The only way to actually accomplish decentralized finance is via structurally sound money.

DeFi, a shortened version of the mouthful “decentralized finance”, is a hot buzzword these days. The term is often associated with crypto tokens and networks, as well as the applications built on top of them for lending, borrowing, asset trading and other financial contracts to be executed without intermediaries.

Most of today’s financial contracts require central intermediaries which are arguably opaque by design and must be trusted by both parties to execute contracts fairly. Sometimes that trust is broken, like when the largest foreign exchange (Forex) brokers colluded for at least a decade to scam their customers — costing companies, pensioners, investors and savers a yet unknown figure that could easily amount to over $1 trillion. Only one person was arrested and the banks involved were fined a total of $1.7B — around 0.2% of their total earnings from the scam. The reasons we distrust banks, and the governments and central banks standing behind them, are abundant — I’m sure you have your own.

DeFi promises to be a more trustworthy platform, composed of open-source code that’s auditable and transparent. Additionally, DeFi opens the floodgates for innovative ideas. Licensing requirements are replaced with code audits, allowing performance to replace accreditation and opening the financial world to new ideas.

Truly decentralized finance — all the way down to the settlement layer — also promises to be a more sane monetary system. Money is an integral piece of civilization, allowing societies to grow and scale without every individual having to trust one another personally. A decentralized financial system can fix the deeply-ingrained problems of our monetary system today.

A financial system free from many of the burdens and pitfalls created by trusted intermediaries and powerful masters sounds like a beautiful future we should all want to usher in.

What stands in our way?

The Trust Dealers And Their Premium

Much of the reason banks and financial intermediaries exist today is to create trust between parties: they are “trust dealers”.

Escrow services are a very direct example of this: a bank with a reputation to uphold will act as middleman to an exchange of assets, ensuring that both parties stick to their end of the deal. An escrow service can be entirely automated in a DeFi system, leading to lower costs and more predictable execution.

Trust dealers earn a “trust premium” for their services, which makes them a lot of money. DeFi takes that trust premium away, and trust dealers won’t let go of that revenue without a fight.

Even many functions of modern governments exist to create trust between parties who want to make and enforce contracts with each other. The Securities and Exchange Commission (SEC), for example, is partially a trust dealer with a three-part mission:

- Protect investors.

- Maintain fair, orderly and efficient markets.

- Facilitate capital formation.

A large part of this involves ensuring that “those who sell and trade securities — brokers, dealers and exchanges — must treat investors fairly and honestly” (SEC). Today, the SEC and its enforcement apparatus need to go around demanding information from private businesses to check that they are acting fairly and honestly.

In a world where brokers and exchanges are automated pieces of code, open source and auditable by anyone, the need for all those resources required for investigations is greatly reduced. In the SEC’s case, the trust premium is more abstract: not revenue, but power.

Central banks and governments also earn a massive trust premium: we trust them to control money supplies with the best interests of the public in mind.

Today’s governments and financial firms are therefore cautious about, if not openly hostile to, truly decentralized financial systems. These systems threaten their trust premium — whether that’s earned in the form of revenue or power over the financial system.

Trust Dealers Are Powerful

This is not a small group of rogue states or niche asset managers but the core of the mainstream financial system: the wealthiest and most powerful people and organizations in the world today.

These groups and individuals defend their role as trusted intermediaries in the financial system — and therefore the trust premium they earn in cash or power — in a variety of ways. What we think of as high-functioning, fair governments claim they need this power over the financial system to combat money laundering and terrorist financing — nevermind the fact that anti-money laundering (AML) policies have less than 0.1% impact on criminal finances (which is less than the “tax” on the Forex scammers!).

When governments turn more openly oppressive they resort to raw power over factual reasoning, and enforcement starts to look more authoritarian: blacklisting individuals from the economy or simply confiscating money from citizens.

The incumbent trust dealers are attacking decentralized systems from all angles, claiming they are too volatile, they facilitate criminal activity and they consume too much energy. However, they know they won’t be able to succeed simply by slamming new technology — they need to offer an alternative or co-opt a new technology to suit their purposes.

Before we get into how trust dealers are confronting the threat of DeFi, we need to discuss the trade-offs inherent to any decentralized system. This will shed light on how a DeFi platform might evade destruction.

Trade-Offs Of A Decentralized System

One of the founders of the Ethereum protocol, Vitalik Buterin, coined a “trilemma” about networks that helps us better understand the trade-offs necessary to realizing a decentralized financial system.

The trilemma goes like this: a database (or a “blockchain”) must sacrifice in one of these areas in order to gain in another:

- Security

- Decentralization

- Scalability

Security

Security means the network is resistant to attacks meant to disrupt its normal operation of validating and finalizing transactions. For a financial system, security is paramount. Without it, the system just won’t work.

How much security is “enough” security? This is a tempting question to ask, but a dangerous one to answer or implement. This question assumes we can understand all possible futures and map out their risks. Throughout time immemorial, humans have repeatedly underestimated the potential for future events to exceed the bounds of imagination and engineering. Thinking that we know what “enough” security looks like, and stopping there, is often a recipe for failure.

Decentralization

Decentralization in our context boils down to the ease with which anyone can validate transactions on the network. If it’s very easy for new validators to join, it’s likely that a large set of nodes will develop to validate transactions, limiting the power of any single entity to change the rules of the system.

Decentralization — like security — comes in degrees. The more difficult it is for new validators to join the network, the more likely it is that a centralized entity evolves to specialize in validating transactions. Eventually, this entity can start influencing the rules of the network or serve as an easy target for more powerful forces to take over in order to co-opt the system.

Scalability

Scalability means the speed with which the network can process data. For a decentralized financial system with lending, escrows and more basic financial services, scalability allows for more complexity and faster experimentation.

Centralized systems — like the hard drive on your computer or the Visa payment network — achieve a high degree of scalability by completely forgoing decentralization. Some blockchain networks, like Ethereum, are able to achieve more scalability by sacrificing security and decentralization.

Tough Choices

To think about the best path forward for a DeFi system, we must consider these trade-offs against the strategies incumbent trust dealers may use to topple or co-opt the system. We cannot naively believe that existing institutions will simply roll over and accept the loss of their trust premium without a fight.

Elizabeth Warren, for example, is certainly preparing for war.

The Trust Dealer’s Attack Types

Before we consider how to balance decentralization, security and scalability, let’s consider how incumbent trust dealers might think about attacking decentralized systems.

Most attacks are likely to fit into three categories:

- Brute Force

- Confidence Erosion

- Co-Opting

Brute Force Attack

The first way is blunt — they will use emotional appeals and, eventually, brute force to discourage or block you and I from interacting with decentralized systems. They are doing this today — using all sorts of misdirection to put down DeFi systems. Some nations have even implemented bans — though none have been of much use, with decentralized systems growing despite the bans.

The brute force attack isn’t working — so they will add on new attacks.

Confidence Erosion Attack

The second involves a bit of subterfuge ˆ with the intent being to disrupt the system in such a way as to damage people’s trust in it. This may come in the form of a hack orchestrated by rogue agents and possibly demonstrating the power of the government to fix it. Powerful financial entities could even use their existing power to create money in order to manipulate prices, destroying confidence in the operation of the markets for assets in the new financial system.

Co-opting Attack

The third attack involves a dash of diplomacy — they may try to co-opt a system with meager decentralization, working closely with blockchain developers to help them achieve better security and scalability. Eventually, the system then steers away from decentralization and ends up looking exactly like the centralized financial system it was meant to replace!

Central bank digital currencies (CBDCs) are another example of a co-opting attack. Governments are building systems they control via the ability to change supply and block transactions, but they are offering them as better alternatives to truly decentralized networks. Elizabeth Warren does exactly this — bashing Bitcoin then praising CBDCs as a better solution to the same problem.

However, CBDCs are not decentralized - the settlement layers of every CBDC will be completely owned and operated by their respective central bank, the biggest trust dealers of them all.

Getting Priorities Straight: Decentralization And Security

All three attacks exploit weak decentralization and poor security. None of the attacks take advantage of any lack of scalability.

Decentralization and security are clearly more important than scalability to the safety, let alone growth, of a DeFi system. It bears repeating that the incumbents in our centralized financial system are the most powerful, well-connected and resource-rich entities on the planet today. Any compromise in decentralization or security in order to support increased scalability is a dangerous trade-off, opening doors for a variety of attacks.

While decentralized systems continue to undergo attacks from incumbents, those building the systems must build in layers. Like erecting a skyscraper, first a deep foundation must be poured, then the steel goes up, then all the inner parts that make it a livable space. You cannot start by stacking glass 10 floors high on an empty lot.

Before we can pay for coffee with bitcoin or make on-chain credit default swaps, we need to ensure the blockchain is as secure and decentralized as possible. The foundation cannot be compromised in the name of scalability. Just like a building, the layers on top of the foundation can trade away some strength for beauty, usability and more.

Which blockchain today is making the right trade-offs to give us the best shot at developing DeFi?

Bitcoin Is DeFi, Altcoins Are Not

While the press and YouTube shill artists will have you think that DeFi is the sole possession of non-Bitcoin networks, these protocols are seriously lacking in security and decentralization compared to the slow, old, “outdated” Bitcoin.

The Sagging Cathedral Of Altcoins

Like a beautiful cathedral built on a marsh, these projects look shiny and promising today but lack the solid foundation to be around tomorrow as the basis of a DeFi system. These networks sacrifice security and decentralization in the name of programmability and transaction throughput. This gives us things to talk about — lots of developer activity, new tokens, protocols — but it hides a lack of supporting strength.

Take Ethereum for instance, long the frontrunner of the DeFi world.

Ethereum suffers from:

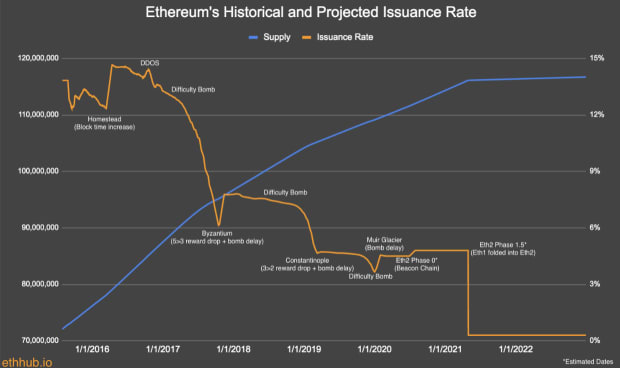

- A monetary policy that is unpredictable and openly targets “minimum issuance to secure the network.” As stated previously, attempting to “optimize” security is dangerous.

- An unclear roadmap for a change to the chain’s consensus mechanism, with frequent delays. This is akin to trying to replace the engine of a plane during a flight.

- Difficulty in setting up and syncing full nodes, which are critical to decentralization of the network. A single company, Infura, provides full nodes as a service which many key applications (“DApps”) rely on at their own peril.

This makes Ethereum open to all sorts of attacks, from co-opting by governments to direct attacks on chain security. The Ethereum chain was even publicly attacked, with its own founder leading the charge, in order to rewrite the chain history after a hack exploited a smart contract on the platform. No wonder the Federal Reserve — the very bastion of today’s centralized financial system — is waxing poetic about the wonders of DeFi on Ethereum!

DeFi on Ethereum and others may be the talk of the town today, but the brightest flames usually burn out first. Bitcoin may not be as flashy, but strong foundations never are — instead they are enduring.

The Humble Fortress Of Bitcoin

Bitcoin optimizes for security and decentralization over scalability. While complex financial contracts are difficult to execute on Bitcoin’s blockchain, Bitcoin beats all other blockchains on security and decentralization.

It is critical that we build financial infrastructure on top of the most decentralized protocol with the highest security while still allowing other layers to settle into the protocol. Bitcoin does this better than any other protocol, and with the most history. Now that incumbent trust dealers are aware of the existence of cryptocurrencies, new protocols don’t stand a chance against co-opting attacks.

Bitcoin nodes are cheap and easy to run, leading to a large set of geographically dispersed validators. A predictable proof-of-work consensus mechanism has led investors to have enough conviction to invest billions in purpose-built bitcoin mining machines, which are plugged in at every corner of the globe. The Bitcoin chain has never suffered a serious reorganization or successful attack on its foundational ruleset.

Bitcoin forms the settlement layer upon which other layers can build. Technologies like the Lightning Network will enable more scalable payments and ease of programmability — bringing new financial primitives rooted in Bitcoin’s decentralized settlement layer. Upgrades to Bitcoin like Taproot and BIP 300 will enable other layers and applications to root firmly to Bitcoin’s simple but predictable operation.

Making DeFi Work

Considering the armada of trust dealers who will face down any DeFi system, only the platform that leans most heavily toward security and decentralization today has a chance of emerging from the onslaught intact.

One by one, platforms that are less secure or decentralized will succumb to the attacks of powerful institutions. Many of the ideas put into practice on those less secure platforms will live on, but built instead on top of the only platform that survives.

And that platform, the best chance we have at DeFi, is Bitcoin.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

via bitcoinmagazine.com