to happen to the value of bitcoin in the next few decades when just another 10% of the world adopts bitcoin, much more so, when 50% or more of the world adopts bitcoin?

For the calculations below, I assume a CONSERVATIVE compound interest rate of 25% and a SEMI-CONSERVATIVE compound interest of 37.5%.

Let's start off with planning for retirement for a person who has 0.01 bitcoin and wants to retire in 15 or 30 years. Here are my CONSERVATIVE and SEMI-CONSERVATIVE calculations for how much you could have in retirement:

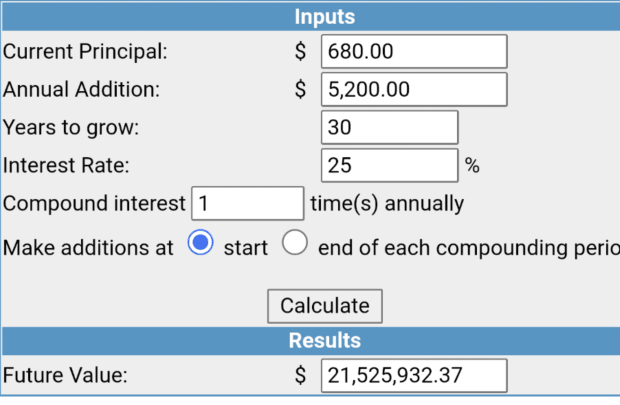

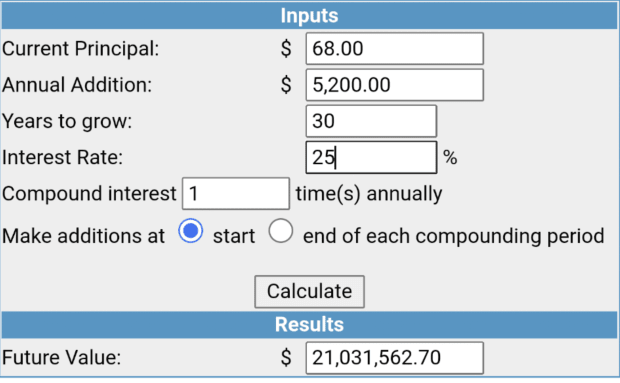

Scenario #1 (CONSERVATIVE):

Current value of 1 bitcoin = $68,000

Person has 0.01 bitcoin

Person saves $100/week ($5200/year) for 30 years

Estimated compound interest rate of bitcoin in 30 years = 25%

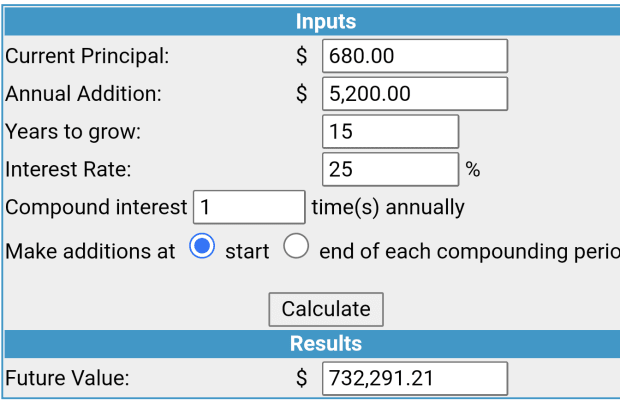

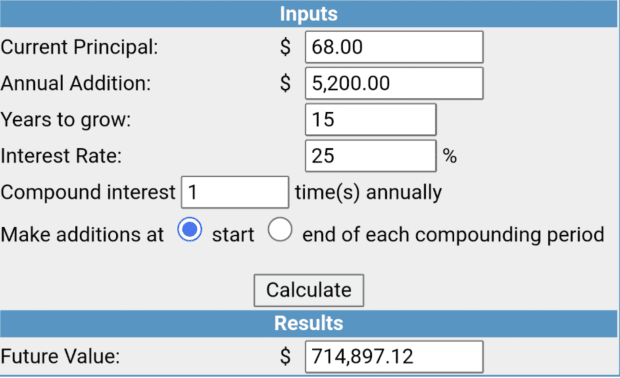

Scenario #2 (CONSERVATIVE): Let's redo scenario #1 except over a 15-year time frame:

As you can see, the power of compound interest is magnified in a 30-year period versus a 15-year period. This is why it is important for people to start retirement planning as early as possible.

Now let's do the same calculations above but let's be SEMI-CONSERVATIVE and use an interest rate of 37.5%:

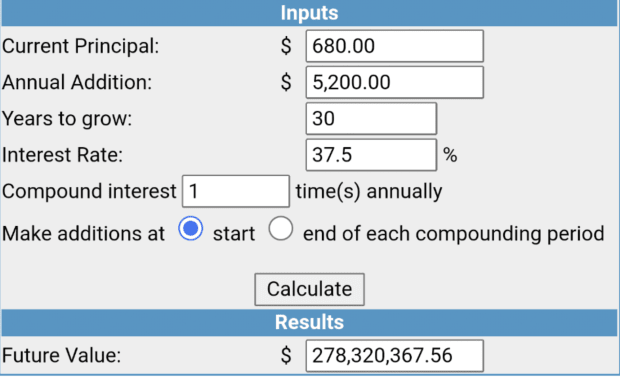

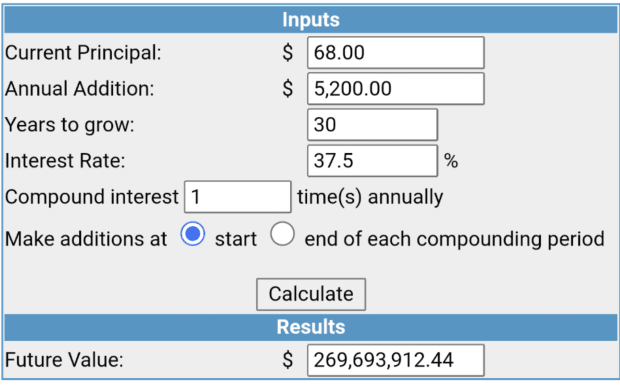

Scenario #3 (SEMI-CONSERVATIVE):

Current value of 1 bitcoin = $68,000

Person has 0.01 bitcoin

Person saves $100/week ($5200/year) for 30 years

Estimated compound interest rate of bitcoin in 30 years = 37.5%

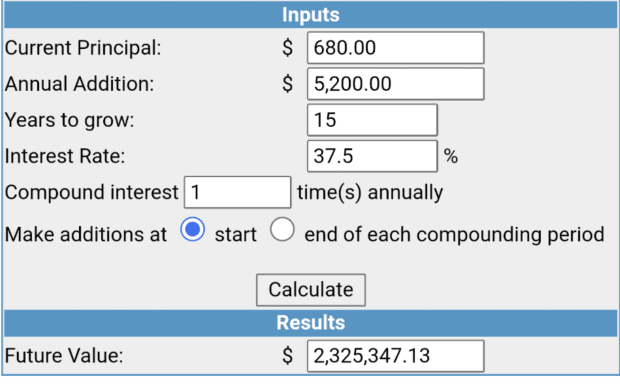

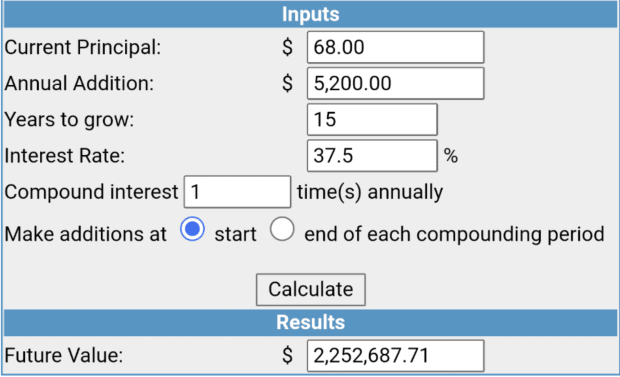

Scenario #4 (SEMI-CONSERVATIVE): Let's do scenario #3 except over a 15-year period:

Now let's plan for a person who has 0.001 bitcoin and wants to retire in 30 years:

Scenario #5 (CONSERVATIVE):

Current value of 1 bitcoin = $68,000

Person has 0.001 bitcoin

Person saves $100/week ($5200/year) for 30 years

Estimated compound interest rate of bitcoin in 30 years = 25%

Scenario #6 (CONSERVATIVE):

Same as Scenario #5 but over a 15-year time frame:

Scenario #7 (SEMI-CONSERVATIVE):

Scenario #8 (SEMI-CONSERVATIVE):

Same as Scenario #7 but over a 15-year time frame:

As you can see, whether you have $680 worth of bitcoin (0.01 of a bitcoin) or $68 worth of bitcoin (0.001 of a bitcoin), please don't discount what you own as being not significant. The calculations above prove that you need to treat your Bitcoin with utmost care and respect. Please treat any Satoshi that you own as "pieces of your most precious TIME."

If you want to run some numbers over a 5-year time frame, in my opinion, compound interest rates of 100% to 200% would be considered sustainable and easily achievable. Here are a couple more scenarios that are very achievable for people to reach EARLY RETIREMENT.

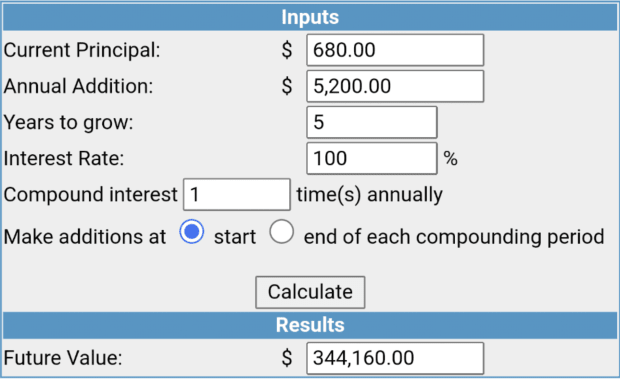

Scenario #9 (CONSERVATIVE):

0.01 bitcoin

Person saves $100/week ($5200/year)

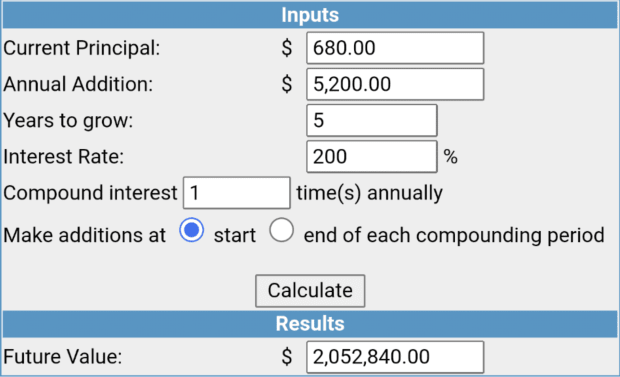

Scenario #10 (SEMI-CONSERVATIVE):

0.01 bitcoin

Person saves $100/week ($5200/year)

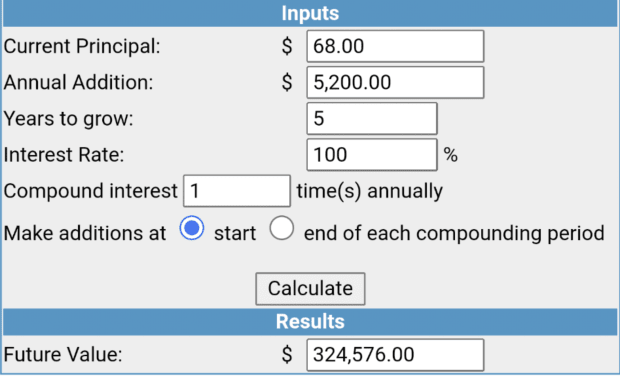

Scenario #11 (SEMI-CONSERVATIVE):

0.001 bitcoin

Person saves $100/week ($5200/year)

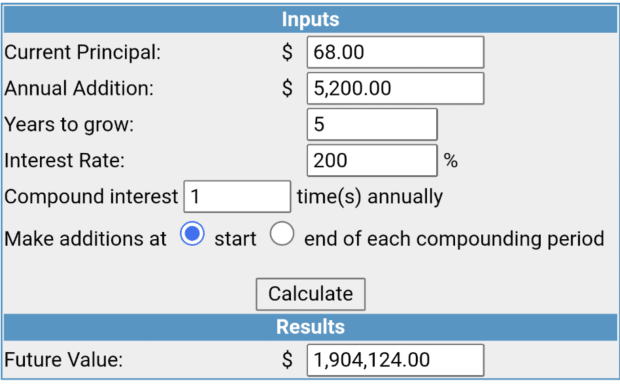

Scenario #12 (SEMI-CONSERVATIVE):

0.001 Bbitcoin

Person saves $100/week ($5200/year)

For scenarios 9-12, I describe them as conservative and semi-conservative scenarios compared to historical 100% and 200% interest rates. This would make a traditional retirement planner roll their eyes and scoff, but bitcoin is not a typical investment and traditional investors don't understand bitcoin's world-altering implications that justify these "conservative" and "semi-conservative" retirement calculations.

As you can see, in five years, with a mere 0.001 bitcoin and saving $100/week, you can feasibly and justifiably attain early retirement. Don't take lightly any satoshi you own because any irresponsible actions in not protecting your precious satoshis could literally cost you TIME. Bitcoin is an asset that affords you to save and leverage your hard-earned time. As Archimedes says, "Give me a lever long enough and a fulcrum on which to place it, and I shall move the world." Bitcoin is the lever and your TIME is the fulcrum.

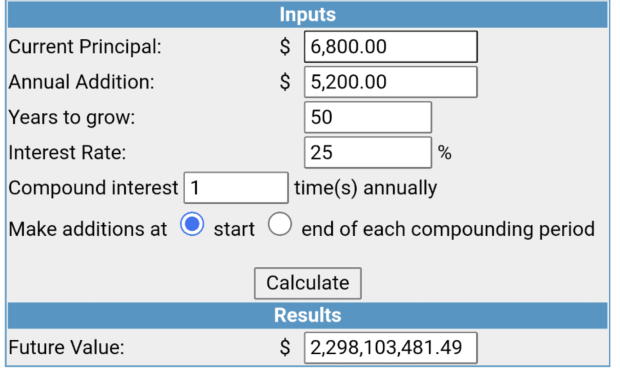

In conclusion, many people do not realize how their bitcoin can sustain perpetual and generational wealth for hundreds of years. Here is one last calculation to demonstrate this notion, if you have just 0.1 bitcoin ($6800 worth of bitcoin). After 50 years of 25% compound interest and you saving $100/week, a person could become a billionaire.

Many people laugh at me when I show them these calculations but little do they realize that these calculations are VERY CONSERVATIVE. For the purposes of this article, I wanted to be very conservative to demonstrate how life-changing bitcoin could be from a generational wealth standpoint.

Please play around with the compound interest calculator located here and plug in what you think are realistic compound interest rates based on your opinion.

Happy retirement and generational wealth planning!!

This is a guest post by Jeremy Garcia. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

via bitcoinmagazine.com