How looking at the history of technological adoption can give us insights into where Bitcoin could be embraced the fastest.

Intro

Throughout time, technology has proven to change our lives by leveraging efficiencies in energy. New ways in how we hunt have saved time and energy for innovation and to live more intentionally. Currently, Bitcoin presents an immense opportunity to change the lives of those who are burdened by old forms of manipulated money and preserve their time and energy. It is the first self-sovereign, programmable money that is proving to destroy expectations of every “expert” imaginable. At the intersection of money and technology, Bitcoin's network effect is spreading like a mind virus to all corners of the globe. This is not a coincidence but the manifestation of a zero to one moment; a radical new technology that will change nearly everything it touches.

This article explores the idea that some regions and nations have a higher susceptibility to adoption in new monetary networks. Specifically, I will outline how the unbanked populations of emerging countries can leapfrog legacy systems, straight into a new monetary standard. But first, let's lay the groundwork for understanding how this can happen with some concepts.

Democratization Of Technology

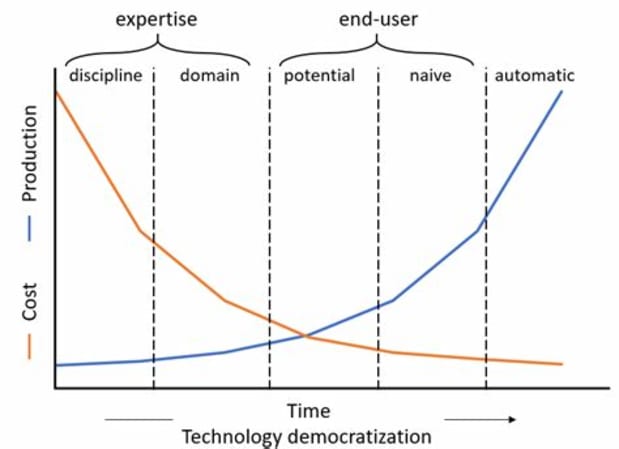

To understand leapfrogging, let’s first look into something that naturally happens when humans produce technology: the democratization of technology. As we make technology, the cost reduces, while the ease of production increases. Our tools get better, people’s skills improve, securing the material for production gets easier, logistics improve, and everything is less costly as humans continue increasing the output/yield over time. Simply put, cost goes down, while production goes up.

A great example is the printing press. Before this innovation, each book had to be typed out or written one by one and distributed almost by osmosis. This means books were more expensive and were only in the hands of the few. After the printing press, people were able to automate a portion of the process by creating blueprints of the books. This cut down labor costs, and there was a huge explosion in printed material. This may have put people out of work; but it also introduced better dissemination of information to a wider group of people and new opportunities to produce more books for less cost and effort.

Another example is photography. Historically, taking photos on film took hours to produce in a dark room. The film had to be brought to a local expert and it would take several days to get back the finished product. Smartphones and photoshop technology made this essentially free. It was then possible to download an app or use the built-in app on smartphones, take pictures, and immediately process them. Democratization of technology has been happening across every single aspect of human society since the beginning of time. Humans create tools to make it easier and cheaper to survive. Each tool becomes better, we then expand and evolve with less energy improving the quality of life.

Fast-forward to the internet age. Emerging countries are just now tapping into the power of the internet. Although there are many factors underlying the reasons for expansion, one thing that is known is that technology builds on itself, making each successive technology easier to produce. Not only is there growth, but there is exponential growth. Certain times throughout history, technology has made such a large leap forward that it allows extremely poor countries to skip the legacy technology and quickly adopt the new one. This is called leapfrogging.

Leapfrogging Explained

Leapfrogging is when the cost to produce one technology is too great for a population, so when a new, drastically cheaper technology is created it’s quickly adopted and the old tech is skipped. This is the coexistence and benefit of separate populations within society. Let's look at the mobile phone revolution as a way to explain leapfrogging. Some societies did not have the wealth or infrastructure to adopt landlines and phone communication when it was brand new, but when the mobile phone was introduced, this gave mostly everyone around the world the ability to opt-in.

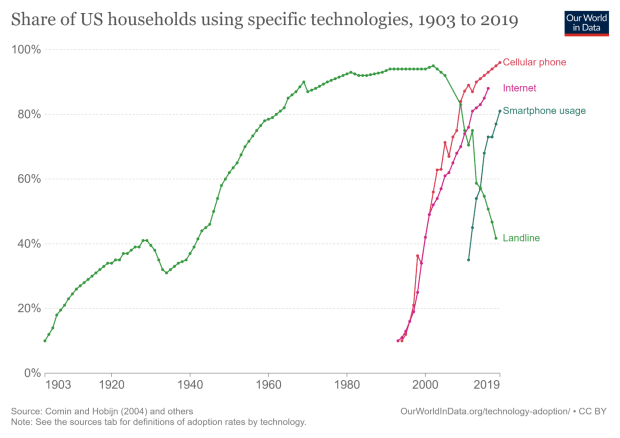

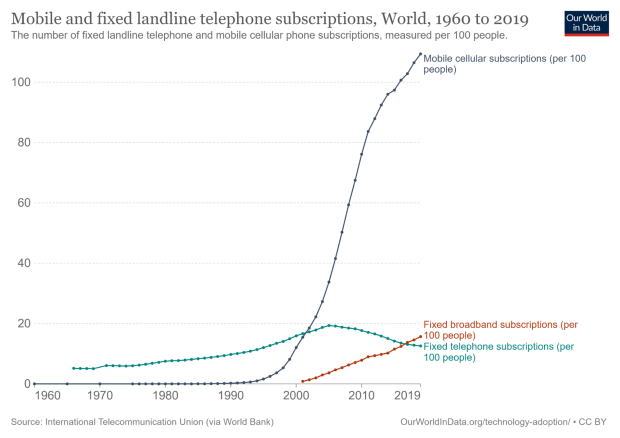

Figure 2 shows the number of landlines in the U.S. population from the 1900s to 2019. Throughout the entirety of the 20th century, the landline was being adopted in the U.S. Consequently it only took a decade to dethrone this old technology. The decline started when the benefit of cell phones outweighed the cost compared to landlines. This is where democratization hit the tipping point and we saw a huge jump from one technology to the next. Now it’s extremely cheap to use technology that is 100 times or even 1,000 times more advanced than the previous. Mobile phones usurped landlines because they were more affordable, easier to use and more mobile. Figure 2 shows how quickly a society can adopt a technology that has significantly more benefits than the previous, even in an advanced society.

A similar thing is happening with television and the internet. Netflix came out and disrupted how people consume media on the television. As more platforms emerged, and people realized they could pay a fraction of the cost for a Netflix subscription rather than $100 for cable and a bunch of commercials, the switch was easy. Legacy systems were bogged down by all of the brick-and-mortar stores and overhead costs. They could not compete and pivot quickly enough, so they lost their seat at the table.

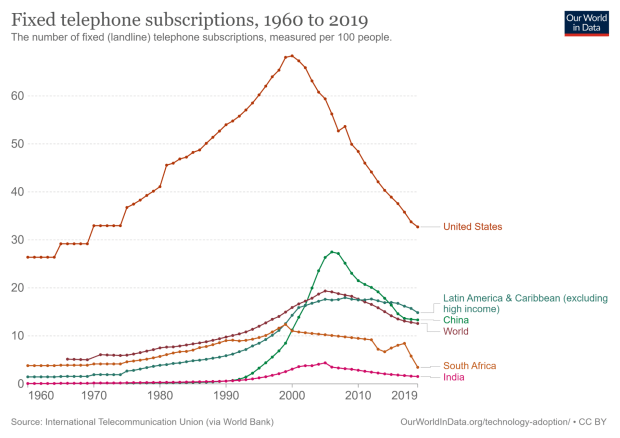

When comparing fixed telephone subscriptions to other countries, the U.S. was way ahead of most. Many factors were contributing to this. Wealth played a huge part, but much of it was the production and first movers’ advantage. The U.S. was the first country to set up telephone lines from Boston to Somerville Massachusetts and expanded from there. Other countries did not have this opportunity, so they were laggards in the technology simply by default. It also made it easy to have a grid to run on top of, being a technologically advanced country with a power grid. Because it was so resource-heavy to set up this grid, this took over 30 years to build up the infrastructure.

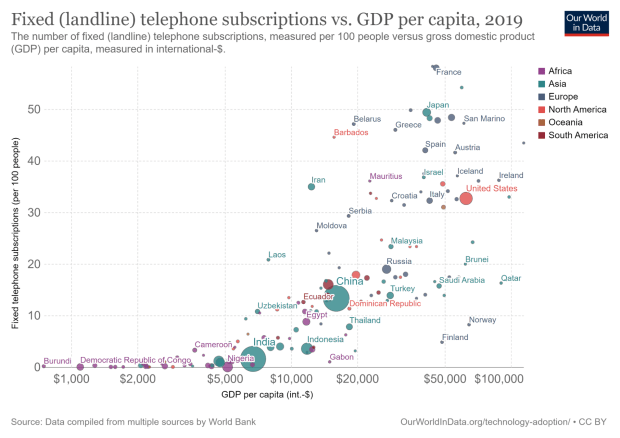

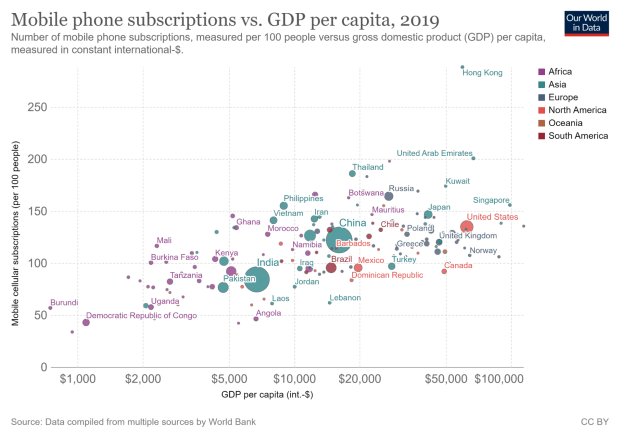

One of the main reasons why it was so hard to increase telephone subscriptions in other countries is because of the initial cost. You can’t just tap into a telephone line, there needs to be a large grid, infrastructure and companies/governments willing to build out this grid. Figure 4 shows that there is a rough line at a GDP per capita of $5,000 to get off zero and start communicating via landline. As the GDP per capita grows in a country, it is more likely they adopt fixed landlines. This is a huge barrier to entry as they try and compete to be a part of the 21st century. With telephones, it brings an easier flow of information across long distances quickly. These are important technologies that helped first-world countries advance quicker than their counterparts. This technology could mean the difference between surviving and thriving in the modern era.

Things get much different when you start looking at mobile phones in Figure 5. To have a mobile phone is drastically cheaper than having a landline, all costs considered. Before, you needed the infrastructure and everything that came with installing a landline phone. But with mobile phones, even at a GDP per capita of less than $1,000, you get ~50% penetration of adoption within the population. All of the countries that were left out of communication with landlines, now have leapfrogged the old technology, right into a new standard of mobile phones.

People benefit, businesses benefit and countries benefit immensely from these technologies. With mobile communication, people have higher leverage over their energy output. Businesses and life in general are more efficient, in turn creating a higher GDP for the country. It is a feedback loop that is good for all of humanity. When one group of people creates new technology, everyone benefits at one point or another.

From Landlines To Mobile Phones To Internet-Connected Smartphones

Not only are poorer countries leapfrogging into mobile phone communication, but they are, in turn, jumping right into the internet age. On top of that, (Android) smartphone costs are dropping significantly every year, with the average cost down by 50% from 2008 to 2016. With the growing ability to connect with the rest of the world comes more opportunities to learn and grow with the rest of the world. An incredible amount of information is available on the internet, and the benefit of being on the network is immeasurable.

When comparing the numbers of mobile phone users to the numbers of landlines, you get a huge disparity in the pace at which they were adopted. Fixed landlines were around for almost 50 years before they started to see some real competition. Thinking back to our Figure 5, this makes sense, because the cost to build infrastructure is drastically higher than that of mobile phones. The opportunity a landline brought to civilization was immense, but the cost-effective mobility of cell phones transcends previous communication technology by a longshot.

As of September 2021, the world’s population was ~7.89 billion people. Of that, there are 10.5 billion cell phones with network connections. That is 2.52 billion more activated phones than there are people. This becomes thought-provoking when adoption data starts to reveal where mobile phones are headed next.

As people adopt mobile phones, smartphones are becoming cheaper and more abundant. The cost of production for smartphones is less and less each year, and soon there will be little reason to have a cell phone without internet connection because the cost difference will be so minuscule. Smartphone abundance is allowing people around the world to tap into the internet and it is estimated that “by 2025, 72% of all internet users will solely use smartphones to access the web.”

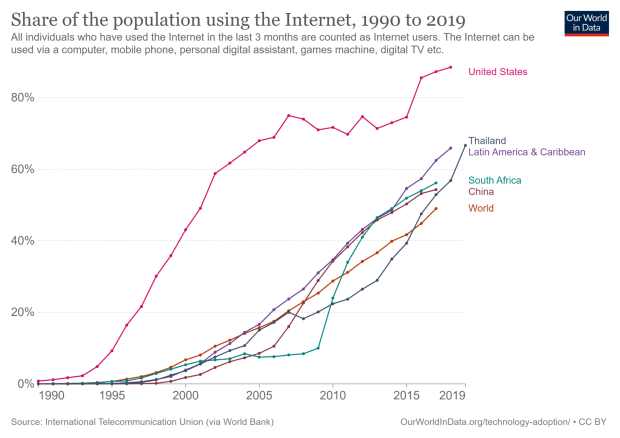

Currently, the world is in a transitionary period of communication. Not all of the world has access to the internet, only 65%, with an increasingly rapid pace of adoption. Because it is so inexpensive to get a mobile phone, and the benefits are immense, the world is being onboarded at an incredible rate.

To answer the question “What is Leapfrogging?” we can look directly at mobile phones. But it’s not just one leapfrog, it’s more of a continuous onboarding to the digital revolution for the entire human population. Things are getting cheaper, and technology is moving exponentially forward, toward a more connected future. Soon, everyone will have access to the internet and will bring about new and exciting opportunities for the world to grow. With the high rate of adoption in communication technology, mobile phones swept across low-GDP countries allowing information to spread. Smartphones are a small hop away from mobile phones. With smartphones comes all sorts of opportunities not to mention the connection to the world's internet. In developing countries, the internet is starting to hit its hockey stick moment. Adoption continues to grow and as smartphones get cheaper, more people in the world have access to the internet, connecting them to their local and global economies and new innovations will come about in unforeseen ways.

This begs the question, what monetary network will they use to transact in the digital age? It's taken years to get the legacy banking system up to speed. We’ve bootstrapped and “Frankensteined” many different ways to connect the internet to a centuries-old banking infrastructure, but these newly onboarded countries have the opportunity to skip that altogether. With no legacy banking infrastructure rooted within the nation, this leaves the door wide open for a new legacy.

Leapfrogging Onto A Bitcoin Standard

It seems the stage is set for a paradigm shift. A perfect storm is brewing in populations that lack bank accounts and access to store their wealth. Coupling this with connection to the internet, and 21st-century e-commerce and monetary system, it is impossible for countries not to adopt it. Because bitcoin is a global asset with no intermediaries, its infrastructure is inherently global. Any improvements to the network, the entire world will benefit automatically without having to update the old tech. Unlike landlines, there is no infrastructure to build, and the barrier to entry is almost zero. You just opt in with a bit of hardware and an internet connection.

As of 2017, according to the World Bank, there are 1.7 billion adults in the world without a basic transacting account. Most of these countries with higher rates of unbanked are poor, have high rates of inflation and lower currency stability, not to mention a disconnected state government ripe with problems. This is extremely common when looking at currencies in other low-GDP countries. So, what are some of the biggest factors in which people would want or need to adopt Bitcoin? If we can answer this question, then maybe we can quantify and pinpoint which countries have the biggest opportunity and most to gain from adopting a Bitcoin standard.

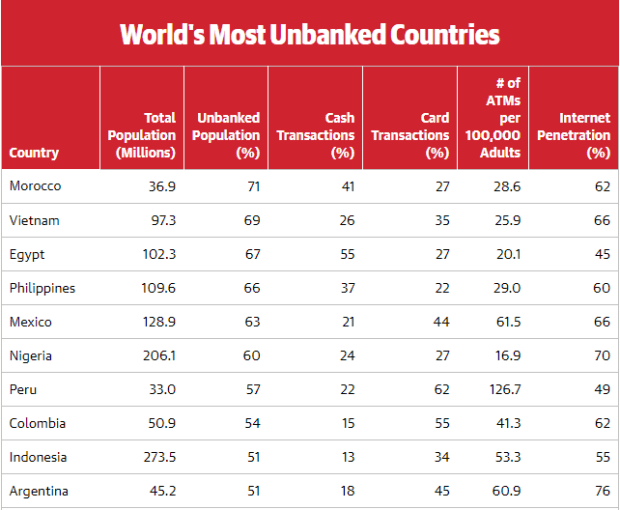

Figure 8 shows the top-10 most unbanked countries as of February 2021. The Oxford dictionary defines “unbanked” as “not having access to the services of a bank or similar financial organization.” Much like building the infrastructure for landlines, it’s expensive to build banks and serve the local economy. Not to mention, many of the people living in these countries don't have the amount of money that would warrant the cost of owning a bank account. Some even share bank accounts with members of their families to save on costs. There is a huge opportunity to solve the problem of banking in low-GDP countries, but many of the digital banking companies around the world are constrained by regulation and geographical jurisdiction. It may be hard to grasp the importance of a bank account having never lived without one, but without a bank, citizens cannot secure funds safely. Without secure funds, the future is uncertain. This is where Bitcoin can solve some of the problems in these less developed and emerging countries. There are three specific ways in which these problems could be solved.

1. Bank the Unbanked

Bitcoin gives everyone the ability to be their own bank with something as little as a cell phone. All that's needed is to be connected to the network and accept funds. The smartphone does all of this. It allows people to download a bitcoin wallet, connect to the internet and start transacting. There are many ways in which one can use this wallet. Coincidentally, the countries above who have low banking numbers within their population, also have mobile phones and high internet penetration. This is an open door from a technological standpoint, allowing people to opt into Bitcoin and secure their funds digitally.

In addition to using the Bitcoin network to transact on your phone, you can also use it as a cold storage solution. Cold storage is similar to a savings account. This savings account or cold storage is disconnected from the internet, making it harder for people to steal your funds. With the old technology of banks, you would have to pay for this solution, but with Bitcoin, it's free, just download the software and/or buy a hardware wallet. There are some cold storage solutions where you can pay for a hardware device, but creating a phone wallet and securing your keys, gives the people an entry point and on-ramp to storing their wealth in a digital bank.

2. Securely Store Value Over Time

The second opportunity is the store of value function. Many of the countries that have unbanked populations and poverty issues are a result of a currency problem. In my previous article, “Bitcoin As A Pressure Release Valve,” I wrote that certain countries have hyperinflated currencies with no option but to turn to the black market. Most of the time, these countries use the U.S. dollar to transact since it holds its value better relative to their currency. Strictly from a monetary standpoint, bitcoin is scarce. It is the most scarce form of money there is. There will only ever be 21 million bitcoin in existence and when the value rises, the production does not increase. This is called elasticity or the lack of elasticity in bitcoin’s case. Unlike fiat money, no government, central bank or agency can print more. And unlike gold, silver or any other commodity, when the demand rises, the amount that is mined stays the same. The first completely inelastic asset in existence is a result of preprogrammed architecture, with consensus in the network that’s default is to not change the protocol.

People that live in countries where the money is known to be manipulated, understand Bitcoin almost immediately. When the idea of something that can't be manipulated is presented, the concept of scarcity and 21 million is understood. With the reality of incorruptible money, the current regime in power can't stuff their pockets without alienating the population through force. These people understand this idea because they have experienced it firsthand. When food prices rise faster than people can spend a weekly budget on groceries, it is immediately apparent the importance of a completely scarce, un-manipulatable asset.

In developed countries with low levels of unbanked, people have ways of storing their wealth. They have a 401k and IRA, and most people own property. This is a way of storing value over time. It may not be completely efficient, but it is sufficient enough to escape some level of inflation. The alternative would be to keep your dollars in a savings account, and the real yield of that is negative and not a smart way to store money. These countries put money in financial devices, because it is the smart thing to do and it preserves time and energy. Unbanked countries have no way of storing long-term value. It is degraded and evaporated through manipulation and high levels of money printing. Emerging countries cannot store time and value into financial instruments. There is no Apple stock or S&P 500 to put money into. They are stuck with low levels of wealth that are stolen away on an ever-moving treadmill. There is no way of truly saving value or energy spent over time.

For the first time, Bitcoin gives the world, particularly those in emerging countries, the ability to hold their value in a closed system that cannot be inflated. Much like the opportunity the mobile phone brought to change communication, bitcoin is the first “store of value'' that is available for low-GDP countries to buy and hold. It allows them to securely transfer their wealth over time, without fear of inflation or confiscation. Add on top of that, if they need to transfer wealth out of the country and flee an oppressive regime, bitcoin is the first asset that gives the ability to do so. Large amounts of gold cannot be taken on a plane or property and homes cannot be transferred to another country. Bitcoin gives people the freedom to do what they want with their earned value, without fear of a centralized power removing it. Bitcoin preserves the fundamental human right of property.

3. Connection to the Digital Economy

The third problem Bitcoin solves is connecting and transacting digitally. Being a digitally native asset, bitcoin smooths the rails of commerce allowing low-GDP countries to join the 21st century of commerce. This is huge, and what cell phones did for communication, digital commerce will do the same. It immensely increases our ability to transact and exchange value. Bitcoin allows anyone, anywhere, to join a digital transacting network and exchange value natively over the internet, whether in person or without knowing them at all.

Digital economies move at the speed of light, while old-school economies move at the speed of osmosis. This brings more time and efficiency for people on both ends of the transaction. Businesses spend less time on transactions, widen their addressable market, and start putting more time and effort into other things that can improve their work. It is the difference between transacting daily in cash and using a preprogrammed point of sales system. It is simply better.

Not only does Bitcoin make things easier and frees up more time, but it is programmable money. Like the internet, Bitcoin can be built in layers. Each layer brings a new way to use it that widens the possibilities and use cases. What the internet did for communication, Bitcoin will do for money.

Combining all three of these factors, you get a massive magnetic pull toward adoption of the new technology. It is hard to slow the movement of technological adoption and impossible to stop. Like throwing a match on a tinder-filled hillside, years of opportunity build up in countries that lack technology where innovation and adoption prepare to explode at the right moment.

Quantifying Bitcoin Adoption In Low-GDP Countries

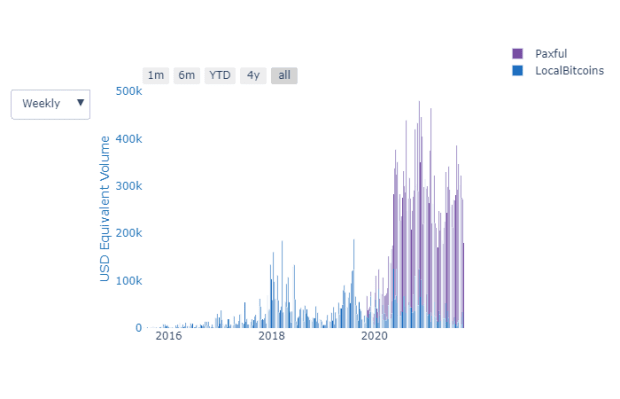

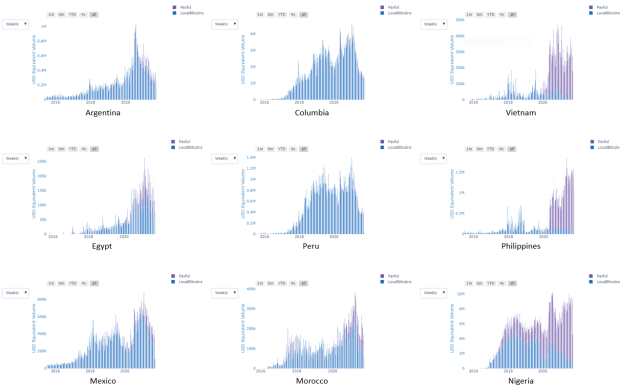

Looking at every one of the top-10 countries from Figure 8, they all have meaningful adoption in Bitcoin and it is growing every week. Not only is Vietnam number two on the unbanked list, but it is also number one on the “Chainalysis 2021 Global Adoption Ranking.” In fact, looking at Figure 10 of adoption through LocalBitcoins and Paxful, USD volume shows that every one of the countries in the top-10 list of unbanked have meaningful adoption.

What does this tell us about Bitcoin adoption in unbanked countries? It tells us that it's working. Continuing to see these trends improve will be good for Bitcoin adoption and not to mention the countries in which they are adopting it. All the ingredients are there. Most are unbanked with high internet access and an unreliable currency that isn't natively digital. All you need is time for the adoption to take hold.

There are also some concerns that come up when thinking about Bitcoin adoption. Like, “How can they adopt bitcoin when it is so volatile?” Well, there are a few solutions to this problem. The first is that when a population has no choice, something as volatile as bitcoin could mean the difference between losing 30% or losing 90% over the span of one year. Keep in mind that bitcoin is already solving three of the major problems listed above, we are just remedying the problem of volatility.

First, look at just bitcoin and its use cases today. For some countries, their currency is just as volatile if not more volatile than bitcoin. Not only that, but it is volatile to the downside, continuing to lose value as the government steals and prints away spent time and energy. If bitcoin were to be used, sure it might be volatile, but this volatility is either short lived, or it’s to the upside.

Now look at bitcoin while using it for everyday transactions through Strike, as a more technical solution. This solution is currently available now in El Salvador as a test case and is starting to roll out to more and more countries. People use the Bitcoin and Lightning rails every single day but transact in USD, choosing to either save in bitcoin or not. This solution gives the best of both worlds. One, a population has the ability to transact short term in a currency that isn't volatile, like other emerging countries. Two, this gives access to the payment rails of Bitcoin and the ability to save in the most scarce asset in existence. Looking back historically, bitcoin has grown at a 200% compound annual growth rate and this has the opportunity to conserve and grow wealth immensely. For someone in a developing world, this is life changing.

As this trend of adoption in underbanked countries continues, new and exciting ways where Bitcoin is used will emerge. For the first time in history, countries have the ability to store wealth in something that cannot be stolen. It gives the opportunity to transact freely without the permission of the state or government, and it allows people to break free from imposed serfdom. Bitcoin is here and it is only getting bigger. There is a change in the tides of time, and Bitcoin is a once-in-a-millennia technology that is pulling the shores.

This is a guest post by Mitch Klee. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

via bitcoinmagazine.com