Eleven approved Bitcoin ETFs have painted the pioneering cryptocurrency with a fresh coat of legitimacy. By receiving an official blessing from the Securities and Exchange Commission (SEC), an institutional investing barrier has been lifted.

With this barrier gone, financial advisors, mutual funds, pension funds, insurance companies and retail investors can now receive Bitcoin exposure without hassling with direct custodianship. More importantly, a taint has been scrubbed off from Bitcoin, previously likened to “tulip mania”, “rat poison”, or “index of money laundering”.

Following the unprecedented domino of crypto bankruptcies throughout 2022, Bitcoin price reverted to November 2020 level of $15.7k by the end of that year. After that great FUD reservoir was drained, Bitcoin slowly recovered during 2023 and entered 2024 at $45k level, first visited in February 2021.

With the 4th Bitcoin halving ahead in April, and with ETFs setting new market dynamics, what should Bitcoin investors expect next? To determine that, one must understand how Bitcoin ETFs elevated BTC trading volume, effectively stabilizing Bitcoin’s price volatility.

Understanding Bitcoin ETFs and Market Dynamics

Bitcoin itself represents the democratization of money. Not beholden to central authority like the Federal Reserve, Bitcoin’s decentralized network of miners and algorithmically determined monetary policy ensures that its limited 21 million coin supply can’t be tampered with.

For BTC investors, this means they can be exposed to an asset that is not on an inherent trajectory of devaluation, which is in stark contrast to all existing fiat currencies in the world. This is the foundation for Bitcoin’s perception of value.

Exchange-traded funds (ETFs) present another democratization pathway. The purpose of ETFs is to track an asset’s price, represented by shares, and enable trading throughout the day unlike actively managed mutual funds. The ETFs’ passive price tracking ensures lower fees, making it an accessible investment vehicle.

Of course, it would be up to Bitcoin custodians like Coinbase to enact sufficient cloud security to instill investor confidence.

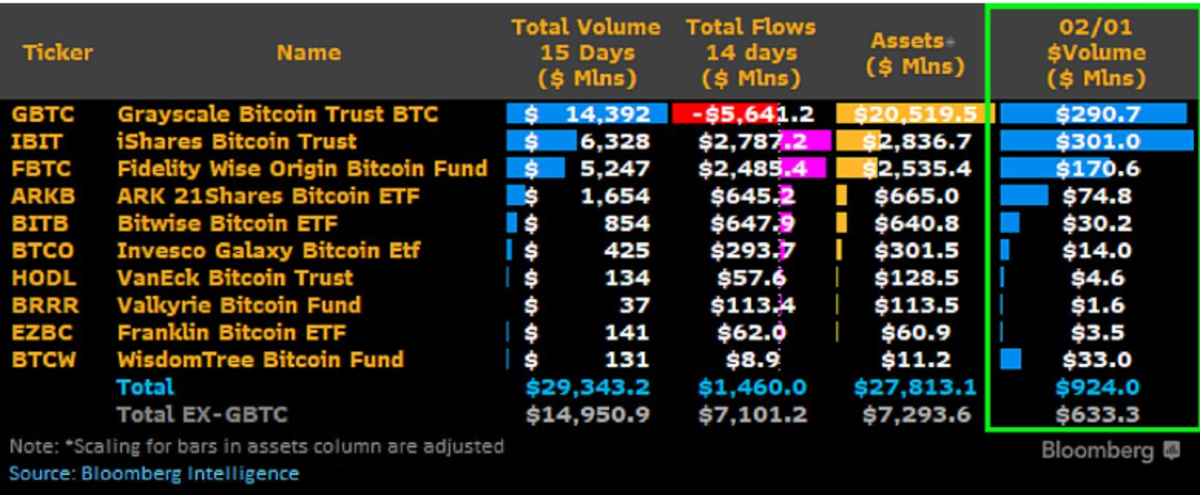

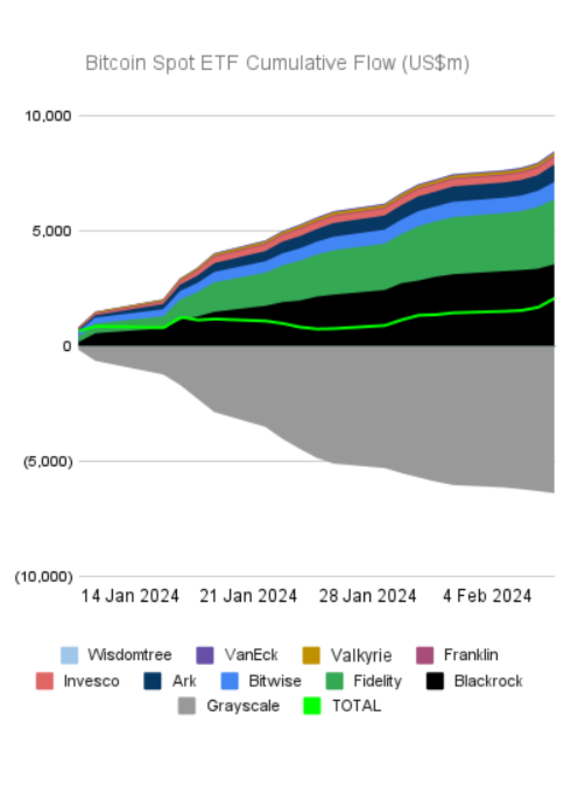

In the ETF universe, Bitcoin ETFs have demonstrated high demand for a decentralized asset that is resistant to centralized dilution. Altogether in the last 15 days, they have resulted in $29.3 billion trading volume against $14.9 billion pressure from Grayscale Bitcoin Trust BTC (GBTC).

This is not surprising. As Bitcoin price moved up due to Bitcoin ETF hype, 88% of all Bitcoin holders entered the profit zone in December 2023, eventually reaching 90% in February. In turn, GBTC investors were cashing out, placing a downward pressure worth $5.6 billion on Bitcoin price.

Moreover, GBTC investors took advantage of lower fees from the newly approved Bitcoin ETFs, shifting funds from GBTC’s relatively high 1.50% fee. At the end of the day, BlackRock’s iShares Bitcoin Trust (IBIT) is the volume winner at 0.12% fee, which will go up to 0.25% after a 12-month waiver period.

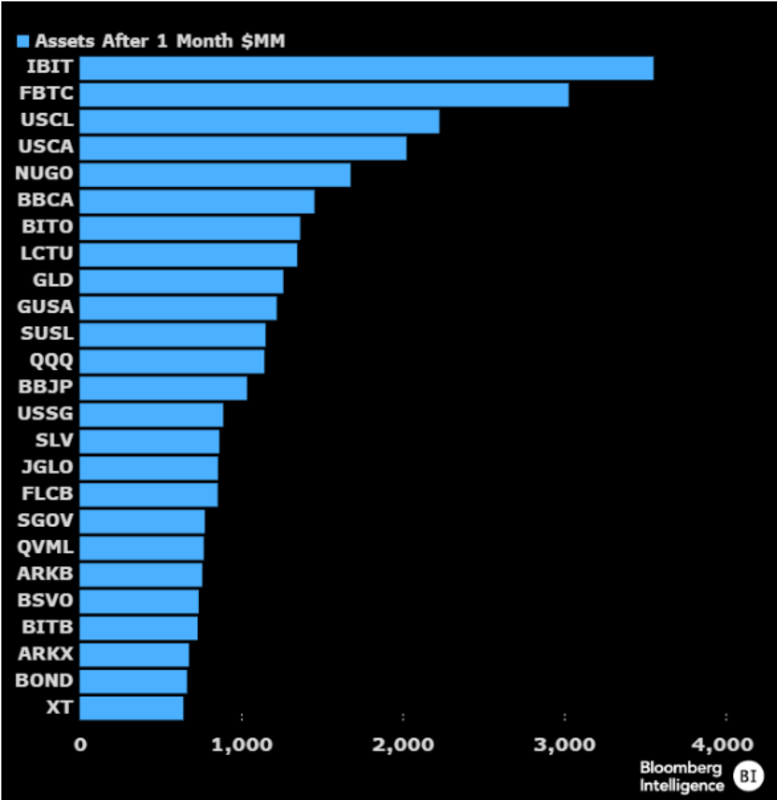

To place this in the context of the wider ETF universe, IBIT and FBTC managed to outpace iShares Climate Conscious & Transition MSCI USA ETF (USCL), launched in June 2023, within a month of trading.

This is particularly indicative given that Bitcoin’s history is one of attacks coming from the sustainability direction. It bears reminding that Bitcoin price fell 12%, in May 2021, shortly after Elon Musk tweeted that Tesla no longer accepts BTC payments precisely due to eco concerns.

During January, IBIT and FBTC found themselves at 8th and 10th place respectively as ETFs with the largest net asset inflows, headed by iShares Core S&P 500 ETF (IVV), according to Morning Star report. With daily ~10,000 BTC streaming into ETFs, this represents a greatly lopsided demand over ~900 BTC mined per day.

Moving forward, as the GBTC outflow pressure wanes and inflow trend increases, the steady stream of funds into Bitcoin ETFs is poised to stabilize BTC price.

The Mechanism of Stabilization

With 90% of Bitcoin holders entering the profit zone, highest since October 2021, selloff pressures can come from many sources, institutional, miner and retail. The higher inflow trend in Bitcoin ETFs is the bulwark against it, especially heading into another hype event - 4th Bitcoin halving.

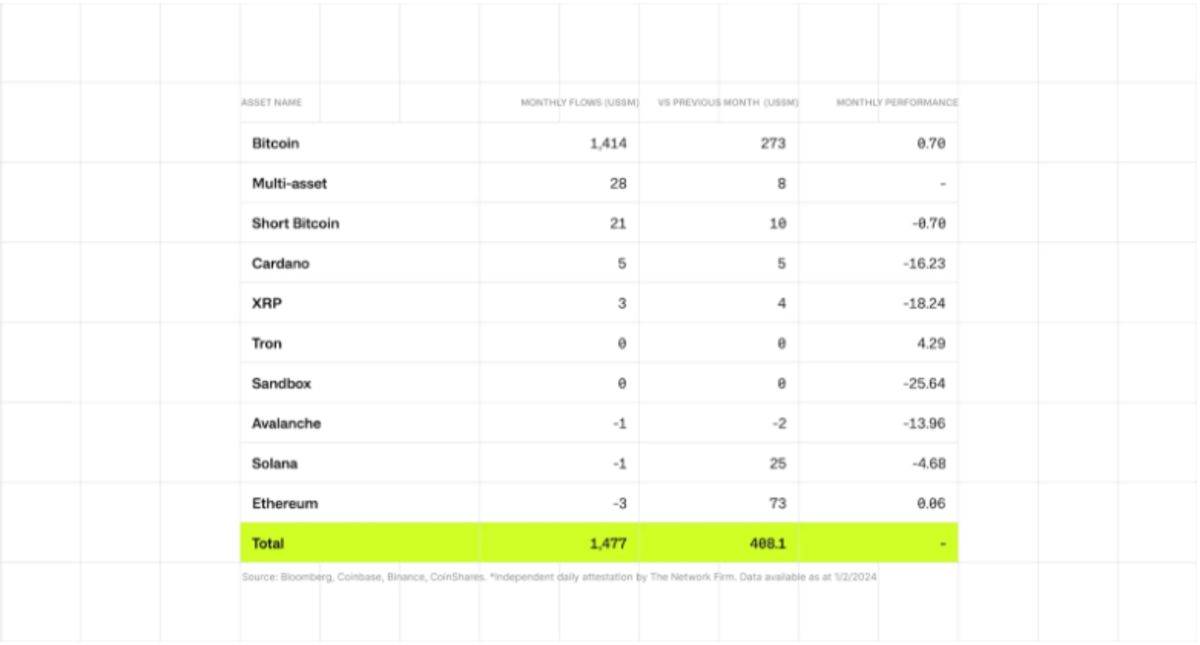

Higher trading volumes generate higher liquidity, smoothing out price movements. That’s because larger volumes between both buyers and sellers absorb temporary imbalances. During January, CoinShares’ report showed $1.4 billion of Bitcoin inflows, together with $7.2 billion from newly issued US-based funds, against the GBTC outflows of $5.6 billion.

In the meantime, large financial institutions are setting new liquidity baselines. As of February 6th, Fidelity Canada set up 1% Bitcoin allocation within its All-in-One Conservative ETF Fund. Given its “conservative” moniker, this signals even greater percentage allocations in future non-conservative funds.

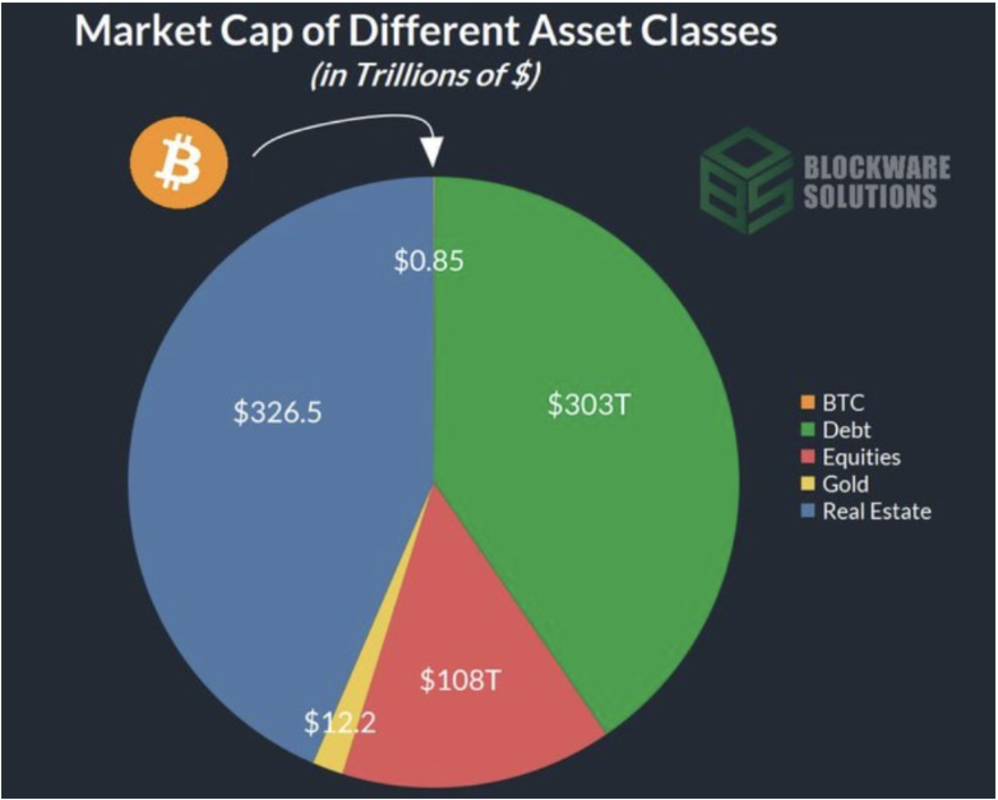

Ultimately, if Bitcoin taps into 1% of the $749.2 trillion market pool of various asset classes, Bitcoin’s market cap could grow to $7.4 trillion, bringing Bitcoin price to $400k.

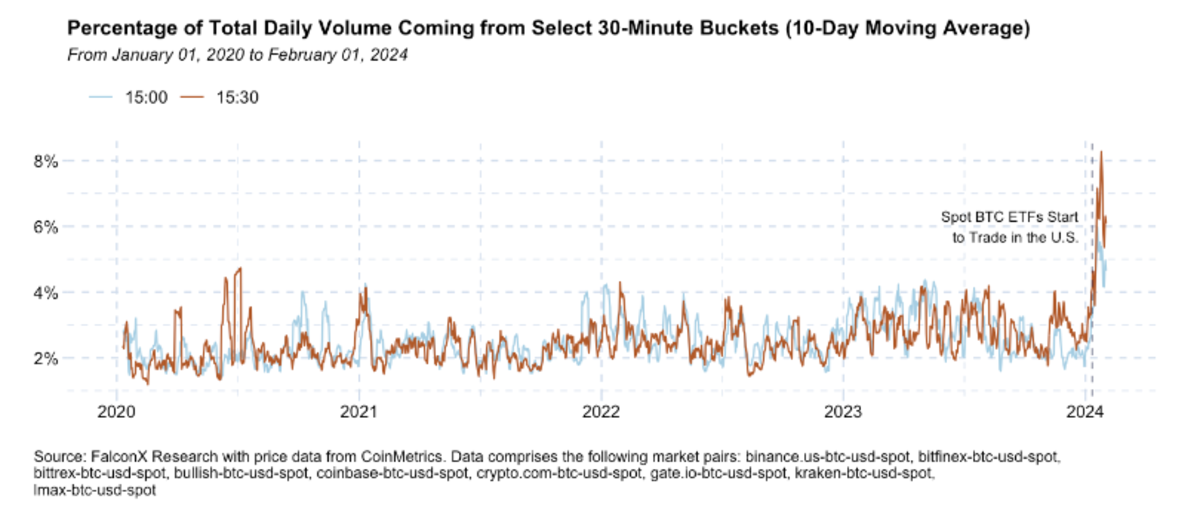

Given that Bitcoin ETFs provide a consistent and transparent market price reference point, large aggregated trades reduce market impact on potential selloffs coming from miners. This is visible from FalconX Research, showing a great uptick in daily aggregate volumes, previously from average 5% heading into the 10 - 13% range.

In other words, the new Bitcoin ETF-induced market regime is reducing overall market volatility. So far, Bitcoin miners have been the main price-suppressing driver on the other side of the liquidity equation. In Bitfinex’s latest weekly on-chain report, miner wallets were responsible for 10,200 BTC in outflows.

This matches the aforementioned ~10,000 BTC inflows in Bitcoin ETFs, resulting in relatively stable price levels. As miners reinvest and upgrade mining rigs ahead of the 4th halving, another stabilizing mechanism could come into play - options.

Although the SEC is yet to approve options on spot-traded BTC ETFs, this development will further expand ETF liquidity. After all, the greater spectrum of investing strategies revolving around hedging increases liquidity on both sides of the trade.

As a forward-looking metric, implied volatility in options trading gauges market sentiment. But the greater market maturity that we will inevitably see following the introduction of BTC ETFs, we’re more likely to see a more stabilized pricing of options and derivative contracts in general.

Analyzing Inflows and Market Sentiment

As of February 9th, Grayscale Bitcoin Trust ETF (GBTC) holds 468,786 BTC. Over the last week, the BTC price went up 8.6% to $46.2k. Concurrent with the previous forecast, this means that BTC dumping is likely to spread out over multiple rallies ahead of the 4th halving and beyond.

By latest numbers provided by Farside Investors, as of February 8th, Bitcoin ETFs have racked up $403 million inflows, totaling to $2.1 billion. GBTC outflows totaled $6.3 billion.

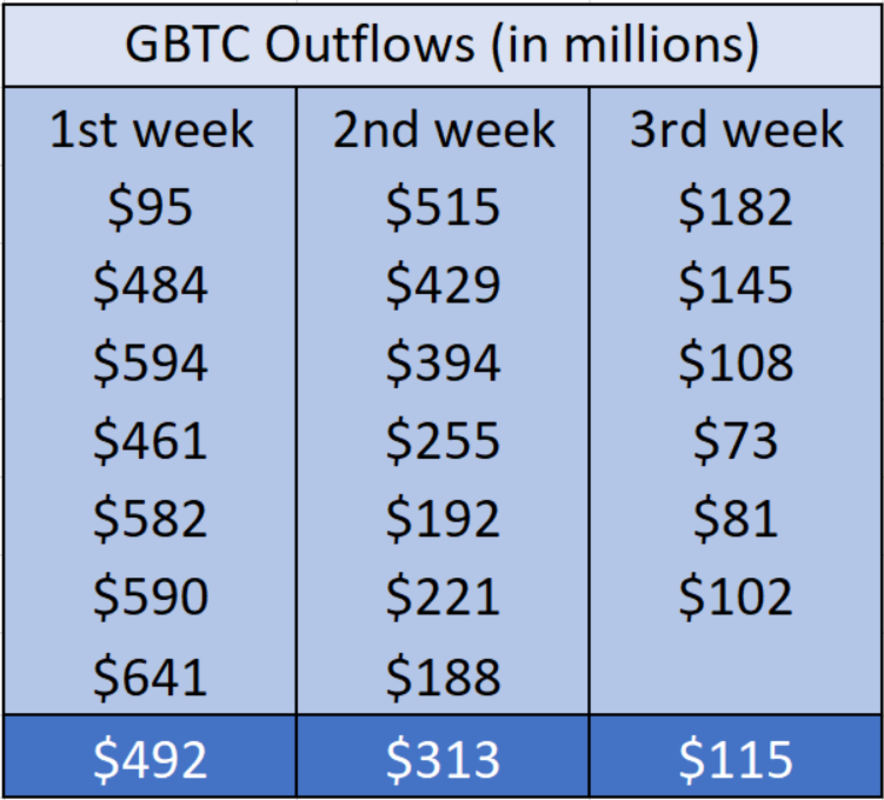

From January 11th to February 8th, GBTC outflows have steadily decreased. Within the first week, they averaged $492 million. In the second week, GBTC outflows averaged $313 million, ending in $115 million on average during the third week.

On a weekly basis, this represents a 36% reduction on sell pressure from week one to two, and 63% reduction from week two to three.

As GBTC FUD unfolded up to February 9th, crypto fear & greed index elevated to “greed” at 72 points. This represents a revisit to January 12th, at 71 points, just a few days after Bitcoin ETF approvals.

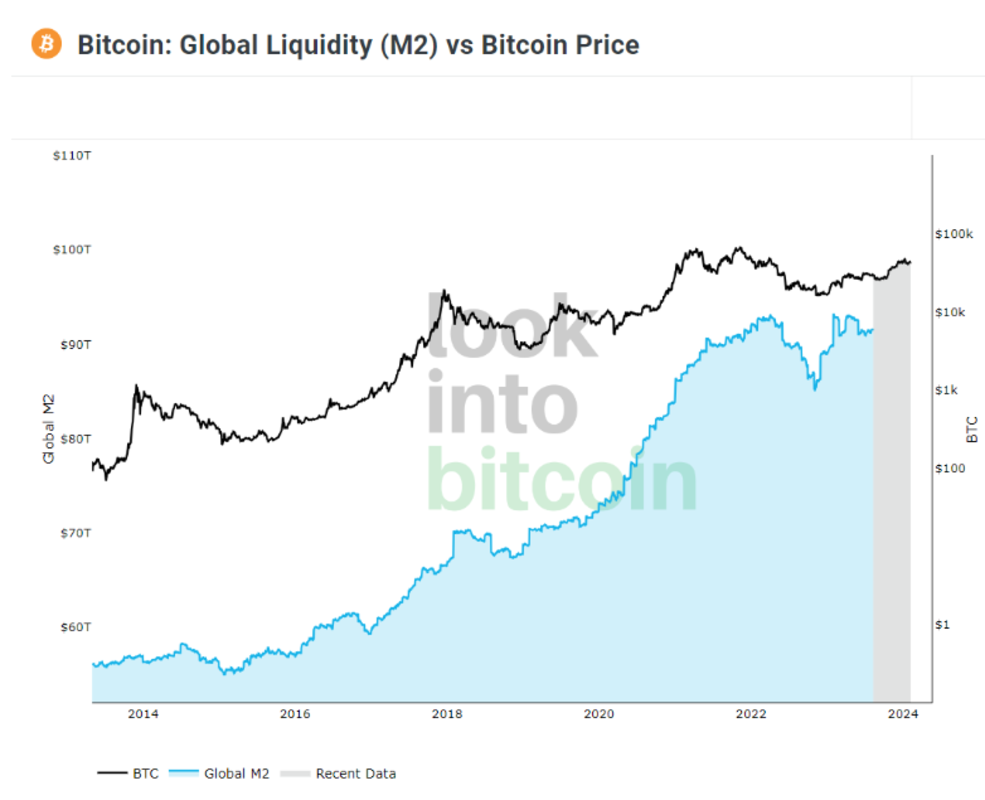

Looking ahead, it bears noticing that Bitcoin price is reliant on global liquidity. After all, it was the Fed’s interest rate hiking cycle in March 2022 that caused the avalanche of crypto bankruptcies, culminating in the FTX collapse. Current fed fund futures project the end of that cycle either in May or in June.

Moreover, it is extremely unlikely that the Federal Reserve will veer off the money printing course. And at such occasions, Bitcoin price followed suit.

Considering the insurmountable national debt of $34 trillion, while the federal spending keeps outpacing revenue, Bitcoin is positioning itself as a safe haven asset. One that waits for capital inflows into its limited 21 million coin supply.

Historical Context and Future Implications

As a similar safe haven asset, Gold Bullion Securities (GBS) launched as the first gold ETF in March 2003 on the Australian Securities Exchange (ASX). Next year, SPDR Gold Shares (GLD) launched on the New York Stock Exchange (NYSE).

Within a week from November 18th, 2004, GLD’s total net assets rose up from $114,920,000 to $1,456,602,906. By the end of December, this decreased to $1,327,960,347. To reach BlackRock’s IBIT market value of $3.5 billion, it took GLD up to November 22nd 2005.

Although not inflation-adjusted, this indicates Bitcoin’s superior market sentiment compared to gold. Bitcoin is digital, yet it is grounded in a proof-of-work mining network spanning the globe. Its digital nature translates to portability which can not be said of gold.

The USG showcased this point when President Roosevelt issued Executive Order 6102 in 1933 for citizens to sell their gold bullions. Likewise, new gold veins are frequently discovered which dampens its limited supply status in contrast to Bitcoin.

In addition to these fundamentals, Bitcoin ETF options are yet to materialize. Nonetheless, Standard Chartered analysts project $50 to $100 billion in Bitcoin ETFs by the end of 2024. Moreover, large companies are yet to follow MicroStrategy’s lead by effectively converting shares sales into a depreciating asset.

Even 1% BTC allocations across mutual funds are poised to skyrocket BTC price. Case in point, Advisors Preferred Trust set up a 15% range allocation into indirect Bitcoin exposure via futures contracts and BTC ETFs.

Conclusion

After 15 years of doubt and aspersions, Bitcoin has reached the apex of credibility. The first wave of believers in sound money ensured that the blockchain version of it is not lost in the bin of coding history.

On the back of their confidence, up until now, Bitcoin investors constituted the second wave. The Bitcoin ETF milestone represents the third wave exposure milestone. Central banks around the world continue to erode confidence in money, as governments cannot help themselves but to indulge in spending.

With so much noise introduced into the exchange of value, Bitcoin represents a return to the sound money root. Its saving grace is digital, but also physical proof-of-work as energy. Barring extreme USG action to sabotage institutional exposure, Bitcoin could even overtake gold as a traditional safe haven asset.

This is a guest post by Shane Neagle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

via bitcoinmagazine.com