Samson Mow recounts the Blocksize War between Big and Small Blockers and takes stock of the companies on the losing side of Bitcoin’s first civil war.

This is an opinion editorial by Samson Mow, CEO of JAN3 and former CSO of Blockstream.

The first major “civil war” in Bitcoin, which would decide the fate of the protocol, took place mainly between 2015 and 2017 and is referred to as the “Blocksize War” or sometimes the “Scaling Debate.” As Bitcoin became more popular and the blocks filled up, transactions became slower and more expensive. From divergent visions of Bitcoin, two camps emerged: the “Big Blockers,” mostly business types who supposedly wanted faster, cheaper transactions and Bitcoin to be established as a global payment system competing with Visa and PayPal in the short-term, and the “Small Blockers,” mostly engineer types who saw Bitcoin as a new money network that could transform our world in the long-term, if it stayed decentralized. They prioritized integrity, resilience and security, arguing that if blocks became big, it would become expensive for users to run a node and would thus incentivize hosting nodes in data centers; a one-way street towards centralization and control by a few, not much different from other systems like banks. This would mean the death of the dream of an apolitical, incorruptible, decentralized money.

The Blocksize War was likely the first attempt to co-opt Bitcoin and exert influence at the protocol level. Control the blocksize, control the protocol.

Entering The War

I found myself pulled into the war in 2015 while I was COO at BTCC, one of the world's largest exchanges and mining pools at the time. I got a call from Mike Hearn, an early Bitcoin developer, saying, “It’s time to upgrade to Bitcoin XT.” Bitcoin XT was a “hard-fork” or incompatible upgrade to increase block size, but that information wasn’t conveyed at all. Back then, communication channels weren't great. There was a vast divide between developers and businesses, which allowed people like Mike Hearn and Gavin Andresen to push something like this without agreement from other Bitcoin Core developers. As things progressed, they pushed harder for XT and the conversation devolved into miners versus developers. Jihan Wu, then co-CEO of Bitmain, drove a lot of the divide in China. “Fire the developers” became a rallying cry for the Big Blocker faction.

"The Blocksize War" book written by Jonathan Bier does a good job summarizing the events that transpired. There was no lack of drama, for sure. However, the book doesn't fully capture the incredible intensity of the experience, which could sometimes be frustrating and even infuriating. Like most Bitcoiners today, those of us active during this period were very passionate about Bitcoin, and we took all of the attacks exceptionally seriously. At times, there were people on our side who doubted our ability to persevere and win.

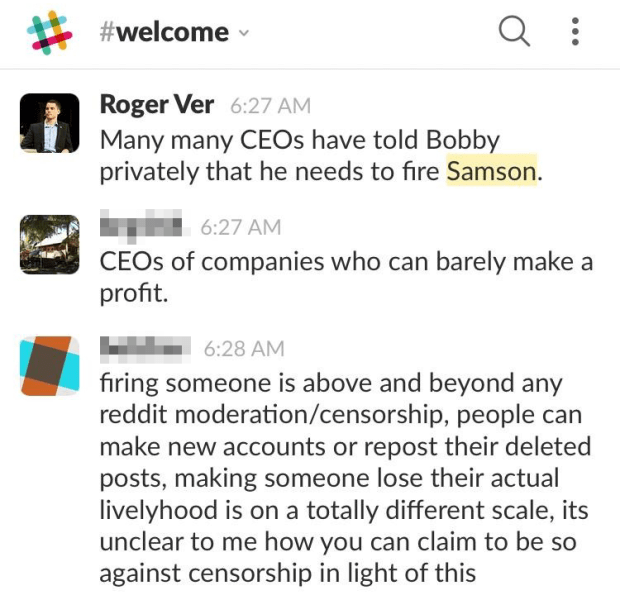

Another dimension to the war that doesn’t get fully captured is the disparity between the two sides. It was literally all the big, ostensibly pro-Bitcoin companies with a ton of capital at their disposal versus a ragtag handful of developers and users. My role on the Small Blocker side was perceived as a betrayal of sorts as I was an executive at a big company and should have aligned with the other business people who “knew better.” That “betrayal” and my ability to skewer the Big Blockers with intellect and wit led to a long-running campaign to get me fired from BTCC by lobbying our board of directors and investors. That should give you an idea of what kind of people we faced.

Blockstream: Augmenting Bitcoin

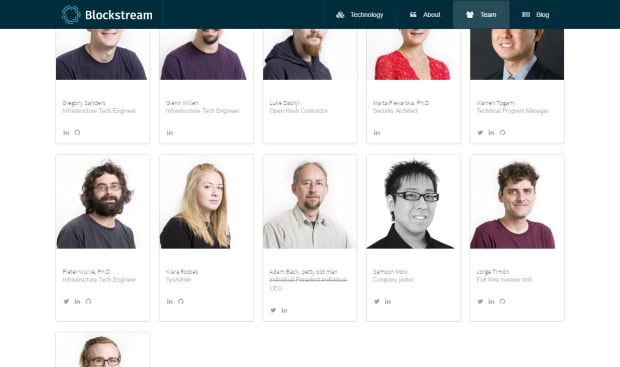

The prevailing narrative during the war was “Bitcoin can’t scale,” so what better way to crush that narrative than to prove it wrong through real-world implementation? After fighting the war alongside Adam Back, I decided to join Blockstream as chief strategy officer in 2017 to focus on augmenting Bitcoin, which would include building infrastructure that would help scale Bitcoin, namely: Lightning and Liquid.

Blockstream has made numerous contributions to the Lightning project, particularly with Core Lightning. Lightning is a Layer 2 peer-to-peer network that operates on top of Bitcoin. It works by opening channels and aggregating smaller transactions off-chain, similar to opening a tab at a bar and paying at the end. Lightning is designed to scale micropayments, enabling anyone to transact bitcoin with near-zero fees. It has a theoretical limit of 40 million transactions per second, ultimately unleashing bitcoin as a planetary-scale decentralized medium of exchange.

The Liquid Network is a Bitcoin sidechain, a blockchain anchored one-to-one to bitcoin. It does not have a native token; it locks bitcoin on the main chain and unlocks Liquid bitcoin (L-BTC) in the sidechain, which gives it new capabilities. Liquid bitcoin is faster because there are one-minute block times and you also benefit from confidential transactions. With Liquid, you can issue digital assets on Bitcoin, such as stablecoins, security tokens and digital collectibles, so there’s no need for altcoins.

One of the first initiatives I championed after joining Blockstream was to increase the decentralization of mining. A vital lesson of the Blocksize War was that there was an overconcentration of hashrate in China, which presented a major attack vector. I secured Blockstream’s first mining site in Quebec in early 2017 and then more miners followed us to North America, leading to a mining gold rush of sorts.

Another initiative I advocated for was getting another block explorer onto the market. With Blockchain.info controlled by Blockchain.com and BTC.com owned by Bitmain, if the Big Blockers wanted, they could have made a powerful push to dictate a particular fork as being the real Bitcoin. Many people back then looked to block explorers as a source of truth. We mitigated this threat by releasing blockstream.info, which is now used in many wallets as a default explorer. Later, mempool.space made their debut and has gained a large market share.

JAN3: Mass Adoption

The best defense is a good offense. Mass adoption of bitcoin may help us to avert future wars.

After five years at Blockstream and accomplishing most of the things I set out to do, I decided to start JAN3, a Bitcoin technology company focused on mass adoption. At JAN3, we help nation-states and their citizens attain true sovereignty and prosperity through Bitcoin. This includes bitcoin bonds, mining, wallets, security, custody solutions and related infrastructure. Many developing countries, especially in Latin America, are under the heel of the International Monetary Fund and can only borrow to refinance debt; a downward spiral. Bitcoin is the way out. They just don’t all know it yet.

We must align incentives with Bitcoin to mitigate future attacks and efforts to stymie hyperbitcoinization. If nation-states are accumulating bitcoin in their strategic reserves, they’re not likely to ban it. If nation-states are mining bitcoin, they’re securing the network and not likely to attack it.

Pushing for more grassroots bitcoin adoption is critical as well. At JAN3, we aim to build the go-to bitcoin wallet for Latin America and other developing markets. We’re taking an approach we believe is different from other Bitcoin companies. Our wallet, AQUA, is primarily a bitcoin and Liquid Tether (USDt) wallet. We aim to deliver the best possible user experience for users to hold both assets and easily swap between them.

Why is Tether important? Tether originated as a way for exchanges to operate without requiring traditional banking, but has evolved into banking for the unbanked. Much of the developing world uses USDt. Many people in countries like Argentina, Venezuela, Turkey, Ukraine and Lebanon rely on it to escape inflation and maintain purchasing power. If you want to onboard more people onto bitcoin, you need to interface with their bank accounts, and for many in the developing world, their bank accounts are increasingly denominated in USDt.

The Antagonists

So where are the characters we fought against during the Blocksize War and how are they doing today?

Bitmain

During the Blocksize War, Bitmain was the all-powerful megacorporation, with tentacles in all parts of the mining industry, from hosting to pools to ASIC manufacturing — they also boasted the largest market share and hash rate. Bitmain used its position to bully others and promote the forks, and then eventually Bitcoin Cash (aka “Bcash”).

In recent years, they had their own internal civil war (who could have imagined?) In October 2019, a power struggle between Bitmain’s co-founders Micree Zhan and Jihan Wu erupted, and Jihan was ultimately ousted as CEO. The Blocksize War and their own civil war had a huge impact, driving their market share down to around 60% from over 75%. Bitmain’s valuation was once in the $40 billion to $50 billion range when they were seeking to IPO. Their most recent valuation was about $4 billion. They’ve repeatedly failed to launch their IPO since 2018. In 2019, I predicted they would never IPO and that has held true so far. Now that they’ve stopped pushing Bcash and Zhan runs the company as a businessman should, they may IPO someday.

Coinbase

“Fire the developers” was a rallying cry that Jihan started and Brian Armstrong amplified it at every available opportunity. In January 2016, Armstrong published a contentious blog post supporting the big blocks and Bitcoin XT, and then pushed for every single subsequent fork up to the failed SegWit2X. You have to give the guy credit for trying.

So how are they doing today? An SEC investigation determined they allowed their users to speculate on unregistered securities. Separately, the SEC charged an ex-Coinbase product manager with insider trading alongside two others. In 2022, Coinbase’s stock dropped more than 75%, resulting from these incidents, as well as their Q1 results, which were at a net loss of $430 million. They could also be $1 billion in the red in Q2. Other questionable acts include conflating its USD and USDC order books and selling spying software to the U.S. Government through its “Coinbase Tracer” program. A few days ago, Cathie Wood of ARK Invest dumped over a million shares of COIN.

Circle

Circle, the issuer of the USDC stablecoin, gave up on Bitcoin in 2016, stating that Bitcoin was over and that in five to 10 years, nobody would be using it, but still continued to support all of the attacks on the Bitcoin network.

Circle bought the exchange Poloniex and sold it at a $146M loss a few years later. In February 2022, before the Three Arrows Capital (3AC) meltdown and the mini bear market, it announced its intention to SPAC to raise capital at a $9 billion valuation. Recently, after it raised $400 million from private equity, an investigative journalist found oddities in USDC’s registration statement, implying USDC holders are unsecured creditors in case of bankruptcy. At the same time, interest rates on USDC yields have collapsed from 10.75% to barely 0.5%, lower than a 3-year Treasury. Meanwhile, Circle CEO Jeremy Allaire declares the company is over-collateralized and in a stronger position than ever, but I’m not so sure. This doesn’t seem like an optimal time to SPAC, and if Circle can’t bring in more cash, they could be in trouble.

Digital Currency Group

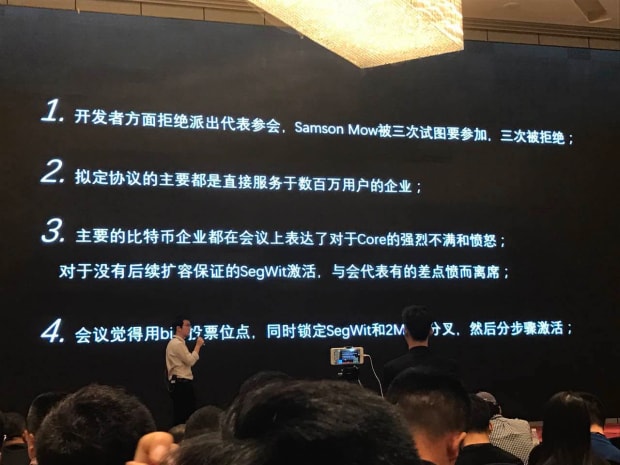

Barry Silbert, the founder of DCG, created the New York Agreement (NYA) in May 2017, whereby the Big Blockers would “fire Bitcoin Core,” and allow the corporations to dictate the rules to the users.

It appears DCG and 3AC could have been colluding to extract value from Greyscale’s GBTC fund trading at a premium relative to spot bitcoin. 3AC used this leverage to fund many things like buying expensive non-fungible tokens, while Greyscale made fees through the arrangement. Terra-Luna's collapse made 3AC go insolvent and Genesis, one of DCG’s subsidiaries, filed a $1.2 billion claim against 3AC for defaulted loans totaling $2.36 billion.

Blockchain.com

Blockchain.com (previously blockchain.info) tried hard to push for all of the Big Block forks as well. They were also the ones that blocked me from attending the NYA meeting. In July 2022, we learned that they lost $270 million and were forced to cut staff by 25%, or about 150 people, all because of bad loans to 3AC.

Roger Ver

Formerly known as “Bitcoin Jesus” and a prominent Big Blocker, Roger Ver attacked Bitcoin relentlessly during the Blocksize War. His primary weapons were using the Bitcoin.com domain and the @Bitcoin Twitter handle to spread misinformation.

In June 2022, we learned that Roger was over-leveraged on Bcash, only to see it collapse to 2019 lows. The CEO of CoinFLEX, the crypto exchange he was trading on, has outed Roger as a defaulter on a $47 million unsecured loan. The default has forced the company to stop withdrawals and try to raise the missing money through an ad-hoc token sale. They also had to make significant layoffs to cut costs. Despite being a shareholder in the exchange, Ver refused to accept responsibility, accusing CoinFLEX of owing him money.

The Big Blockers Weren’t Even Bitcoiners

Time has revealed that many of the Big Blockers were never Bitcoiners or even remotely interested in what Bitcoin could do to fix the world. Our antagonists turned out to be heavily into shitcoins, DeFi and fiat-money riches. Many did risky things with their companies, like unsecured lending, rehypothecation, etc., and they are now paying for it.

As Bitcoin grows and becomes more prevalent, there will be more incentives to co-opt it. We need more systems and infrastructure around Bitcoin that will allow it to resist bad actors. We need more education about how Bitcoin works and why it’s essential. But most importantly, we need more adoption and alignment of incentives with Bitcoin. That is the best way to avert another Blocksize War.

We must remember what Bitcoin represents and what’s at stake: our last hope at an apolitical, decentralized, permissionless money and the prosperous future it enables. The price of freedom is eternal vigilance.

This is a guest post by Samson Mow. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

via bitcoinmagazine.com